|

Yesterday aluminum producer Norsk Hydro stated they could cut production by another 30,000 mt/yr. However, they did not give a timeline for when these potential cuts could occur. This adds to the nearly 100,000 mt/yr of cuts they have already done this year. AEGIS notes that these potential curtailments add to a growing list of European smelter curtailments that have occurred this year. Excluding Norsk Hydro’s potential cuts, AEGIS estimates that approximately 1.16 million mt/yr, or 26% of Europe’s annual smelter capacity has gone offline since late 2021 due to falling demand or high electricity prices. Norsk Hydro made this prediction in its Capital Markets Day presentation, released yesterday. (Source: Norsk Hydro, Reuters) |

|

|

|

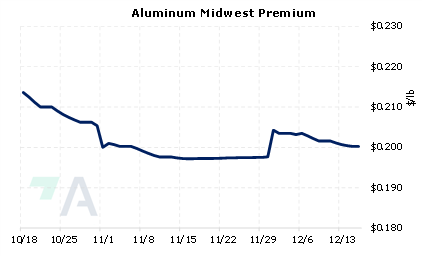

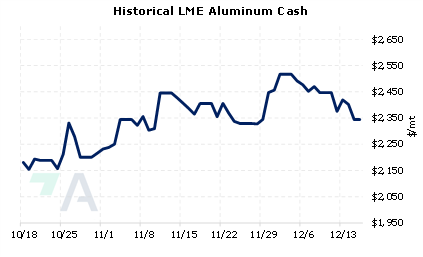

Despite the production cuts in Europe, LME aluminum prices are down about 14% this year. Will more curtailments in Europe and elsewhere begin to push prices higher? Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/16/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

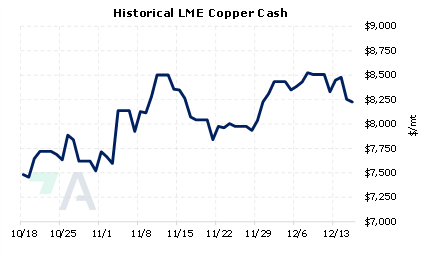

12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? |

||

|

|

||

| Important Headlines | ||

|

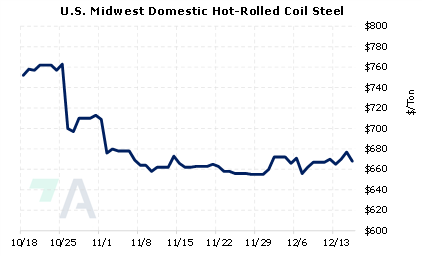

12/15/2022: China Nov aluminium output rises as power controls ease 12/15/2022: Aluminium producer Norsk Hydro to raise capex, cut more costs 12/14/2022: Aluminium, copper sink on disquiet over China COVID cases 12/13/2022: US HRC: Prices flat, new increase announced 12/13/2022: Cliffs ups prices, targets HRC low at $750/st 12/13/2022: Peru copper mines face transport delays as protests spread 12/13/2022: Copper price rises as US inflation rate slows 12/12/2022: Analysis: Turbulence still haunts LME nickel, months on from trade debacle 12/9/2022: Exclusive: Canada aims to speed up new projects with critical minerals strategy 12/9/2022: WTO rules US steel, Al tariffs unwarranted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||