|

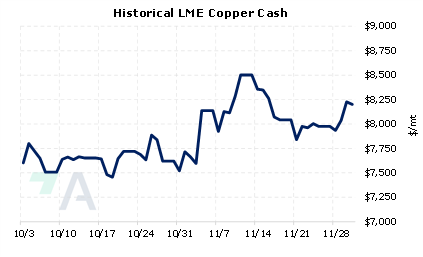

LME Copper prices surged over 10% in November, the first monthly price gain since April 2022. AEGIS notes that this was the largest monthly price jump since April 2021. We also point out that the recent uptick in prices could be tied to China’s COVID and economic policies. Earlier this week, Chinese government officials stated they will “speed up” COVID vaccinations for the elderly, leading some to speculate that the government could start easing some COVID policies. Also, this week, in an attempt to boost its faltering real-estate sector, Chinese authorities relaxed financing restrictions on property developers. Last week Friday, to increase the country’s money supply, China’s central bank lowered the reserve requirement ratio (RRR) on domestic banks. The RRR is the percentage of funds that a bank must hold in reserve and not lend out. (Source: Bloomberg) |

|

|

|

AEGIS notes that these measures could boost copper demand, and therefore could remain supportive of LME copper prices. Even with the recent price gains, this still could be a good opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/1/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/30/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

||

|

|

||

| Important Headlines | ||

|

11/29/2022: China property stocks surge on fundraising support; COVID protests cloud demand 11/29/2022: US HRC: Spot prices flat, mills push increases 11/29/2022: Ukraine's Metinvest says operations restored after power outages 11/29/2022: LME had regulatory obligation to be able to cancel nickel trades in March, filings say 11/28/2022: Cliffs ups flat steel spot prices by $60/st 11/28/2022: METALS-Base metals fall amid China COVID protests 11/28/2022: South Korea's striking truckers say no deal reached in government talks |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||