|

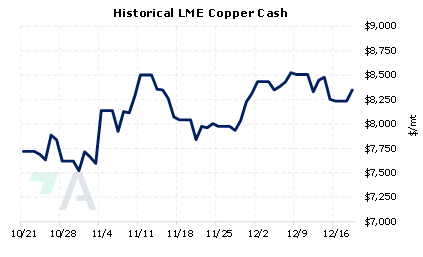

The Panamanian government will likely close the Cobre Panama copper mine after the mine’s owner failed to reach an agreement over royalty payments to the government. Despite months of negotiations, the mine’s parent company, First Quantum Minerals, missed a deadline last week to agree to a $375 million/yr royalty to the government. However, First Quantum stated they are open to further dialogue. The Cobra Panama mine began operations in 2019 and is one of the largest projects brought online in recent years. According to company estimates, the mine will produce 340,000 to 350,000 mt of copper in 2022. Based on USGS figures, this equates to approximately 1.5% of global production. (Sources: Bloomberg, Reuters, USGS) |

|

|

|

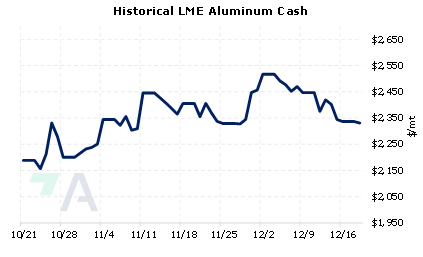

LME copper prices are down over 14% this year mainly because of falling global demand. However, several analysts and producers recently quoted by Bloomberg are bullish on long-term copper demand due to the “energy transition.” This could be a good opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/19/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? |

||

|

|

||

| Important Headlines | ||

|

12/18/2022: China November aluminium imports fall amid rising domestic supply 12/16/2022: First Quantum mulling all legal options after Panama halts flagship mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||