|

The research firm AutoForecast Solutions says North American vehicle production is worse than thought, and there are implications for steel. Units produced will number 573,000 less in 2022 than in 2021, while a previous estimate from July had been only a 348,000 unit decrease year-over-year. It might be worse than that, though; another 450,000 vehicles are “at risk” of not being produced, per AutoForecast Solutions. Based on AutoForecast’s “at risk” volume, AEGIS estimates 445,000 short tons of steel demand could be lost or deferred until later. According to the American Iron and Steel Institute's (AISI) Automotive Program, the average North American vehicle contains 1,980 lbs of steel, of which approximately 1,480 lbs are flat-rolled products. Approximately 486 lbs of aluminum are used in each vehicle as well. The slowdown in vehicle production is primarily the result of an ongoing semiconductor outage. (Source: Argus) |

|

|

|

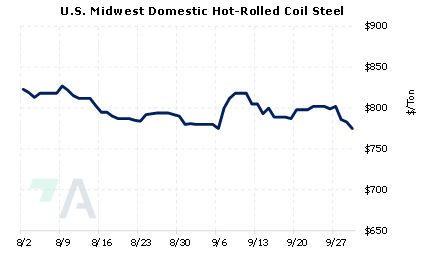

As automotive production has dropped in recent months, so too have steel prices. Prompt-month (October) CME HRC futures are down nearly 50% from the highs of mid-March. This could be a good time for steel end-users such as automotive original equipment manufacturers to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/30/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

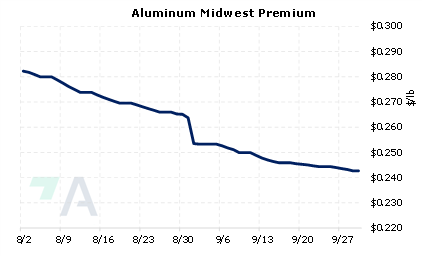

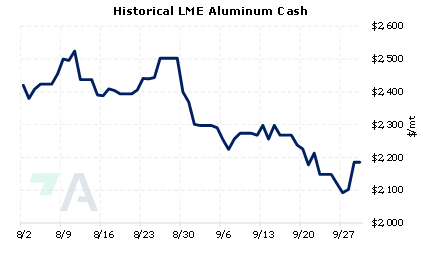

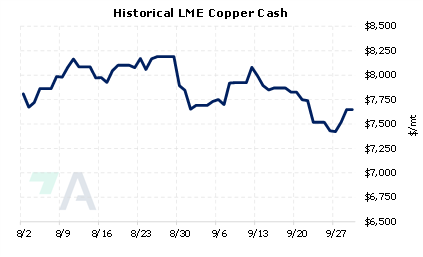

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/29/2022: LME to discuss banning Russian metal, sources say 9/28/2022: Nippon Steel says India JV with ArcelorMittal to spend $5 bln to boost capacity 9/27/2022: Hydro responds to reduced aluminium demand, partially curtails production 9/26/2022: NorthAm auto cut estimates continue to rise 9/26/2022: Grim demand outlook pushes copper prices to 2-month low 9/25/2022: Chinese copper trader Maike will sell assets and restructure, Financial Times reports 9/25/2022: China’s Maike Metals will sell assets and restructure, says chair 9/23/2022: China's manufacturing steel demand rebounds in August, further improvement to be modest 9/23/2022: Steel makers fear deepening crisis from energy crunch as output halted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||