|

India’s steel output has doubled in the past eight years, and its government would like domestic steelmakers to more than double production by the end of the decade. Currently, production is 120 million mt/yr, with an annual capacity of 154 million mt. However, the government wants domestic producers to double their production capacity to 300 million mt within the next eight years. According to their Steel Minister, India has a “tremendous” amount of infrastructure projects coming online within the next few years. Thus, steel production needs to grow rapidly. According to USGG data, India is now the world’s second-largest steel producer, bested only by China. (Source: Bloomberg, USGS) |

|

|

|

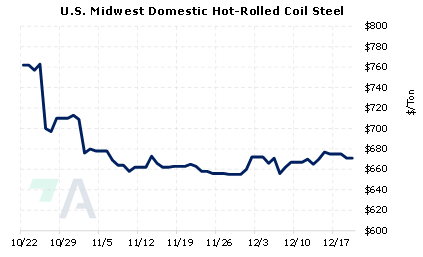

AEGIS notes that India’s appetite for steel is already growing. According to the Economic Times, steel consumption was 75.3 million mt between April and November, up 12% compared to the same period in 2021. Similarly, finished steel imports between April and November were 3.8 million mt, up 22.5% compared to the same period in 2021. Even though India normally imports little steel from the US, higher Indian demand could be bullish to CME HRC prices, if their demand for US finished-steel products increases over the coming years. Moreover, other major steel importers could be forced to look elsewhere for steel, especially if their cargoes are diverted to India. This could be a good time for steel end-users to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/20/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

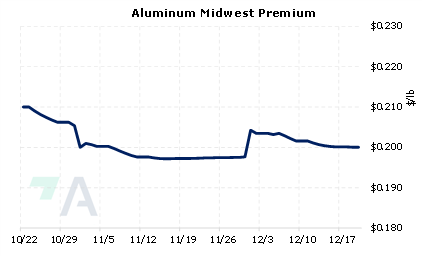

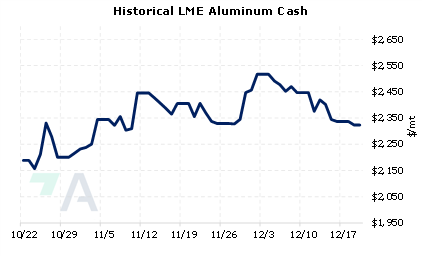

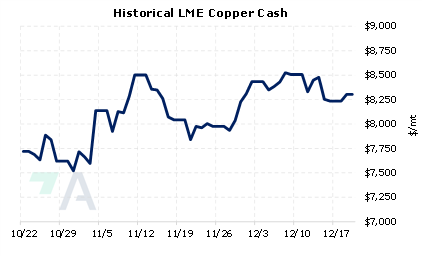

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? |

||

|

|

||

| Important Headlines | ||

|

12/19/2022: Tesla hits 3,000 cars a week in Berlin, Austin later than planned 12/19/2022: Norway's Hydro plans wind farm to power industrial plants 12/18/2022: China November aluminium imports fall amid rising domestic supply 12/16/2022: First Quantum mulling all legal options after Panama halts flagship mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||