|

| |

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

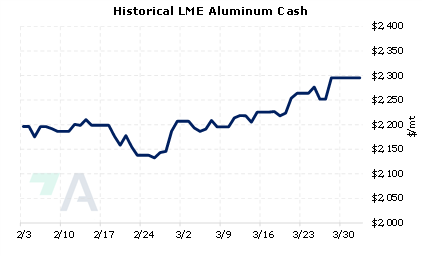

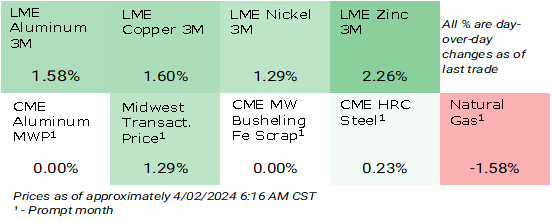

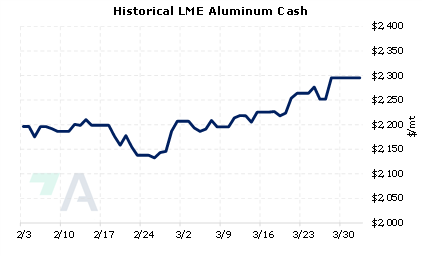

- LME Aluminum 3M Select is up $37/mt, the highest level since late December.

- Last trade was $2,374/mt (6:15 AM CST)

- China’s primary aluminum smelters continue at a brisk pace despite some lingering hydropower and electricity issues in the top-producing Yunnan province. Last month, primary aluminum production was 3.56 million mt, up 4% compared to March 2023, according to Shanghai Metal Market (SMM) estimates. Approximately 500,000 mt of previously curtailed production will be brought back online by the end of April. Some remaining capacity will be kept offline due to continued hydropower issues. With overall demand still subdued, this increasing production could be a burden to global (LME) aluminum prices. (Source: SMM)

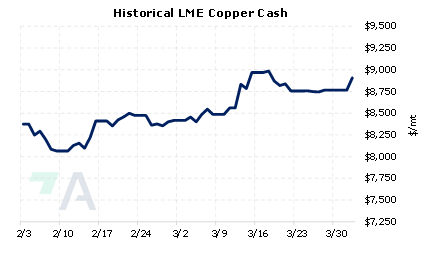

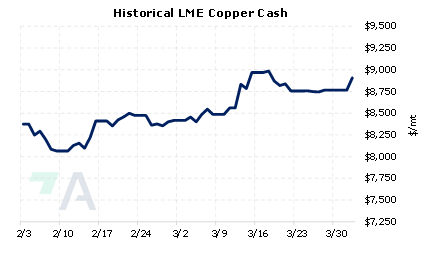

- LME Copper 3M Select is up $139.5/mt, starting the week on a positive note.

- Last trade was $9,006.5/mt (6:15 AM CST)

- To help build relationships with the world’s top emerging copper and cobalt miners, the US State Department is talking with producers such as the Democratic Republic of the Congo’s (DRC) state-owned copper miner Gecamines, the agency stated late last week. These conversations center around supply deals and building new mines and usually occur every four to six weeks. The department did not comment on whether or not it will seek to buy out First Quantum’s copper operation in neighboring Zambia. The department stated, “Washington's goal is not to offset China's influence in Africa's critical mineral sector but to diversify its own supply chains and encourage African partners to boost their mining standards.” Several of China’s largest metals producers have taken debt or equity stakes in Africa’s most promising copper and cobalt operations. (Source: Reuters)

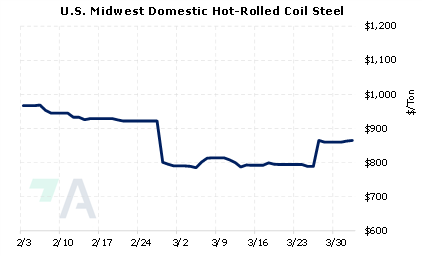

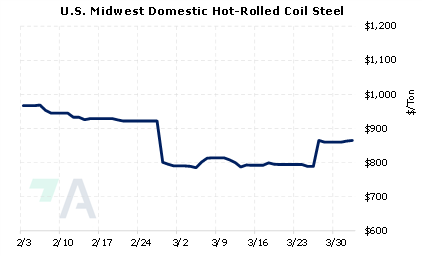

- Prompt month CME HRC Steel last traded at $865/st, up $2/st (6:15 AM CST).

- After falling throughout most of late 2023 and early 2024, prompt CME cobalt prices have stalled near $13.60/lb for the past several weeks. If you are an end-user of battery metals such as cobalt or lithium hydroxide, please get in touch with AEGIS for strategies.

|

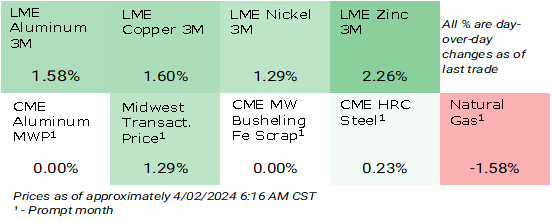

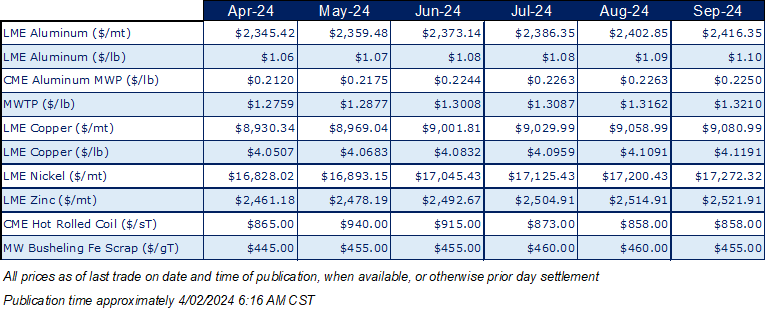

Price Indications

|

|

|

|

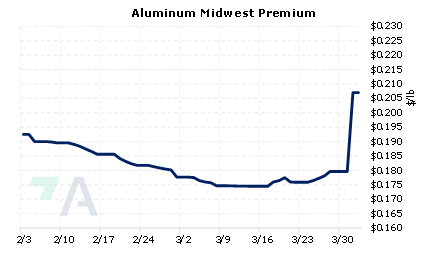

Today's Charts

|

|

|

|

|

AEGIS Insights

|

|

3/27/2024: AEGIS Factor Matrices: Most important variables affecting metals prices

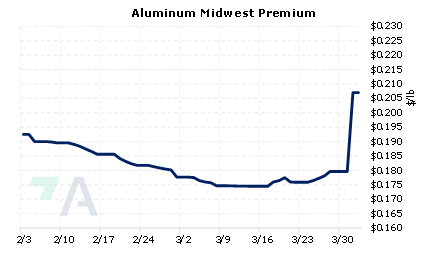

3/20/2024: Midwest Premium Buyers Should Hedge While Prices Hover at 3-Year Lows, and Demand Appears To Be Stabilizing

3/14/2024: Important US Economic Data (AEGIS Reference)

2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little

2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers

1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge

|

|

| Important Headlines |

|

4/1/2024: Weak supply and demand to prevent aluminum prices from going up

3/31/2024: Nippon Steel emphasises its 'deep roots' in the US as it pursues U.S. Steel deal

3/29/2024: US talks often with Congo's Gecamines on cobalt and copper, official says

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|