|

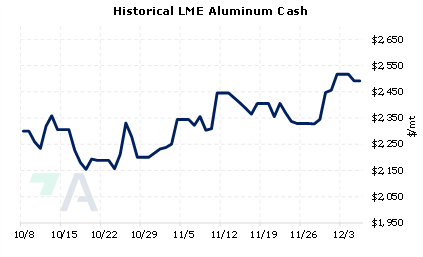

Rising production in China will lead to a global aluminum market surplus of 156,000 mt, thereby potentially weighing on prices into 2023, according to Bloomberg. This “small” surplus compares to an expected deficit of 560,000 mt this year. Bloomberg, therefore, expects aluminum prices to range between $2,200 to $2,500/mt in 2023, a similar range seen in 2H 2022. Production will grow in China, Canada, Indonesia, and India; however, currently curtailed production in Europe will remain offline through at least 2023. Beyond 2023, Bloomberg expects a surplus of 238,000/mt in 2024 and 156,000 mt in 2025. Aluminum demand will increase in 2023 through 2025; however, at a slower pace than the increasing production. The uptick in demand will mainly come from increasing electric vehicle production. (Source: Bloomberg) |

|

|

|

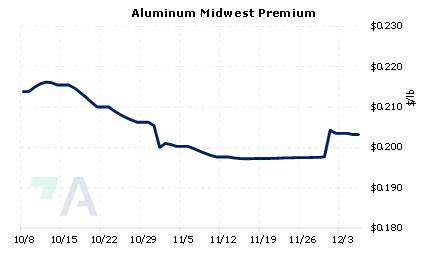

Aluminum prices are up nearly 20% from the lows of late September, with the last trade on the 3M Select at $2,490.0/mt (7:00 AM CST). That said, prices could fall in 2023 if Bloomberg’s predicted surplus comes to fruition. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (12/6/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/01/2022: What's Been Driving Aluminum Prices Lately? 11/30/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History |

||

|

|

||

| Important Headlines | ||

|

12/5/2022: US, EU weigh climate-based tariffs on Chinese steel, aluminium -Bloomberg News 12/5/2022: Volkswagen resumes production at China plants 12/2/2022: HSBC resigns as LME member after exiting industrial metals |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||