|

China’s aluminum product exports could increase by nearly 40% over the coming years. The country’s largest aluminum producers will study plans to jointly build alumina plants in Guinea and new factories and fabricators in Southeast Asia, according to Bloomberg. The companies involved, which include Aluminum Corp. of China Co. and Shandong Weiqiao Pioneering Group Co., believe that these additions could boost the country’s aluminum product exports to 10 million mt. Researcher Antaike estimates that China’s aluminum product exports will total 6.3 million mt this year, up 16% from 2021. The companies also plan to improve domestic mining to increase bauxite reserves. These company statements were initially published in the China Nonferrous Metals Industry Association’s newsletter mid-last week. (Source: Bloomberg) |

|

|

|

The companies did not give a timeline on how long it will take to implement their plans. However, China’s aluminum exports are already on the rise, which could handicap prices. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (11/21/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

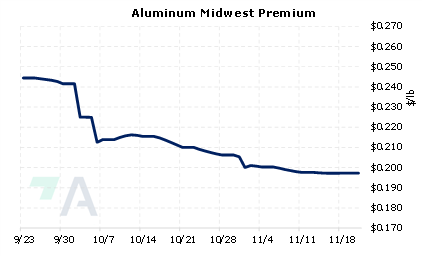

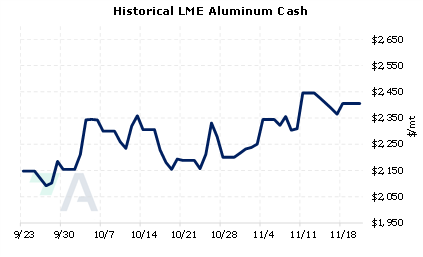

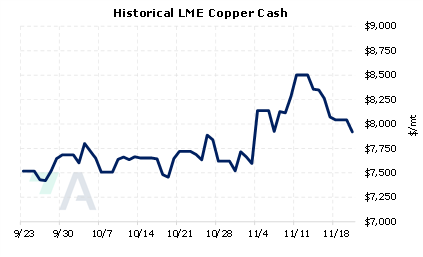

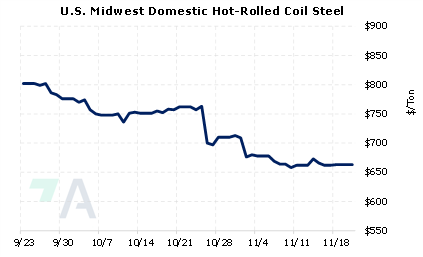

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

||

|

|

||

| Important Headlines | ||

|

11/18/2022: Rio to pursue Turquoise bid after ending talks with minority shareholders 11/16/2022: Nickel prices tumble as LME scrutinises volatile trading 11/15/2022: US steel shipments down again in September 11/15/2022: US HRC: Prices fall, market sees the floor 11/15/2022: Column: LME stays Russian metal ban with views starkly split 11/14/2022: Electric vehicle makers burning cash, slammed by sky-high costs 11/14/2022: No surge of Russian metal into LME warehouses-exchange 11/14/2022: Nucor kept December plate prices flat 11/11/2022: LME will not ban Russian metal from its system |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||