|

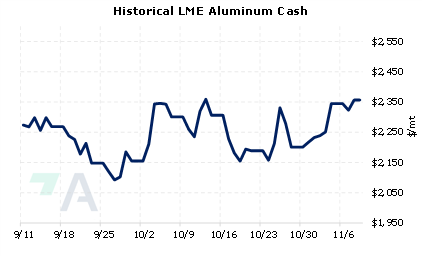

As of this morning, LME aluminum stocks have fallen by 19,600 mt from the October 28 peak of 578,425 mt. Most of the recent decline originated from warehouses in Port Klang, Malaysia. AEGIS notes that the aluminum delivered out Port Klang warehouses was likely there only briefly. As of October 19, LME aluminum stocks in Port Klang totaled 381,425 mt, more than double the level seen on October 10. Most of this recent increase came from Citibank, according to unnamed sources cited by Reuters late last month. According to the sources, increasing borrowing costs had cut the profitability of the bank’s aluminum trading. Banks such as Citibank, often use metals such as aluminum as collateral for financing deals. Such deals normally involve borrowing money to purchase aluminum now to sell forward for a higher price. However, rising interest rates have made such deals less attractive. Thus, as existing financing deals have expired and were not renewed, more aluminum has been delivered to LME warehouses. (Sources: Bloomberg, Reuters) |

|

|

|

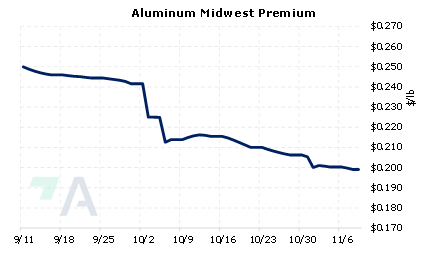

Aluminum prices have largely trended sideways since early October, despite the large volumes of deliveries into LME warehouses. However, some industry professionals have warned that even greater volumes could be delivered to the exchange. Last month, US aluminum producer Alcoa professed fears that 1,000,000 mt of Russian-origin aluminum could be delivered to the LME every year. Allowing even higher volumes of metal onto the LME could ultimately push prices lower. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (11/09/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/07/2022: AEGIS Primer on LME Aluminum Price History 11/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

11/7/2022: China again holds firm on ‘zero covid,’ despite the worsening toll 11/7/2022: Moody's says India a bright spot in global steel demand 11/4/2022: India's April-October finished steel exports drop 55% y/y - data |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||