|

| |

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

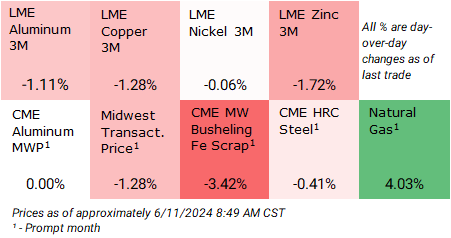

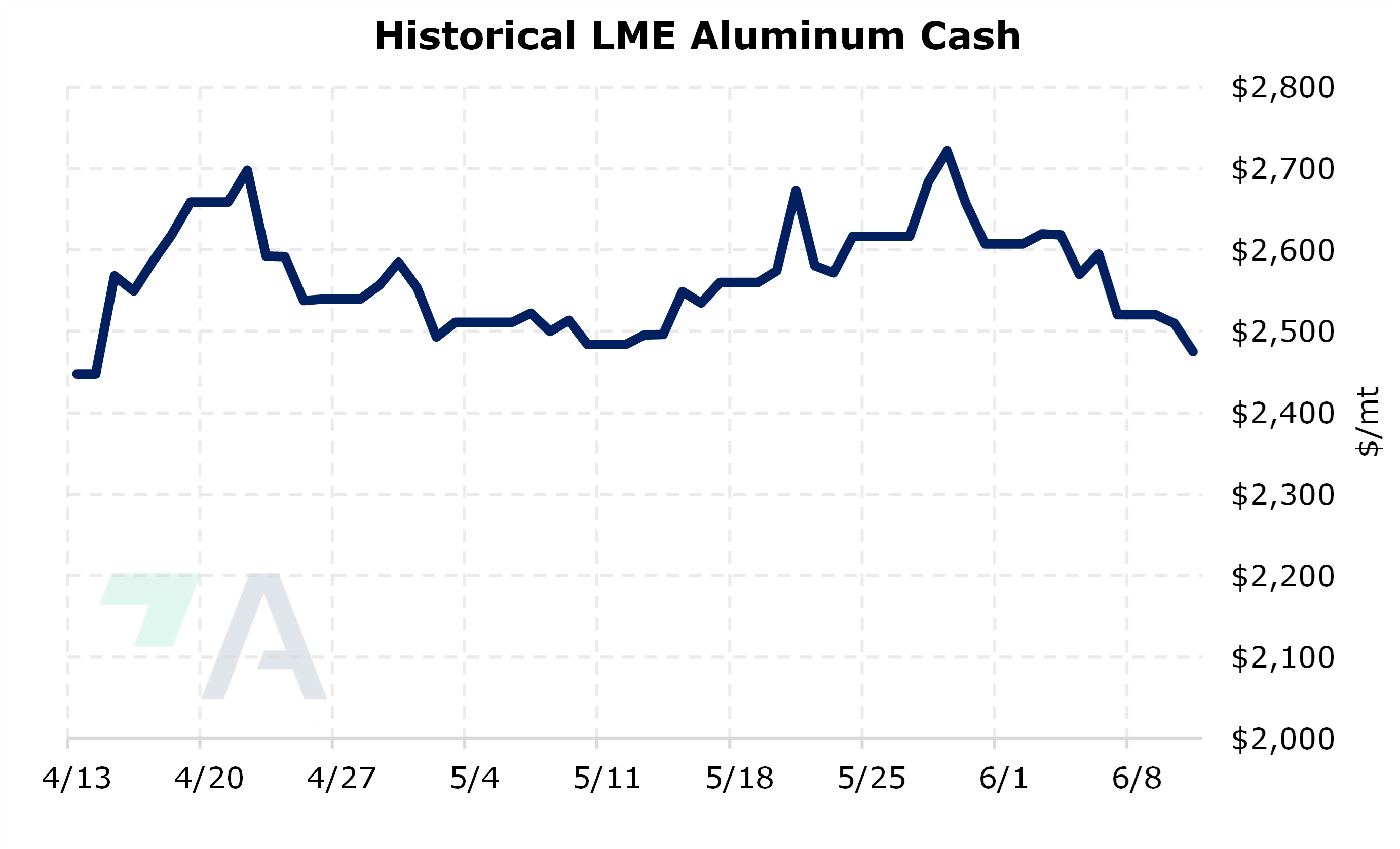

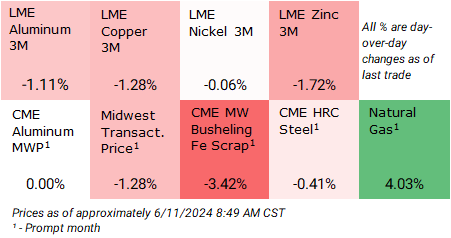

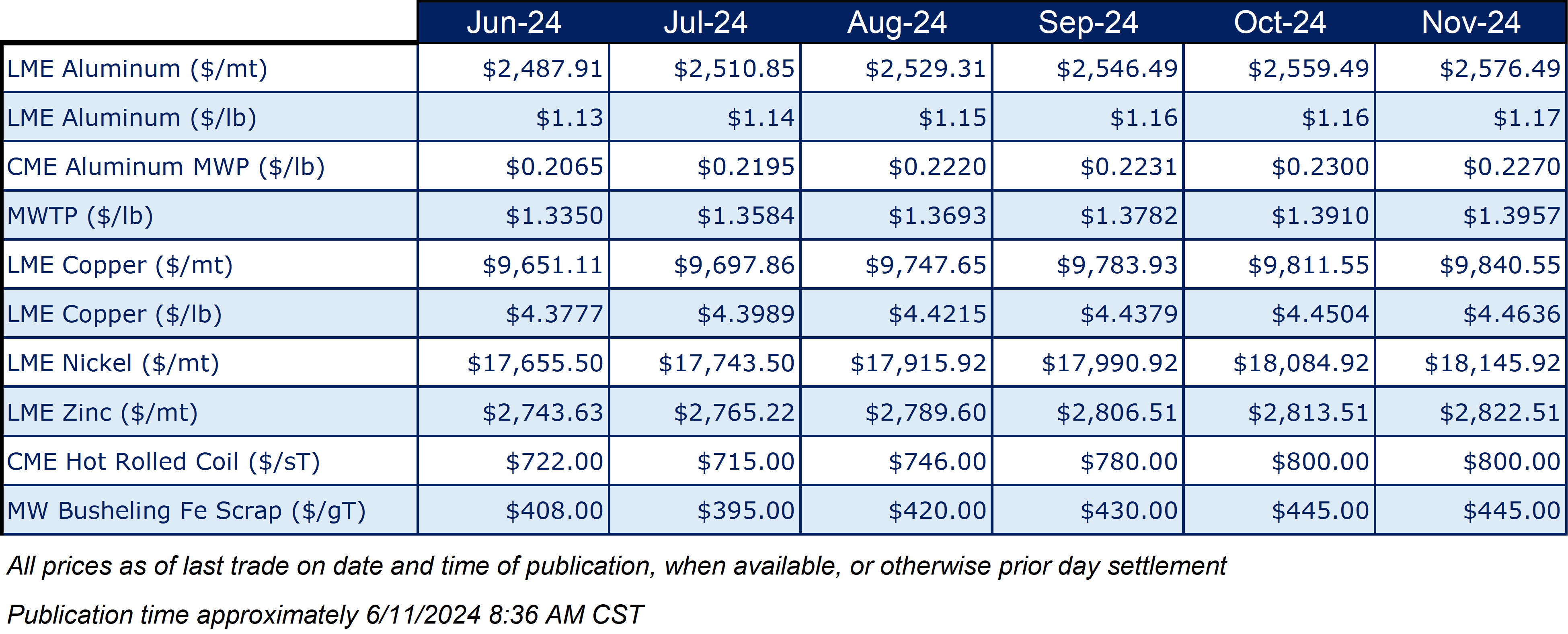

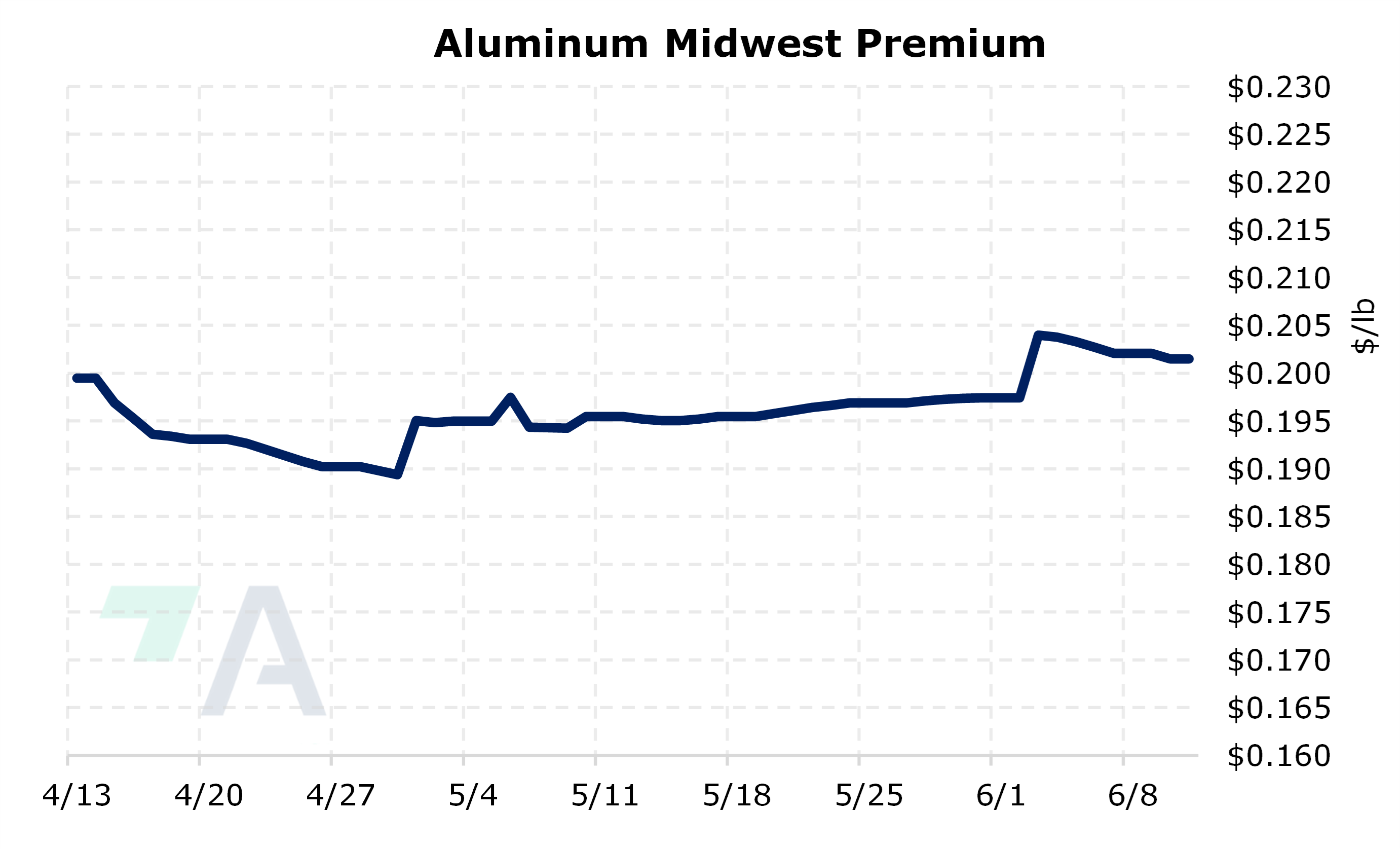

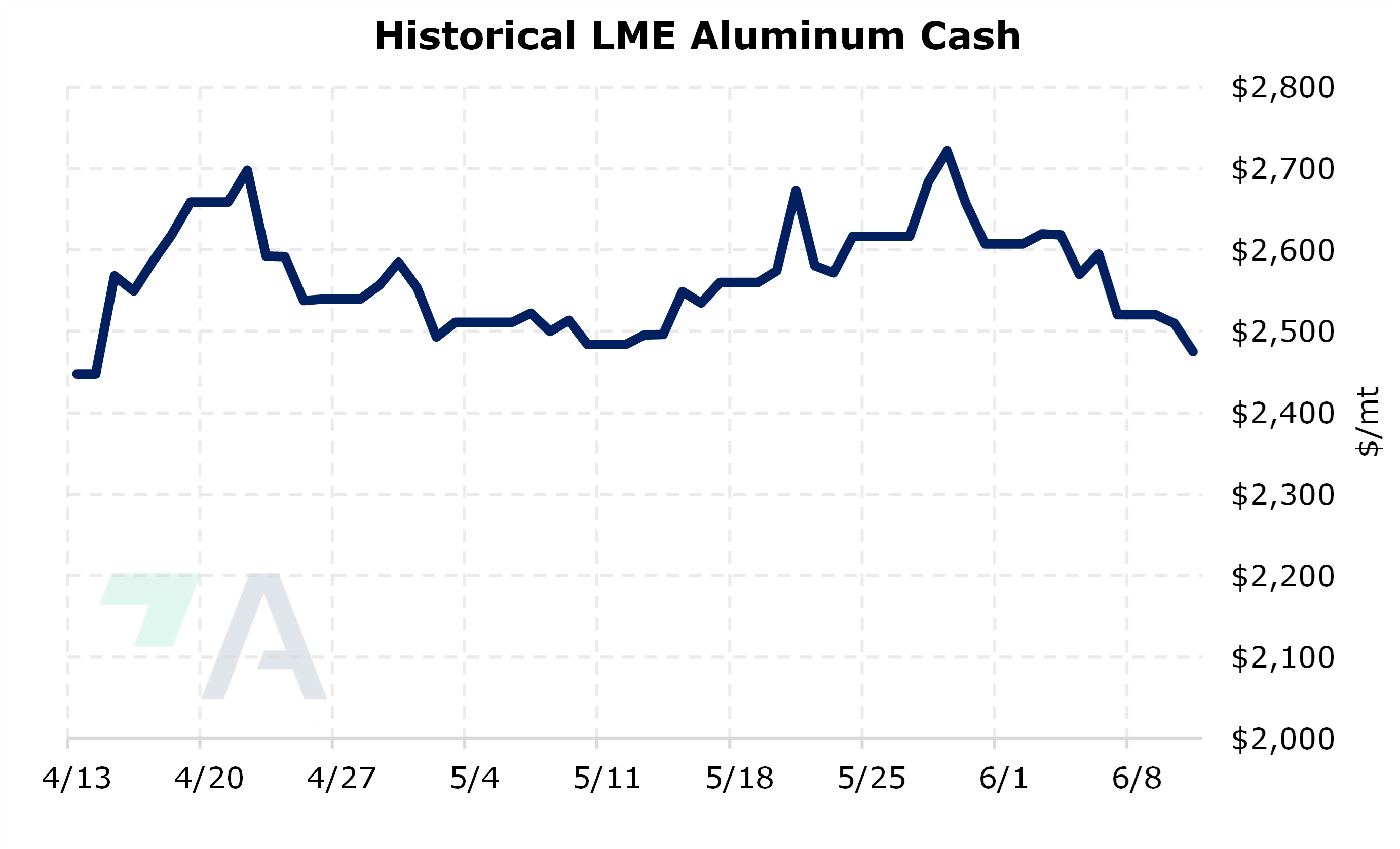

- LME Aluminum 3M Select is down $34.56/mt, extending yesterday’s losses

- Last trade was $2,475/mt (9:00 AM CST)

- In early May, there was a significant increase in aluminum stocks at London Metal Exchange (LME) warehouses, marked by the largest daily inflow ever recorded. This surge was driven by deliveries into Malaysian warehouses by major metals traders, including Trafigura. By the end of May, total aluminum inventories had soared by 128% compared to last month. (Source: Bloomberg)

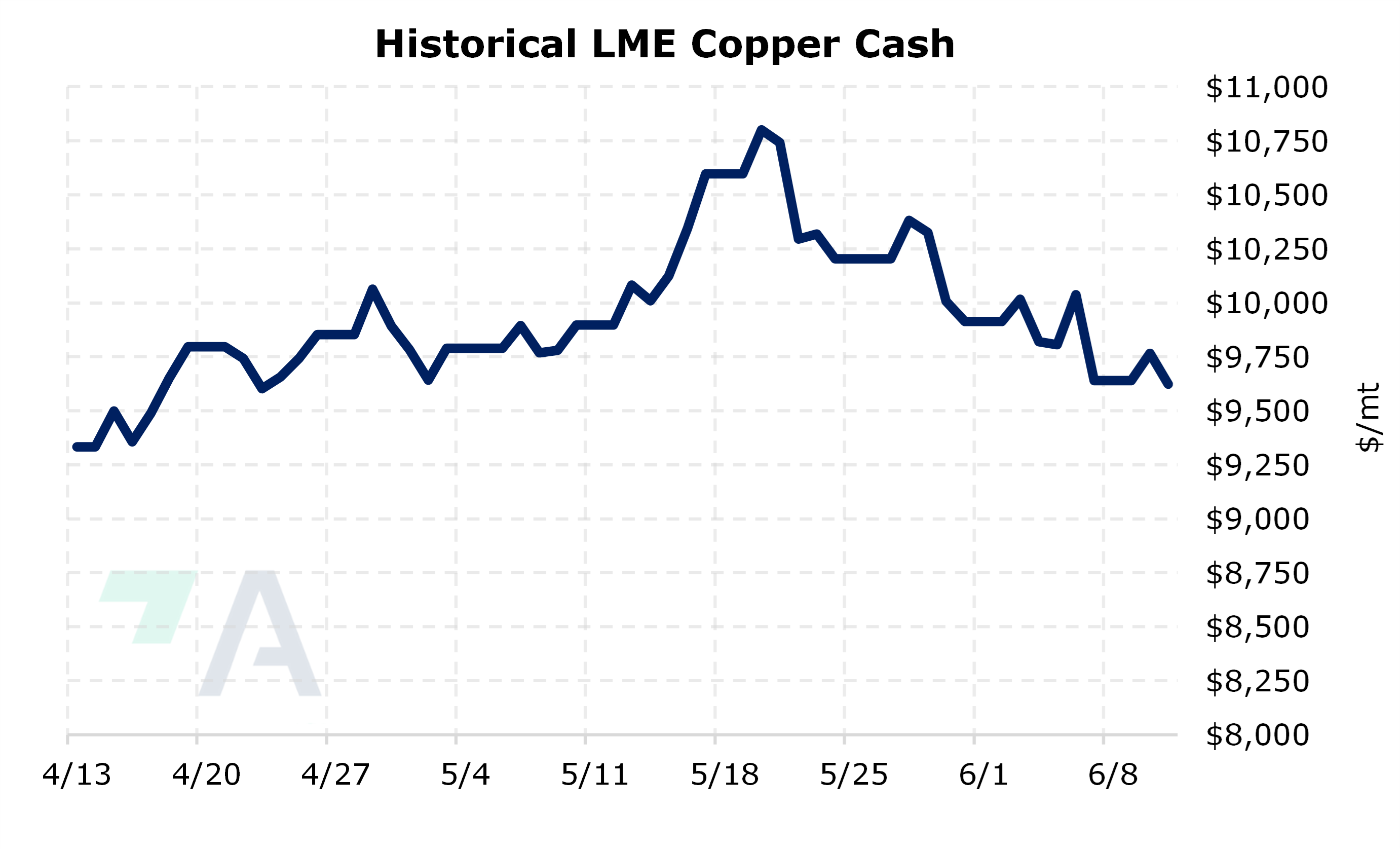

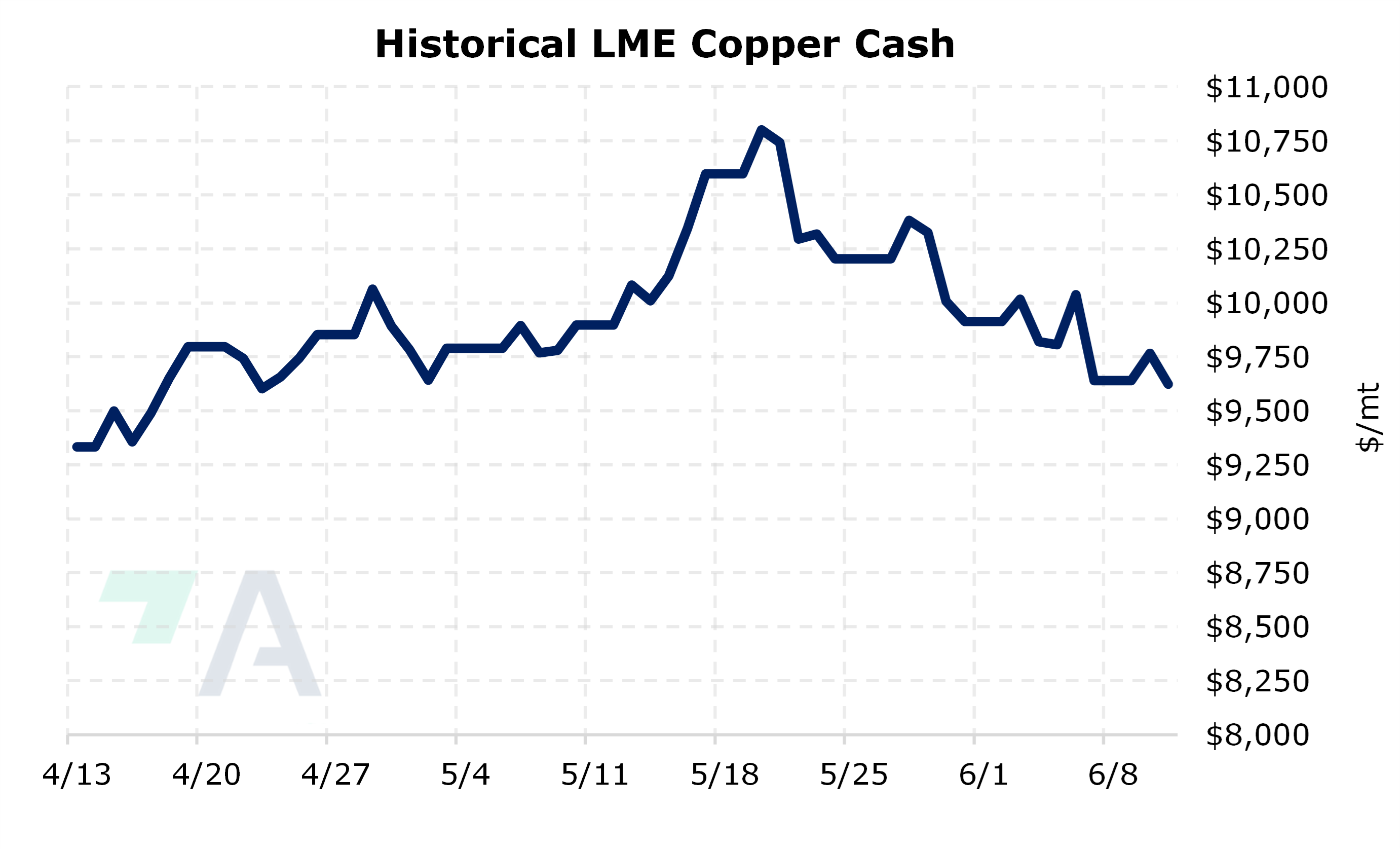

- LME Copper 3M Select is down $127/mt, the lowest level in nearly a month.

- Last trade was $9,623.5/mt (9:00 AM CST)

- Copper prices hit a seven-week low as Chinese fabricators showed muted demand despite a recent price pullback. Chinese manufacturers consider current copper prices too high, resulting in limited purchases. This sentiment is reflected in rising inventories on both the Shanghai Futures Exchange and the London Metal Exchange, with copper inventories reaching their highest levels in years. (Source: Bloomberg)

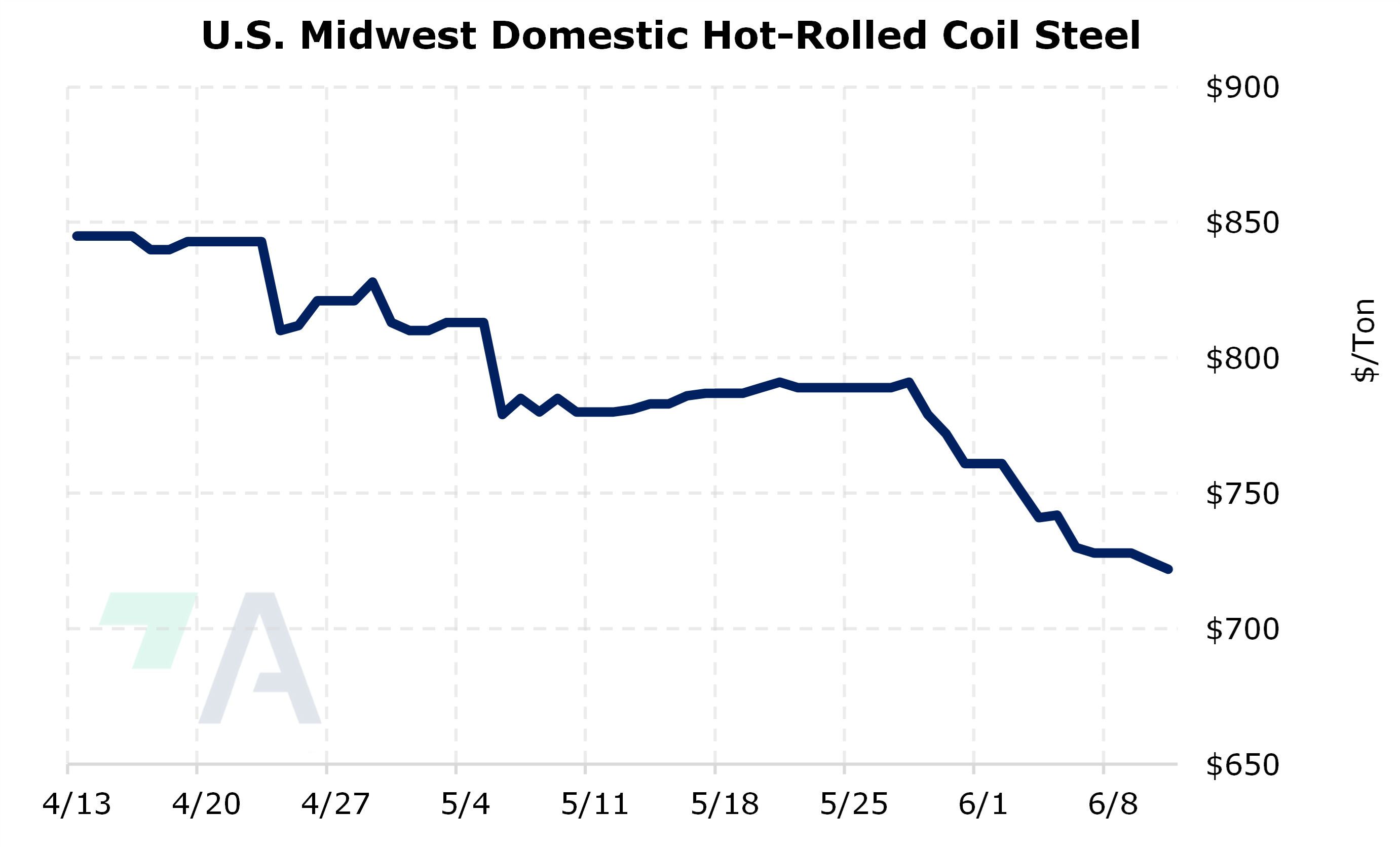

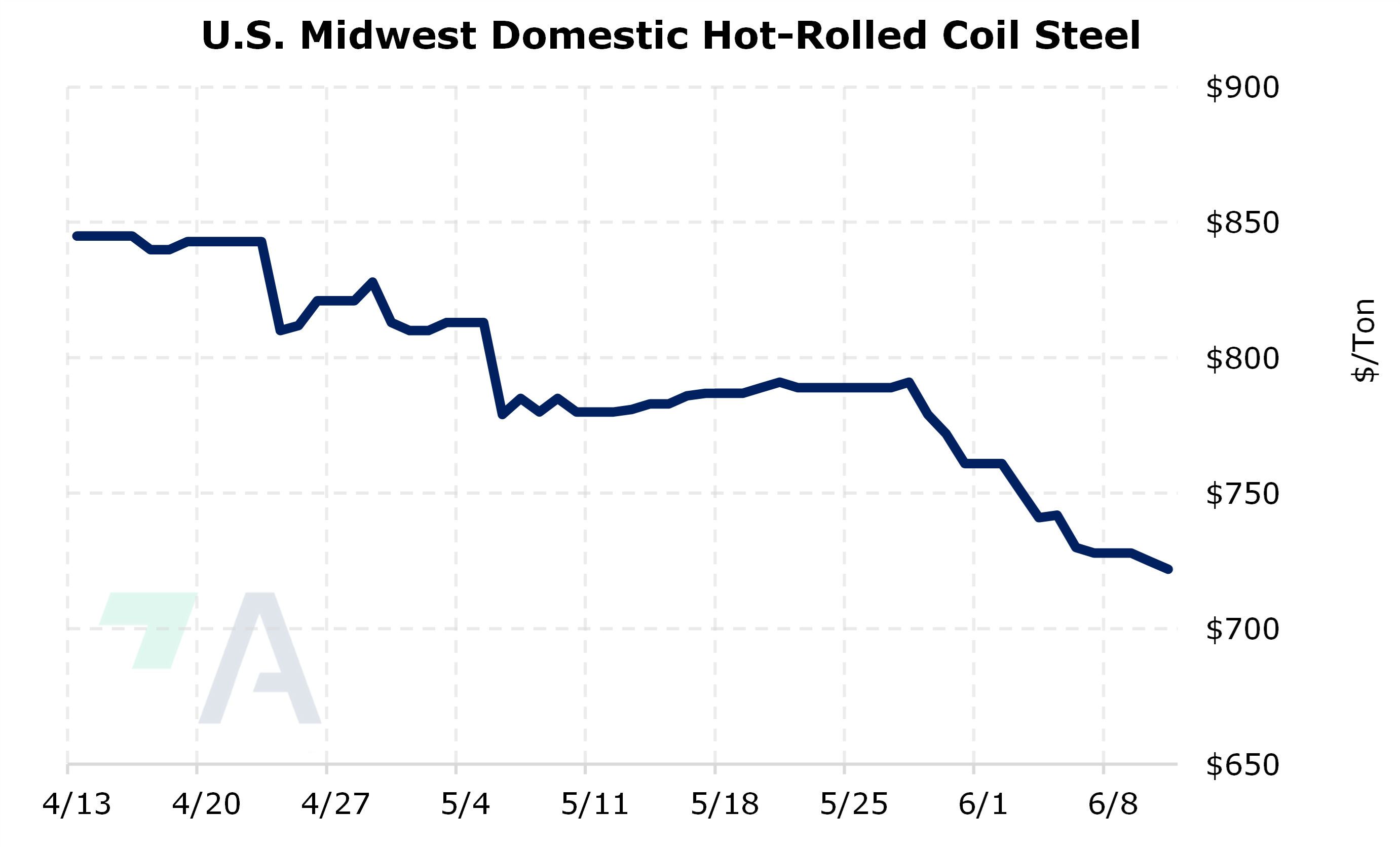

- Prompt month CME HRC Steel last traded at $722/st, down $3/st (9:00 AM CST).

- Iron ore prices have dropped to a two-month low amidst lingering concerns about China's property market. Doubts persist over the effectiveness of China's efforts to address its prolonged property crisis, despite recent policy measures aimed at stabilizing the market. The State Council's directive to formulate new policies to absorb existing housing stock and stabilize markets has not fully reassured investors. Iron ore inventories at Chinese ports have surged to their highest levels in over two years, adding to market uncertainties. Futures for the commodity in Singapore fell as much as 2.2% to $103.80 a ton before rebounding slightly to $104. (Source: Bloomberg)

|

Price Indications

|

|

|

|

Today's Charts

|

|

|

|

|

AEGIS Insights

|

|

5/29/2024: AEGIS Factor Matrices: Most important variables affecting metals prices

5/2/2024: Important US Economic Data (AEGIS Reference)

4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in US Markets

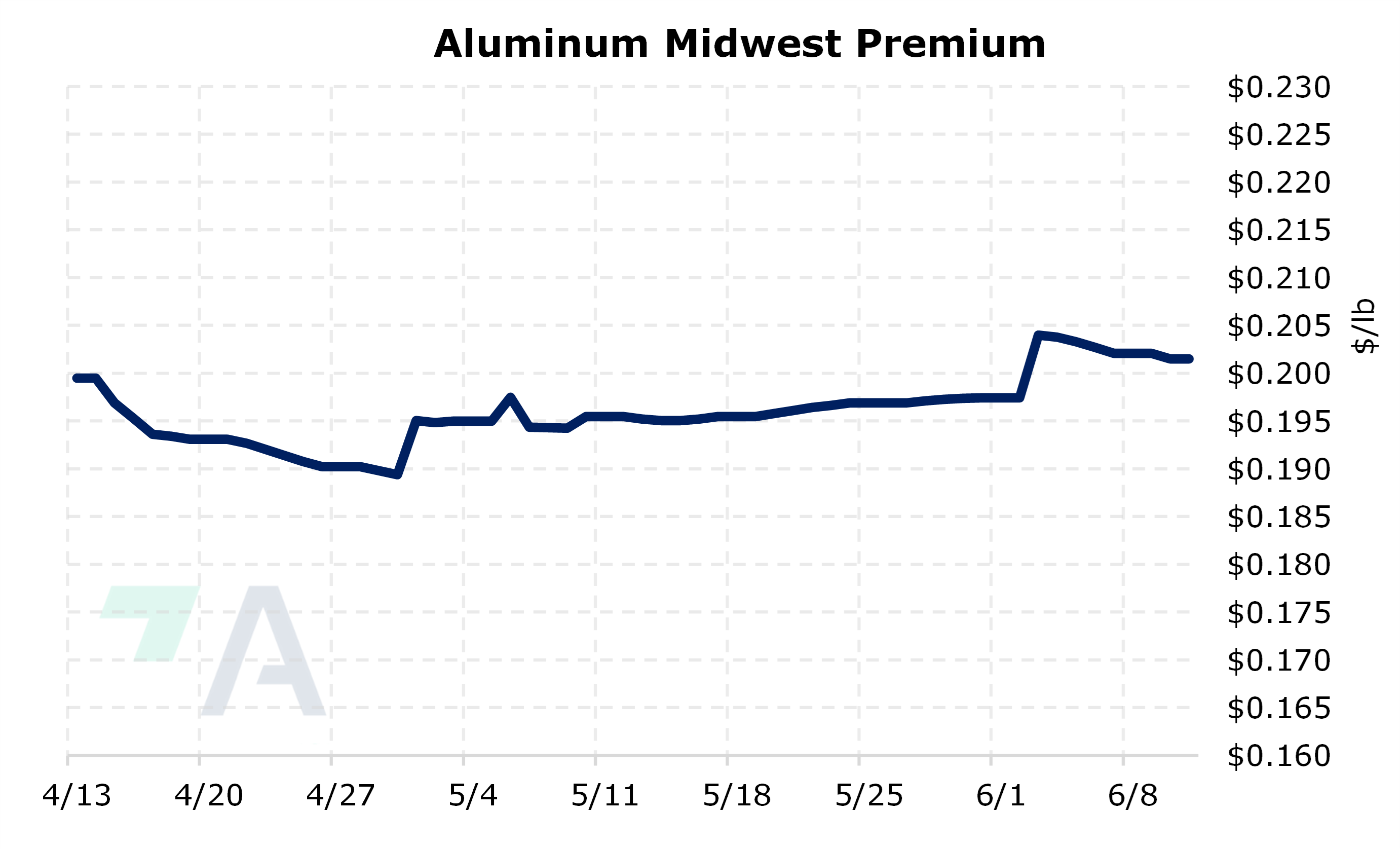

3/20/2024: Midwest Premium Buyers Should Hedge While Prices Hover at 3-Year Lows, and Demand Appears To Be Stabilizing

2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little

|

|

| Important Headlines |

|

6/4/2024: Volvo to issue world's first EV battery passport ahead of EU rules

6/4/2024: South Korea, Africa leaders pledge deeper ties, critical mineral development

6/3/2024: The PMI of the domestic aluminum processing industry recorded 41.7% in May | Shanghai Non ferrous Metals

6/2/2024: Nippon Steel's Mori returns to US this week for talks on US Steel takeover

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|