|

**AEGIS is attending the SMU Steel Summit Conference 2022 at the Georgia International Conference Center in College Park on August 22 – 24. If you would like to schedule a meeting during the summit, please contact Patrick McCrann at pmccrann@aegis-hedging.com or (713) 936-2806. ** |

|

|

|

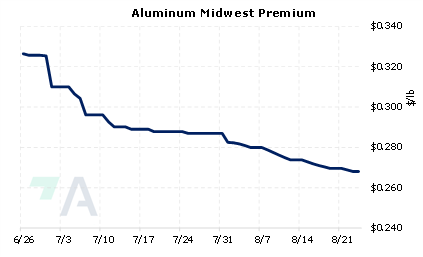

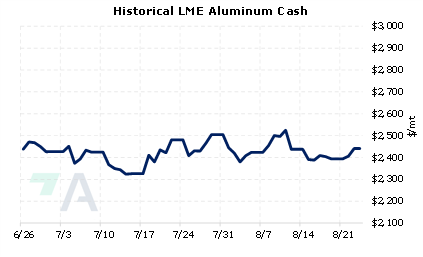

European aluminum smelters are grappling with rising electricity prices, and now some are contending with worker strikes. The aluminum market seems to be in balance right now, as prices have largely trended sideways for nearly two months. However, aluminum prices could rally if more production is taken offline due to increasing electricity prices or more worker strikes occur. This past Monday, Alcoa announced that workers at its 200,000 mt/yr capacity Mosjøen plant would begin a strike, effectively immediately. According to the press release, the plant will work towards a 20% reduction in production by September 19. After that date, an additional 10% of production will be shuttered every other week, until 34 of the 404 pots remain operational. This was the second Norwegian-based smelter shutdown announcement in as many weeks. Last week, Norsk Hydro announced that 20% of production at its Norway-based Sunndal plant will be taken offline due to a worker strike that was set to begin on Monday, August 22. From the March highs to July lows, the LME 3M Aluminum Select contract dropped by over 43%, bottoming at $2,310/mt on July 15. Prices have rallied slightly since then, as the last trade was $2,414/mt (7:00 AM CST). Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (8/24/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

8/17/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond 8/2/2022: Russia Finds New Alumina Supply |

||

|

|

||

| Important Headlines | ||

|

8/23/2022: Cliffs CEO does not foresee sheet output cuts 8/22/2022: Strike at Alcoa’s Mosjøen smelter in Norway commences 8/22/2022: Ford cuts workforce amid EV push 8/22/2022: Climate disasters risk putting a damper on electric-car making 8/22/2022: European gas prices surge on renewed Russian gas supply uncertainty 8/22/2022: Japan's Tokyo Steel cuts sales prices on weak demand 8/22/2022: Japan’s ferrous scrap outlook mixed |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||