|

Southern Copper reports that its production cash cost jumped to $1.10/lb last quarter, up from $0.59/lb in 2Q 2021. Rising costs for fuel and other operating materials, and a mine stoppage led to a decline in income, according to Bloomberg’s interpretation of Southern Copper’s 2Q report. Southern Copper’s report also stated that production volumes for copper, silver, molybdenum, and zinc all had year-over-year declines. Miners such as Southern Copper are being burdened by rising inflationary pressures and falling metals prices. |

Higher steel demand is expected this year. Pent-up consumer demand for new cars, trucks, and SUVs will lead to higher steel shipments in 2H 2022, according to steel producer Cleveland Cliffs. The company made these statements in its 2Q 2022 earnings report. This renewed demand comes after two years of lackluster automotive production, when North American light vehicle production averaged 13 million units per year, down from 17 million units per year prior to 2020, according to their calculations. Cleveland Cliffs is the largest steel supplier to the automotive market, according to S&P Global.

Regarding nickel supplies, the LME will not ban nickel from Russia’s top producer, Norilsk Nickel. Reuters reported this revelation late week. This disclosure from the LME comes despite the UK government sanctioning Norilsk Nickel’s president, Vladimir Potanin, late last month. Last Friday, the LME stated it continues to evaluate the sanctions that the British government placed on Potanin in June. The exchange has not disclosed how much nickel in its system is from Norilsk Nickel. According to Reuters, Norilsk Nickel is the world’s largest producer of refined nickel. In our view, possible banning of Russian nickel or other metals is an upside price risk, as doing so could lead to global shortages. The most straightforward way to hedge this risk is by entering into nickel swap contracts for a portion of your consumption.

As for aluminum supplies, due to a recent downturn in prices, nearly half of China's aluminum capacity is probably operating at a loss, Alcoa's CEO stated in an earnings call last week. The company, therefore, estimates that between 10% to 20% of global aluminum smelter capacity was unprofitable in June. Falling aluminum prices might have been tolerable if that were the only concern; however, the company expects that rising energy and raw material costs will erode its profit margins, despite increasing global demand. Surging electricity costs in North America and Europe, recession fears, and COVID lockdowns in China are affecting global aluminum demand and supply, according to Bloomberg.

Finally, regarding the Section 232 tariffs, The Beer Institute proclaims the current Section 232 tariffs on aluminum imports have cost the industry over $1.4 billion since 2018 and have brought no economic benefit to American consumers. These statements were asserted at last week’s public hearings on the economic impact of Section 232 import tariffs on the steel and aluminum industries. During the hearings, the US International Trade Commission heard from consumers and producers of those metals, which have been tariffed since 2018 by the Trump administration. The Beer Institute was especially vocal about the tariffs, saying the tariffs “increase production costs, inhibit investment, and impact consumer prices.”

Section 232 tariffs are at the discretion of the US executive branch and are allowed for reasons of national security. Current tariffs are 10% on aluminum imports and 25% on steel imports. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel and aluminum onto the US market. AEGIS notes the cost of the tariffs has supported Midwest Transaction Price on aluminum. Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the U.S, as these tariffs are based on aluminum prices, and are built into the Midwest Transaction Price. The ITC will release findings in March 2023.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

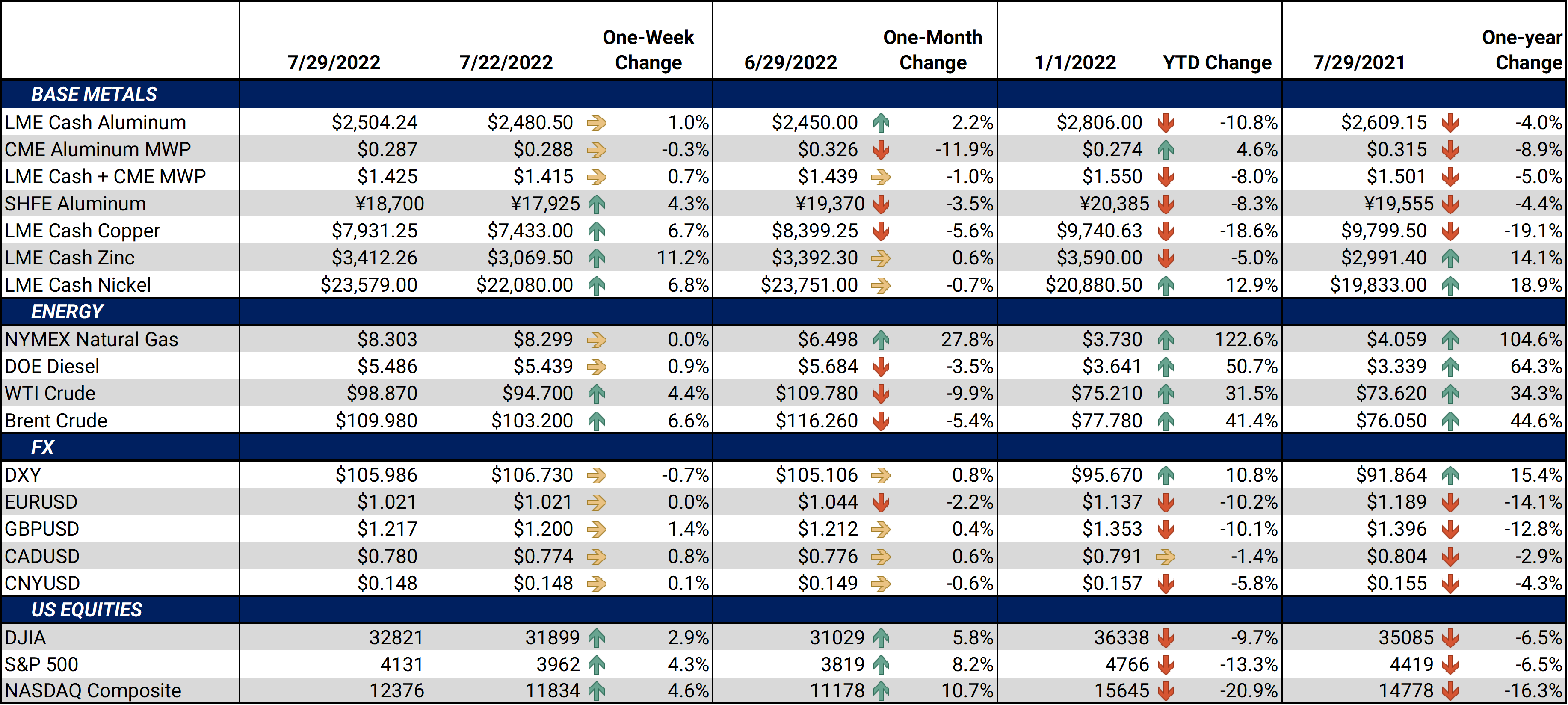

LME Aluminum 3M settled at $2,488.50/mt, up $13.00/mt on the week. Compared to last Friday, aluminum’s forward curve is little changed, and its shape is essentially the same, also. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. If you are an end-user, you might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 28.7¢/lb this week. The CME Midwest Premium contract was steady this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,917.50/mt, up $465/mt on the week. LME Copper's forward curve is now in contango, meaning that spot prices are lower than futures prices. It has shifted vertically higher by approximately $500/mt. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $23,619/mt, up $1,497/mt on the week. Nickel’s forward curve shifted higher this week, and is in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $855/T, up $10/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/27/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/27/2022: American Automotive Production is on the Rebound 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

|||||

Notable News |

|||||

|

7/28/2022: US economy contracts for 2nd consecutive quarter 7/28/2022: ArcelorMittal H1 crude steel output falls 13% on year 7/27/2022: Analysis: Peru's mining execs 'lose faith' in gov't despite moderate shift 7/26/2022: US HRC: Prices fall, large buys reported 7/26/2022: Column: Where there's muck there's brass ... and critical minerals 7/26/2022: Why China’s economic measures may not be enough to drive up consumer demand 7/25/2022: LME won't ban Nornickel's metal as Russian firm isn't under UK sanctions -sources 7/24/2022: Column: Aluminium producers feel the margin pain as price slumps 7/22/2022: Cliffs expects automotive steel demand rebound by year-end: CEO |

|||||