|

The LME will not ban nickel from Russia’s top producer, Norilsk Nickel. Reuters reported this revelation late week. This disclosure from the LME comes despite the UK government sanctioning Norilsk Nickel’s president, Vladimir Potanin, late last month. Last Friday, the LME stated it continues to evaluate the British government placed on Potanin in June. The exchange has not disclosed how much nickel in its system is from Norilsk Nickel. According to Reuters, Norilsk Nickel is the world’s largest producer of refined nickel. Banning Russian nickel or other metals could lead to global shortages. |

|

|

|

Even though Russian nickel has not been banned from the LME system as of yet, the exchange would have to ban Russian metal if sanctions did occur, per UK law. End-users such as stainless-steel producers who are worried about sanctions, or are generally bullish on price, could hedge future needs by buying swaps or call options, both of which would establish a maximum price. Such positions are basic for end-user hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (7/26/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

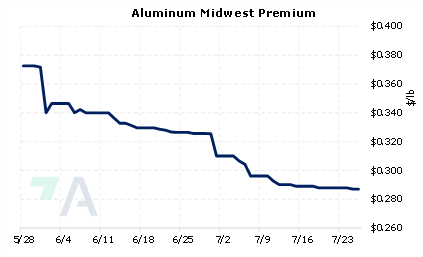

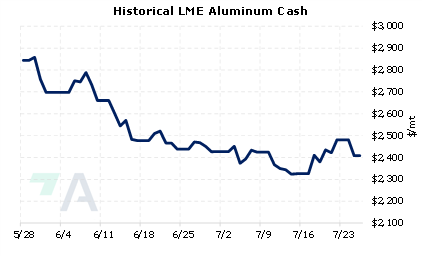

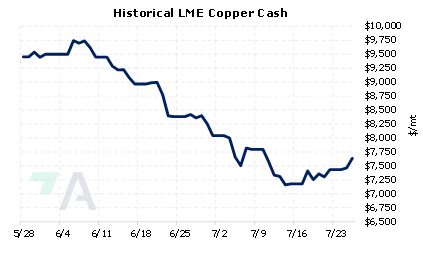

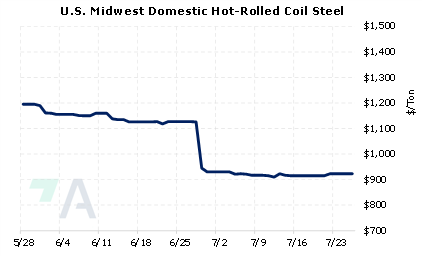

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/20/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

||

|

|

||

| Important Headlines | ||

|

7/25/2022: LME won't ban Nornickel's metal as Russian firm isn't under UK sanctions -sources 7/24/2022: Column: Aluminium producers feel the margin pain as price slumps 7/22/2022: Cliffs expects automotive steel demand rebound by year-end: CEO

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||