|

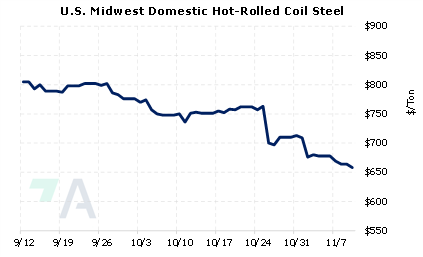

Steel industry professionals have lamented that the market is “oversupplied,” and a new contract between the United Steelworkers (USW) and US Steel might add fuel to the fire. The USW has averted a possible strike, as the union and US Steel tentatively agreed to a new four-year contract earlier this week. The new contract includes a wage increase, a $4,000 bonus, and higher pension and 401K contributions. The agreement will be similar to the one the USW reached with Cleveland-Cliffs in October, according to an unnamed source interviewed by Bloomberg. Unnamed sources recently told Argus that a potential strike by the United Steelworkers could be “the only action that could turn around the market, save increased production cuts by steelmakers.” (Source: Bloomberg, Argus) |

|

|

|

CME HRC prices have dropped in recent months, mainly due to the aforementioned “oversupplied” conditions. Prompt month (November) CME HRC futures are down nearly 58% from the highs of mid-March, as the last traded was $658/st (7:00 AM CST). This could be a good time for steel end-users to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (11/10/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/09/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

11/9/2022: US ferrous: Northern markets slide in November 11/7/2022: China again holds firm on ‘zero covid,’ despite the worsening toll 11/7/2022: Moody's says India a bright spot in global steel demand 11/4/2022: India's April-October finished steel exports drop 55% y/y - data |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||