|

The Chicago Mercantile Exchange (CME) has taken aim at the LME’s dominance in industrial metals trading. Open interest in the CME’s aluminum contract has surged over 400% this year. Also, nearly 150 new accounts began trading the CME’s aluminum contract between May and mid-September this year. However, total open interest in CME aluminum is currently about 30,000 mt, a fraction of the 14 million mt for the LME. Trading volumes in aluminum increased dramatically after the CME adjusted the daily settlement period to align with the LME close, thereby opening greater arbitrage opportunities between the two contracts. |

|

|

|

Similarly, trading in the CME’s cobalt contract is growing. Open interest in the CME’s cobalt contract has increased by over 500% this year. Compared to CME’s cobalt contract, trading in the LME’s cobalt contract has largely ground to a halt. “Liquidity in the cobalt market is almost solely based in Are you looking to hedge your aluminum or cobalt needs? AEGIS is very adept at trading aluminum swaps and options, so please contact us regarding strategies. We note that most (if not all) commercial aluminum contracts are tied to LME pricing. If you want to use CME for aluminum hedging, you should ensure that your commercial exposure is also tied to CME pricing. As for cobalt, there is currently no options market for CME cobalt, but end-users such as electric vehicle producers can hedge future needs via swaps. Using swaps can help guard against a potential increase in cobalt or aluminum input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Again, please contact AEGIS for specific strategies that fit your operations. (11/15/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

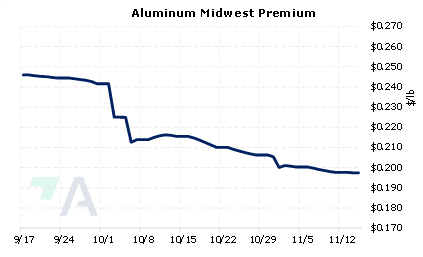

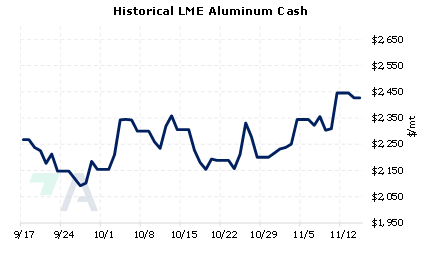

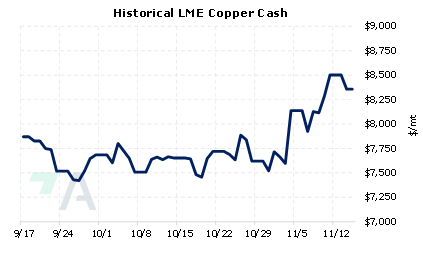

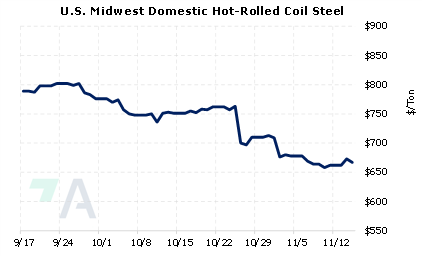

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/09/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

11/14/2022: No surge of Russian metal into LME warehouses-exchange 11/14/2022: Nucor kept December plate prices flat 11/11/2022: LME will not ban Russian metal from its system |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||