|

|

|

|

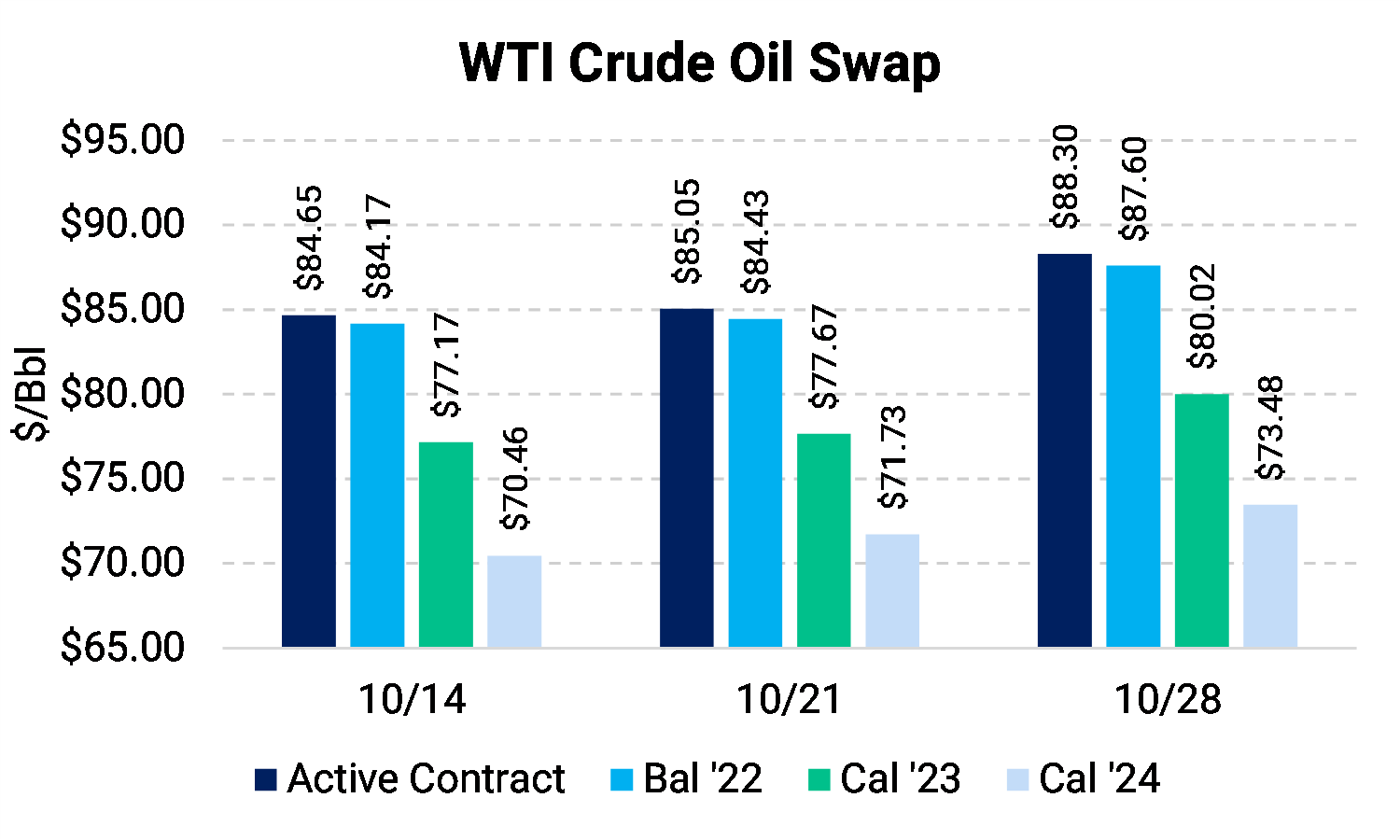

Oil posted a weekly gain. WTI increased by $2.85 this week, or 3.56%, to finish at $87.90/Bbl. Prices found support from signs of a strengthening U.S. economy and tight crude and product markets but were held back from their potential by China’s demand uncertainty.

The USD Index (DXY; a proxy for the U.S. dollar value against a basket of six other international currencies) fell to its lowest in a month this week. The weakness in DXY was one of the bullish factors affecting crude prices. A weaker dollar can cause foreign buyers of dollar-denominated commodities to pay less for the same amount of goods, and the ongoing dollar weakness is likely holding up oil prices.

The U.S. exported a record volume of oil last week in response to the global energy crunch brought on by Russia’s war in Ukraine. This is even as political tensions over U.S. fuel prices rise. EIA weekly data showed that total U.S. petroleum exports, which include crude oil and petroleum products, reached a record high of 11.4 MMBbl/d last week, even while domestic fuel inventories are at historic seasonal lows.

Crude prices also found some support yesterday from 3Q2022 U.S. economic data that revealed stronger-than-expected GDP growth. U.S. GDP rose at an annualized rate of 2.6% in the third quarter, according to a preliminary estimate from the Commerce Department. The growth came after two consecutive quarters of declines and may ease some recession fears and bolster the demand outlook.

Although economic growth is typically a positive indication, it can also prompt the Federal Reserve to keep raising interest rates for longer to manage inflation, which might eventually cause a slowdown. The central bank is expected to raise interest rates by 75 basis points at its meeting next week. The Fed could make its fourth-straight rate increase.

On the demand side, China is still facing uncertain crude demand. On Thursday, the nation imposed new Covid-related mobility curbs in about 28 cities, which are its major manufacturing hubs and population centers, restricting more than 200 million people.

The market will continue to face supply uncertainty in the months ahead as OPEC+ cuts output, and the EU imposes sanctions on Russian crude. Hence, we believe there is an upside to prices and the forward curve. We still recommend costless collars for most clients.

A collar would set a price floor but with a cap on upside participation if prices realize much higher than the forward curve. Costless collars are a popular way to hedge for protection while participating in some price recovery, should one happen.

This week’s rally ended a nine-week streak of lower weekly closes in which the prompt contract had fallen 49%.

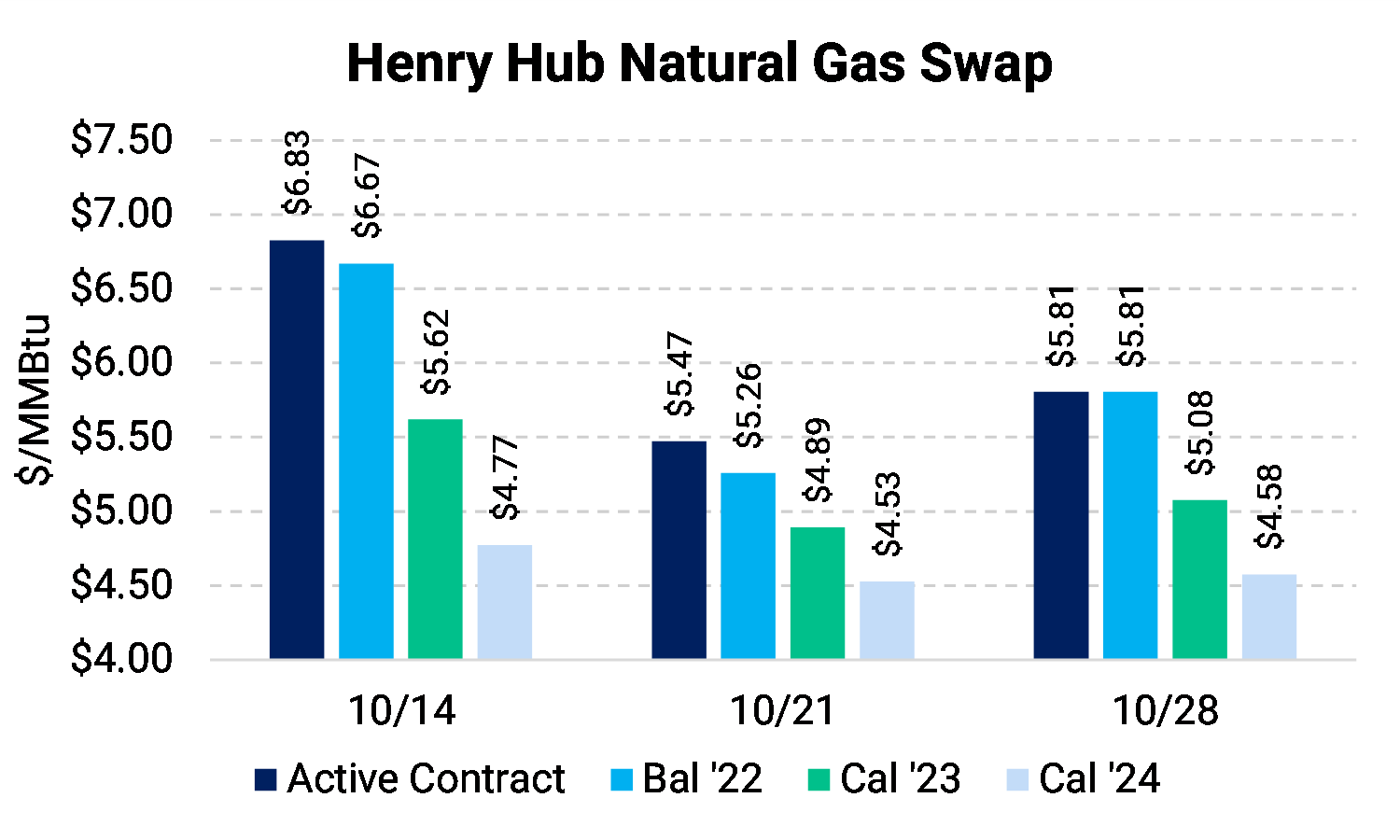

The past five weeks have been marked by lower prices and larger-than-average storage builds. This week was, however, a reversal of both trends: prices finished the week higher, and EIA said storage grew at a much smaller rate last week. In addition to the price swings in Henry Hub, certain regional markets also exhibited heightened volatility.

The December Henry Hub contract, which is now the prompt month, finished the week higher by $0.15 to $5.63. The Summer ’23 strip settled higher by $0.12 to $4.66, and the Winter ‘23/’24 strip finished the week up $.04 to $5.25.

Ending the streak of consecutive 100+ Bcf storage injections, this week, the EIA reported a build of only 52 Bcf. This number surprised many analysts, who expected a larger increase; it was also the smallest storage build relative to the five-year average injection since August. Despite this, by our measures, on a weather-adjusted basis, the market has still been averaging about 2 Bcf/d oversupplied. With milder weather this week than last, it is likely that next week’s report will show a return to the trend of large storage builds and further replenish what had been a large storage deficit this summer.

Read more about the latest gas storage and supply-demand situation.

While the price of the NYMEX Henry Hub contract rose this week, West Texas daily cash prices traded negative. Gas prices in the Permian basin have been under pressure for most of the year, declining significantly compared to the price of Henry Hub. This week, however, the price action at the Waha hub in the Permian Basin was particularly unusual, as the fixed price traded into negative territory for the first time in two years. Due to pipeline maintenance on two key Permian pipes, too much gas had too little pipeline takeaway capacity, leaving gas stranded and prices collapsing.

Read more about this event and how prices in West Texas may evolve in the future.

AEGIS hedging recommendations are unchanged this week, with costless collars remaining a valuable hedging tool due to above-average implied volatility in the call-option leg of the collar (allowing one to achieve a higher floor and ceiling price). If the market continues to soften or call-option volatility subsides, this recommendation may change.