|

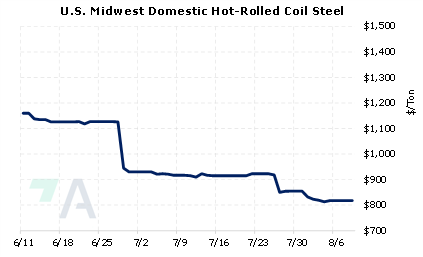

*Because of unforeseen technical issues, we are not able to update the charts and tables for today's First Look. We are sorry for any inconvenience. * Due to overall falling demand and oversupply, Argus’s spot HRC assessment is now $822/st, a nearly 48% drop since January 1. However, according to Argus, pipe shortages and increasing driller demand due to high oil and natural gas prices have made the oil and gas sector a “bright spot” for steel demand and prices. That said, tubular producer Tenaris stated they are looking to increase pipe production at its current facilities and is in the process of purchasing another furnace. Cleveland-Cliffs, Nucor and Steel Dynamics are also working to bring a combined 16,200 st/day, or an additional 1.45mn st/quarter, back online in the 2H 2022. |

|

|

|

Increased production by Tenaris, Cleveland Cliffs and others could further suppress prices for both HRC and tubulars. Steel producers or service centers who holding inventory or are concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options, both of which would establish a minimum price. Such positions are basic for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. HRC steel’s forward is currently in contango meaning that spot prices are currently lower than futures prices. This allows a steel producer to hedge future sales at prices higher than the current spot market. Please contact AEGIS for specific strategies that fit your operations. (8/10/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

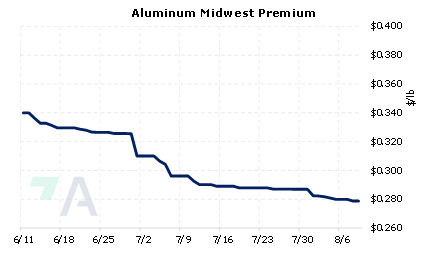

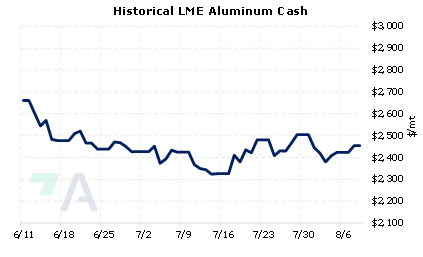

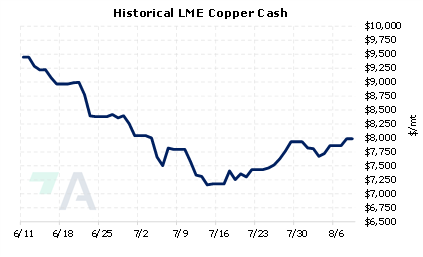

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

08/09/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond 08/03/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 08/02/2022: Russia Finds New Alumina Supply 07/27/2022: American Automotive Production is on the Rebound |

||

|

|

||

| Important Headlines | ||

|

8/9/2022: Column: Glencore's smelter warning galvanises the zinc price 8/8/2022: Energy industry bright spot for NorthAm steel 8/7/2022: US Senate passes landmark bill to tackle climate 8/5/2022: US imports of unalloyed aluminum continue to rise loosening supply further 8/5/2022: FUTURES WRAP: LME scrap contract reaches all-time daily trading volume high |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||