|

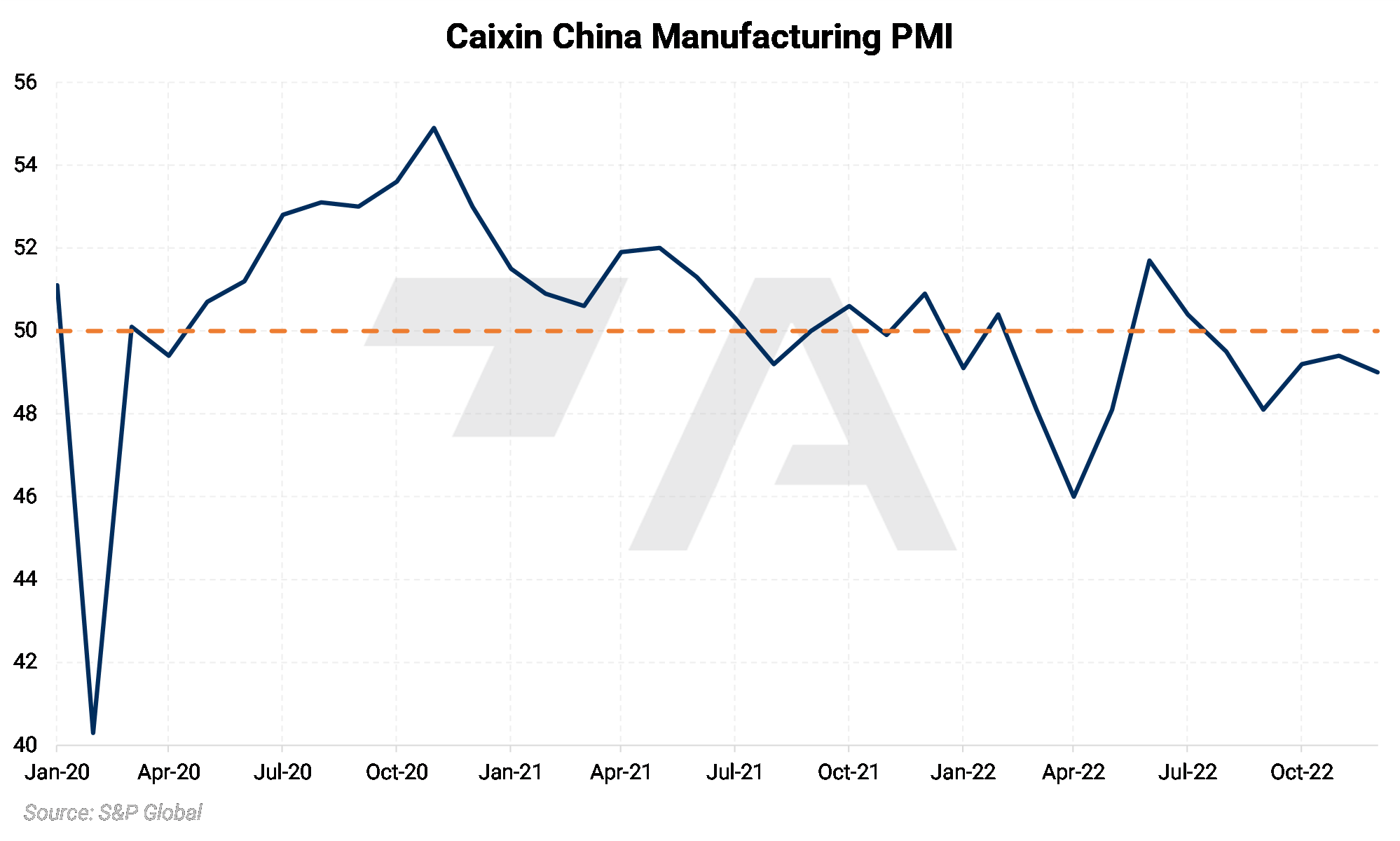

Aluminum LME aluminum prices tumbled over 3% in the first trading week of 2023, due in part to concerns that a “vicious virus wave” in China could hinder the country’s factory activity in 1Q 2023, according to Bloomberg. AEGIS notes that surging COVID cases, weakening demand and logistical issues have already weighed on China’s manufacturing activity in recent months. The Caixin/Markit manufacturing purchasing managers' index (PMI), which is a widely used gauge of China’s manufacturing activity, fell to 49.0 in December, down from 49.4 in November. To interpret this index, we note that readings above 50.0 indicate that an industry’s activity is increasing, while readings below 50.0 signal contraction. Based on this metric, China’s manufacturing activity has been contracting since August 2022. (Source: Bloomberg, Reuters) |

|

This week’s pullback in LME aluminum prices adds to the nearly 15% drop that occurred last year. Despite the negative headlines and worries over short-term aluminum demand, analysts interviewed by Reuters feel that China’s recent relaxation of its COVID policies could lead to an uptick in economic activity later this year, and consequently, aluminum demand. This could ultimately push aluminum prices higher. |

|

|

|

Some European metals traders have seen a recent uptick in spot aluminum purchases, and according to one unnamed source recently interviewed by S&P Global, the newly implemented cap on European natural gas prices “will grant more clarity to consumers, and with this, they can start hedging energy and start buying metal.” This cap on European natural gas prices is triggered when benchmark LNG prices reach a certain level and is an attempt to cool inflation and lower energy bills for residential and commercial consumers. These factors could push aluminum import premiums into Europe higher in 2023. These premiums fell precipitously in 2H 2022; as European duty-paid premiums (over LME) now hover near $250/mt. This is down nearly 60% from the record high seen in May 2022 when these premiums surged to $630/mt as end-users scrambled to buy up inventories. This initial run to buy aluminum was due to fears that escalating energy costs and logistical issues would lead to metal shortages. However, fears over Europe’s economic recovery have led to softening metals demand and premiums in 2H 2022. Due to falling demand, logistical issues, and self-sanctioning efforts by many European countries, nearly 1 million mt of Russian aluminum that normally goes to Europe was diverted to Asia last year. This is in addition to the nearly 1.4 million mt of European production due to soaring electricity prices. (Source: S&P Global, Reuters) |

|

|

|

LME warehouse inventories are starting the year at the lowest levels in nearly 25 years, and AEGIS wonders if the scramble to buy inventories will continue into 2023. Collectively, total inventories across all six major LME metals dropped approximately two-thirds last year. Most notably, zinc inventories dropped by 90%, and aluminum was down nearly 72%. LME inventories are important as they are the “market of last resort,” as traders and end-users generally do not source metals from such warehouses. Also, these inventory levels are thought to be a gauge of metal supply constraints. (Source: Bloomberg) AEGIS notes that this substantial drop in LME inventories coincided with a significant decline in metals production, specifically in Europe. For example, high electricity prices across Europe in 2022 forced many zinc and aluminum smelters to curtail production fully or partially due to unprofitability. Specifically for aluminum, AEGIS estimates that approximately 1.16 million mt/yr, or 26% of Europe’s annual smelter capacity has gone offline since late 2021 due to falling demand or high electricity prices. As curtailments increased across Europe, end-users sought out LME stocks to help fill in supply gaps. |

|

|

|

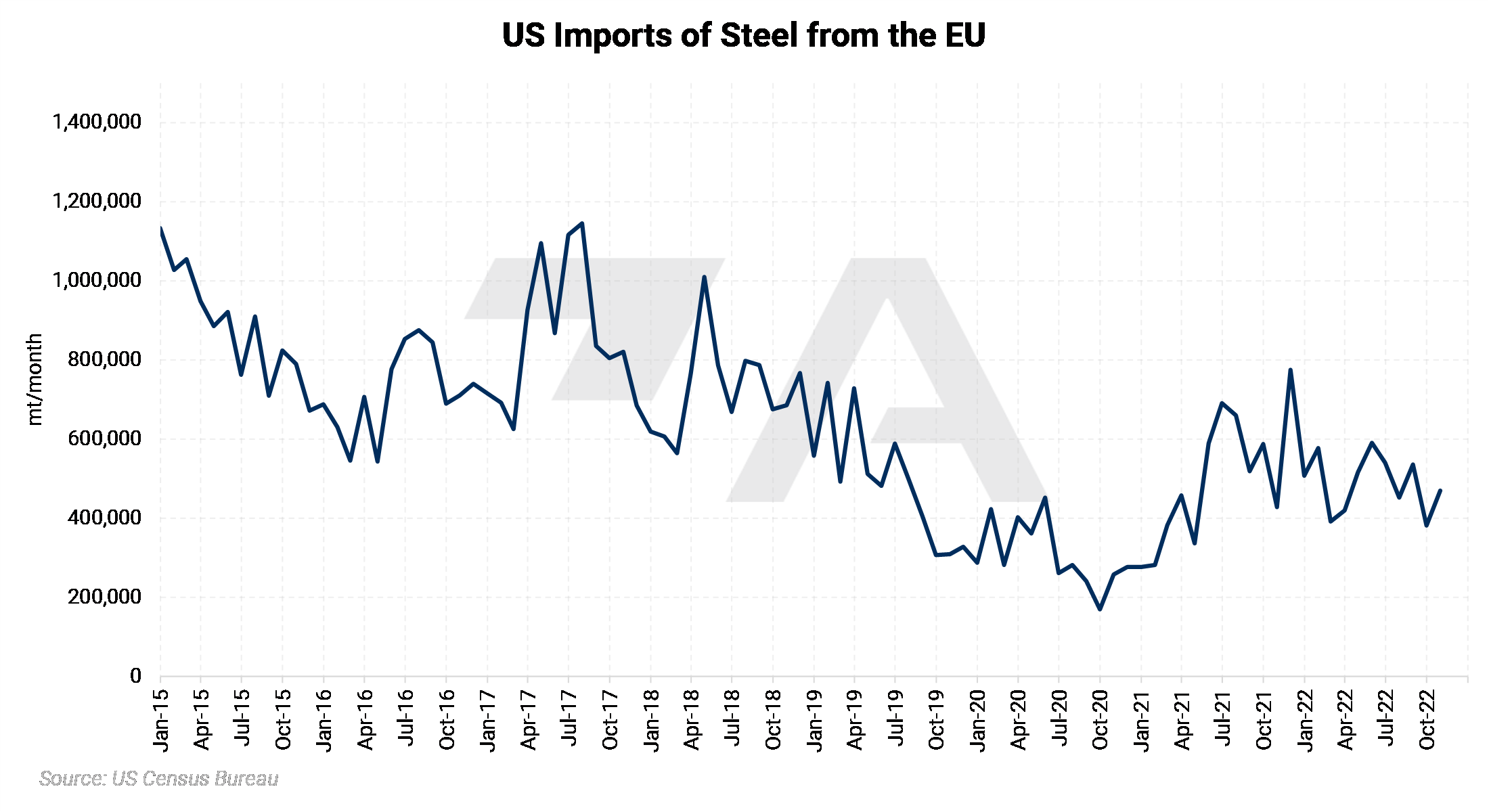

Steel The EU’s proposed carbon tax on steel imports will make it more costly for Indian steelmakers to meet India’s lofty production goals, according to JSW Steel. The proposed tariff, which would be paid by the seller, is an attempt to combat carbon emissions from steel production in China, India, and other major producers. Approximately 45% of India’s steel is produced via high-polluting blast furnaces because JSW and other similar Indian producers have little access to adequate scrap supplies. Thus, to sell into Europe, the producer will either pay the carbon tax or adopt less-polluting production methods. Currently, India produces about 120 million mt of steel per year, with an annual capacity of 154 million mt. However, the Indian government wants domestic producers to double their production capacity to 300 million mt by 2030. In 2021, the EU imported a record 3.54 million mt of steel from India. This is approximately 11.6% of the EU’s total steel imports that year. If the EU’s imports of Indian steel drop significantly due to this change in policy, then steel buyers and sellers in the EU could be forced to change their policies with other trading partners. This could ultimately have an impact on American steel prices, specifically CME HRC prices. For example, the EU buys little steel from the US; however, the US was the second-largest importer of EU steel in 2021. That year, approximately 12.4%, or 2.226 million mt, of US steel imports came from the EU. If European producers significantly reduce exports, then American end-users could be forced to look elsewhere for steel, thus driving up HRC prices and import premiums here in the US. (Sources: Bloomberg, World Steel, Eurofer) |

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,295.50/mt, down $82.50/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $80/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.2¢/lb this week. The CME Midwest Premium market is in contango throughout early 2023, flat between July and Dec ‘23, and then goes flat beyond Jan. ’24. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,589.50/mt, up $217.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted higher by about $200/mt. The forward curve is now in contango through July 2023 but becomes backwardated after that contract. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $28,079/mt, down $1,969/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $1,900/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $730/T, down $14/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

|||||

Notable News |

|||||

|

1/6/2023: India's April-December finished steel exports drop 54% y/y -data 1/5/2023: China establishes mortgage rate adjustment mechanism for some home buyers 1/5/2023: Copper price bounces on news about fresh investment in China 1/4/2023: Global Commodities Holdings to launch nickel trade platform in February 1/3/2023: European primary aluminum market faces uncertain start to 2023 1/3/2023: Analysis: Panama and First Quantum harden battle lines over key copper mine 1/2/2023: Panama president says final contract to miner First Quantum has been presented 12/30/2022: Panama says it rejects First Quantum's legal bid to avoid halting operations 12/30/2022: Growth constraints to shackle industrial metals for a few more months 12/30/2022: Coal, gas lead 2022 commodities rally; recession clouds new year |

|||||