|

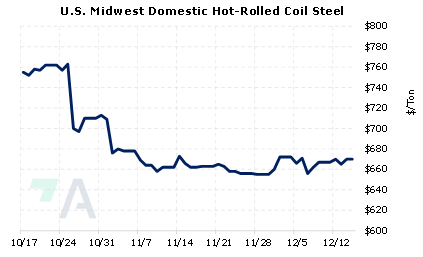

American steelmakers are increasing prices even further. On Tuesday, Cleveland-Cliffs announced they will increase prices for its flat-rolled products by $50/st. They have also set a minimum HRC price of $750/st. AEGIS notes that this minimum price is just below the current forward curve for CME HRC steel prices throughout 2023. This was the second price hike Cleveland Cliffs has done in the past three weeks, as they increased prices by $60/st on November 28. However, they did not set a minimum HRC price in the November 28 announcement. After Cleveland-Cliffs’s prior announcement, competitors Nucor, ArcelorMittal, Stelco, and US Steel all made similar price hikes in late November. (Source: Argus) |

|

|

|

Why do Cleveland-Cliffs and others feel the need to raise prices? According to Argus, most steel producers are operating at breakeven or even at a loss. CME HRC prices have tumbled throughout most of 2022, mainly because that the HRC steel market is “oversupplied.” Prompt month (December) CME HRC futures are down over 58% from the highs of mid-March, as the last trade was $670/st (7:00 AM CST). This could be a good time for steel end-users to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/15/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? |

||

|

|

||

| Important Headlines | ||

|

12/14/2022: Aluminium, copper sink on disquiet over China COVID cases 12/13/2022: US HRC: Prices flat, new increase announced 12/13/2022: Peru copper mines face transport delays as protests spread 12/13/2022: Copper price rises as US inflation rate slows 12/12/2022: Analysis: Turbulence still haunts LME nickel, months on from trade debacle 12/9/2022: Exclusive: Canada aims to speed up new projects with critical minerals strategy 12/9/2022: WTO rules US steel, Al tariffs unwarranted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||