|

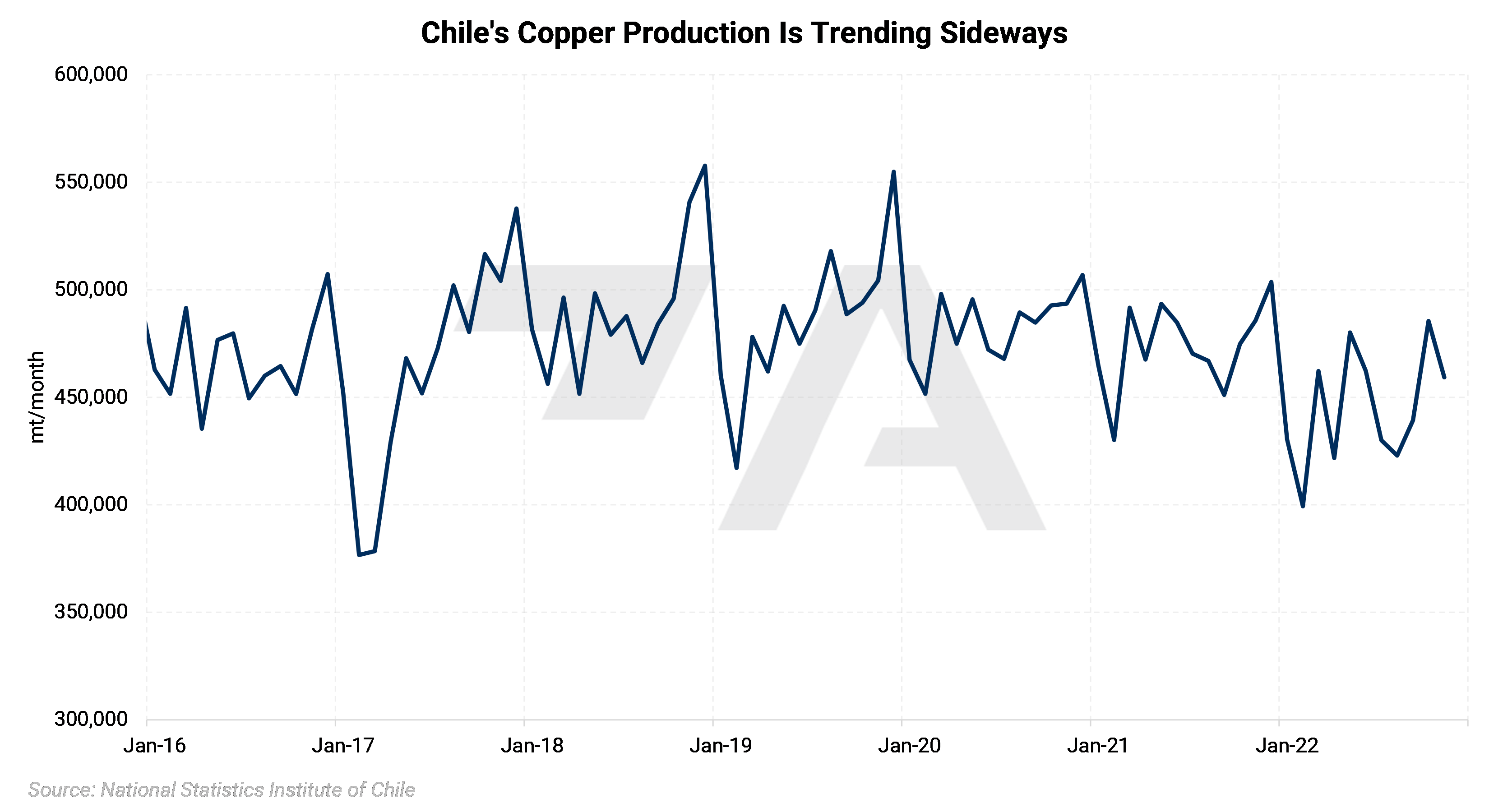

Copper Red tape could hinder Chile’s red metal production. Due to project delays, increasing taxes, and higher development costs, Chile’s copper production will peak at 7.14 million mt in 2030, according to the Chilean Copper Commission (Cochilco). This updated forecast of peak production is both later and lower than their prior projection of 7.62 million mt in 2028. AEGIS notes that several large miners, including BHP, Freeport-McMoRan, and Antofagasta have already stated that they are holding off on new projects while Chile’s political environment remains unclear. The Chilean congress is currently rewriting the country’s constitution, and there are worries that some new regulations could be prohibitive to copper production. According to Cochilco, Chile produced an estimated 5.345 million mt last year. Chile is the world’s largest copper producer, based on USGS data. (Sources: Reuters, Bloomberg, USGS) |

|

Protests throughout Peru have worsened in recent weeks, potentially restricting access to the country’s copper supply, according to Bloomberg. The Las Bambas mine, which is responsible for approximately 2% of the world’s copper mine supply, has seen transport of copper concentrates impacted by road blockades, according to Reuters. Last Friday, Glencore announced that they had suspended operations at the Antapaccay copper mine after the 3rd attack on the facility in a month. Moreover, transport officials recently told Reuters that protestors have blocked roads in 18 of 25 of the country’s regions. The ongoing protests began in early December when then-President Pedro Castillo was impeached and arrested on corruption charges. At 2.2 million mt, Peru was the world’s second-largest copper miner in 2021, according to USGS data. (Source: Reuters, Bloomberg, USGS) |

|

|

|

Aluminum Aluminum prices could hit “just shy” of $4000/mt this year due to pent-up global demand and China’s economic “reopening,” according to Goldman Sachs. AEGIS notes that this bullish view on Chinese aluminum demand comes after the country produced a record 40.21 million mt of aluminum last year. We also note that the Chinese government has recently implemented a series of real estate-related stimulus measures that will likely boost aluminum demand. Goldman’s comments were made at the S&P Global Aluminum Symposium held earlier this week. (Source: Bloomberg) |

|

|

|

Tin Tin is the best-performing LME metal in 2023, soaring over 22% so far this year. AEGIS believes the recent price action could be due to Chinese buying as their economy reopens or speculation that Chinese restocking will continue its brisk pace in 2023. China imported 31,115 mt of refined tin last year, up nearly 535% from the 4,900 mt imported in 2021. Last year’s import volumes were also the highest since 2012. According to Reuters, Chinese tin demand was down last year due to the pandemic, thus, the recent significant jump in imports “suggests a major restocking exercise.” We also note that the recent jump in tin prices could also be due to Minsur’s tin mine closure in Southern Peru. Since early December, Southern Peru has been rocked by violent political protests, forcing Minsur to cease operations at its San Rafael tin mine earlier this month. According to Minsur’s website, the San Rafael operation is the leading Tin producing mine in South America and the third largest in the world. (Sources: Reuters, International Tin Association, Minsur) Nickel Due to Western sanctions on the Russian economy, Russian miner Nornickel has had to adjust its sales strategies in recent months, further aligning itself with China, Turkey, and Morocco. Nornickel has not been directly sanctioned; however, Western sanctions have impacted payment systems, supply chain logistics, and its ability to buy new equipment, according to Reuters. As for maintaining and developing markets, CEO Vladimir Potanin stated that keeping current clients is “more difficult, and new ones are expensive to win.” AEGIS notes that the consequences of Western sanctions, along with falling European demand for Russian metals, could be why Nornickel stated recently that they might lower their output by about 5% this year. Their nickel production in 2022 was approximately 219,000 mt, thus, Nornickel’s output in 2023 will likely be approximately 208,000 mt. Based on USGS data, Russia is the world’s third largest nickel miner, responsible for approximately 9.3% of global nickel mine production. (Source: Reuters, Bloomberg, USGS) |

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,627/mt, up $16.50/mt on the week. Aluminum prices were up this week. This has caused most of the forward curve to shift vertically higher by approximately $30/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 27.0¢/lb this week. The CME Midwest Premium market is in contango through February 2023 but then goes into backwardation for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,263/mt, down $60.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $60/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $28,902/mt, up $131/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $100/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $775/T, up $8/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

01/25/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/24/2023: Peruvian Protests Could Support Copper Prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? |

|||||

Notable News |

|||||

|

1/26/2023: U.S. bans mining in parts of Minnesota, dealing latest blow to Antofagasta's copper project 1/26/2023: Panama won't allow Canada's First Quantum to expand its copper mine operations 1/26/2023: LME expands nickel committee to help improve contract, dwindling volumes 1/25/2023: Exclusive: Chile mine delays to slow copper growth; peak seen lower, later -regulator 1/25/2023: Freeport-McMoRan quarterly profit slumps on lower copper prices 1/24/2023: Column: Tin on the rebound as China scoops up surplus metal 1/23/2023: Column: Power problems rein in global aluminium output growth 1/23/2023: Ford to cut up to 3,200 European jobs, union says, vowing to fight 1/23/2023: Potanin says sanctions constrain Nornickel, force it to adjust strategy 1/21/2023: Glencore halts operations in Peru due to violent protests 1/21/2023: Over 50 injured in Peru as protests cause 'nationwide chaos' |

|||||