|

A growing mortgage payment revolt is occurring in China. Apartment owners in China typically begin mortgage payments during construction; however, however, an increasing number of borrowers have begun withholding payments to protest construction delays. This crisis, which started in June, has rapidly grown to over 300 housing projects in about 91 cities, according to Bloomberg. Analysts polled by Bloomberg estimate the current total of at-risk mortgages is valued between $150 billion and $370 billion. Several analysts think this number will grow, because they believe banks are underreporting loan defaults. That said, Chinese authorities are aiming to stem the tide of defaults, as last weekend Chinese officials stated that they are “urging” banks to increase loans to real-estate developers to finish incomplete projects. |

|

|

|

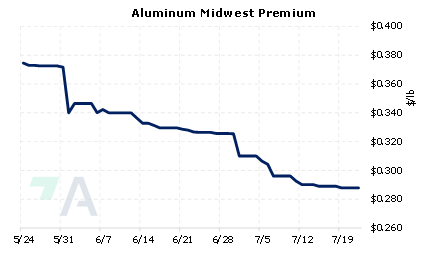

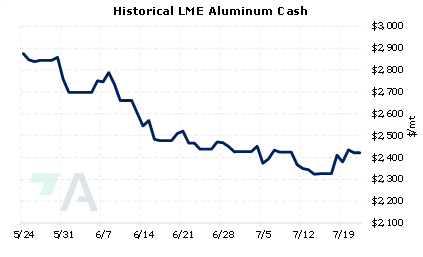

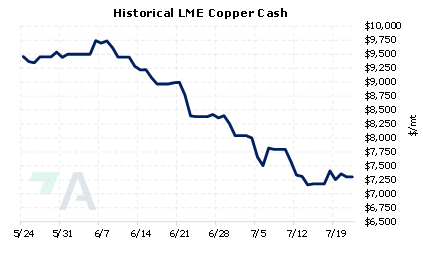

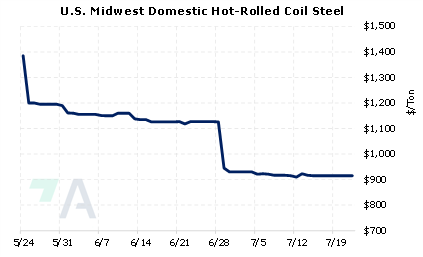

An ongoing real estate crisis in China could weigh on prices for many metals, including aluminum and copper. Producers of either metal who are concerned about decreasing prices might consider hedges that provide downside protection. These might include applying simple hedges involving swaps to lock in a price or put options to establish a minimum price. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum price for a steel producer, as they would simultaneously buy a put option (creating a floor, or minimum) and sell a call option (creating a cap, or maximum). The call and put premiums offset, making the construction costless. It is popular because of the downside price protection, but you sacrifice access to much higher prices if prices should rise. Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (7/22/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/20/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

||

|

|

||

| Important Headlines | ||

|

7/21/2022: China steel trade to fall in coming months as weak demand outlook weighs 7/19/2022: China’s homebuyers are running out of patience with the real estate slump 7/19/2022: Two giant miners warn of tougher times as world demand wavers 7/18/2022: China scrambles to defuse alarm over mortgage boycotts and banks runs 7/18/2022: China raises loan-support efforts for developers amid mortgage boycott 7/18/2022: Estimated NorthAm auto losses rise 7/18/2022: Commodity Tracker: 5 charts to watch this week 7/17/2022: Mongolia says Russia-China gas pipeline will break ground in 2024 7/17/2022: CMOC's Congo mine suspends copper and cobalt exports |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||