|

Due in part to a recovering global automotive sector, platinum usage will jump 19% year over year to 7.77 million oz in 2023, according to the World Platinum Investment Council (WPIC). This jump in demand, along with supply issues in South Africa, will push the market into a deficit of 303,000 oz next year. This is a large shift in demand, as a surplus of 804,000 ounces is expected this year. Increasing vehicle production and stricter emissions regulations are driving the boost in automotive demand. Also, some manufacturers are substituting palladium with cheaper platinum. Swapping palladium for platinum will account for nearly 500,000 oz of platinum demand next year, according to WPIC figures. (Source: Reuters) |

|

|

|

CME platinum futures are the global benchmark for platinum futures. January ’23 futures are up nearly 25% from the September lows, with the last trade at $997.3/oz (7:00AM CST). Increasing demand from the automotive sector could continue to drive platinum prices higher. Options are very illiquid for the platinum, so we would that end-users use swaps to hedge their needs. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. *Please note that our offices will be closed on Thursday, November 24 due to the Thanksgiving holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * (11/23/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

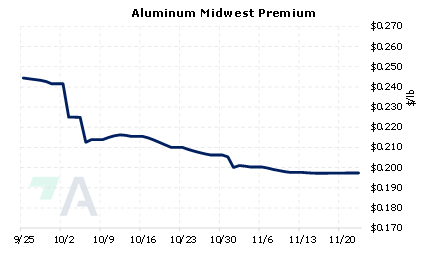

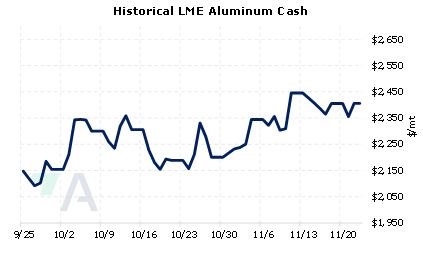

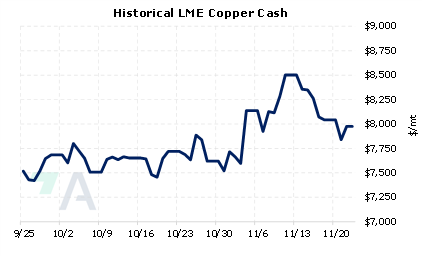

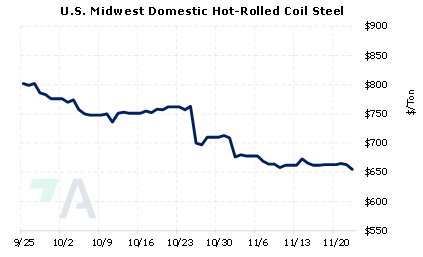

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

||

|

|

||

| Important Headlines | ||

|

11/21/2022: Platinum deficit expected in 2023 after bumper surpluses, WPIC says 11/21/2022: North American auto losses deepen 11/21/2022: Large rail union SMART-TD votes to reject labor deal as national strike moves closer 11/18/2022: Rio to pursue Turquoise bid after ending talks with minority shareholders 11/18/2022: Indonesia faces difficult task to create OPEC-like group for nickel 11/17/2022: Canada 'very unlikely' to join OPEC-like group for nickel -gov't source |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||