|

Nyrstar will resume operations at its Budel, Netherlands-based zinc smelter this month, according to company statements from late last week. Due to unprofitability, the smelter was placed on care and maintenance approximately two months ago. Since the start of the Russia-Ukraine conflict, Russia has decreased natural gas flows to Europe. This drop in natural gas flows has led to soaring natural gas (TTF) and electricity prices across the continent. As zinc smelting is electricity-intensive, soaring electricity costs have forced producers such as Nyrstar to curtail production fully or partially. However, AEGIS notes that both European natural gas and electricity prices have fallen tremendously since the summer highs which is likely why Nyrstar is able to restart operations. Nyrstar’s Budel, Netherlands smelter normally has an annual capacity of 315,000 mt, making it one of Europe’s largest zinc smelters. (Sources: Reuters, Bloomberg) |

|

|

|

Zinc prices at the LME are down over 15% this year, with the last trade at $2,998/mt (7:00 AM CST). Also, zinc’s forward curve is currently quite backwardated. This allows a zinc end-user such as a galvanizer to hedge future purchases at prices lower than the current spot market. Buying swaps or call options are viable strategies, as either would establish a maximum zinc price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please note that zinc options have lower liquidity than swaps. Please contact AEGIS for specific strategies that fit your operations. (11/17/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

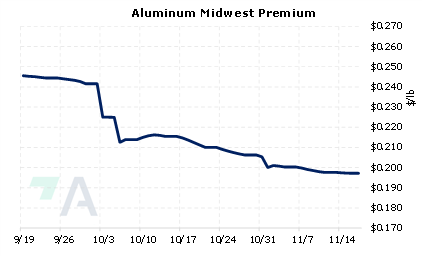

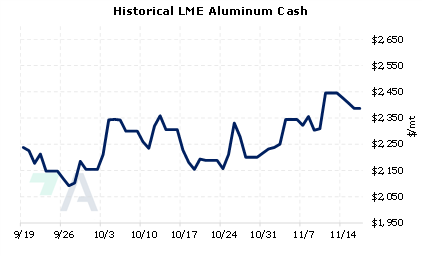

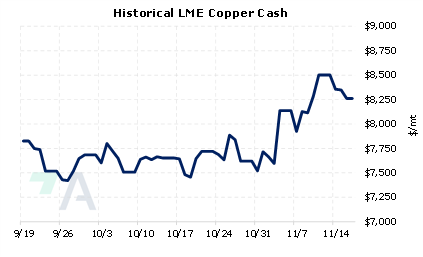

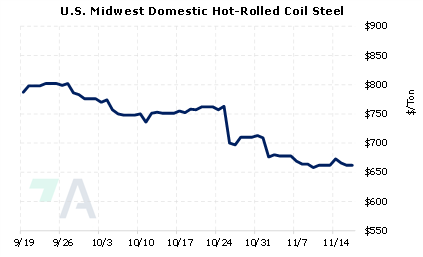

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

11/15/2022: US steel shipments down again in September 11/15/2022: US HRC: Prices fall, market sees floor 11/15/2022: Column: LME stays Russian metal ban with views starkly split 11/14/2022: Electric vehicle makers burning cash, slammed by sky-high costs 11/14/2022: No surge of Russian metal into LME warehouses-exchange 11/14/2022: Nucor kept December plate prices flat 11/11/2022: LME will not ban Russian metal from its system |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||