|

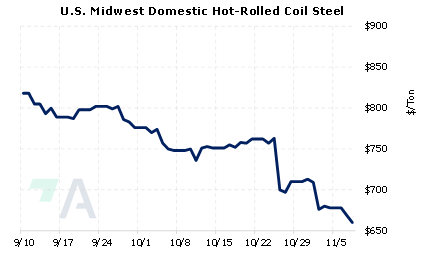

India’s steel demand could grow at a "high single-digit" rate over the next 12 to 15 months, according to comments from Moody's Investors Service yesterday. According to their comments, this expected demand growth could come from infrastructure investments before India’s 2024 national elections. Moreover, they believe that Indian demand is a “bright spot” compared to other regions. AEGIS notes that India’s steel is already on the upswing. Compared to 2021, the country’s finished steel consumption grew by 11.4% between April and October to 65.5 million mt, according to government data. Imports of finished steel also grew during that period, as they imported 3.2 million mt, up 14.5% from the same period in 2021. (Source: Reuters) |

|

|

|

Even though India normally imports little steel from the US, higher Indian demand could be bullish to CME HRC prices, if their demand for US finished-steel products increases over the next year. Moreover, other major steel importers could be forced to look elsewhere for steel, especially if their cargoes are diverted to India. This could be a good time for steel end-users to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (11/8/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/07/2022: AEGIS Primer on LME Aluminum Price History 11/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

11/7/2022: China again holds firm on ‘zero covid,’ despite the worsening toll 11/7/2022: Moody's says India a bright spot in global steel demand 11/4/2022: India's April-October finished steel exports drop 55% y/y - data |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||