|

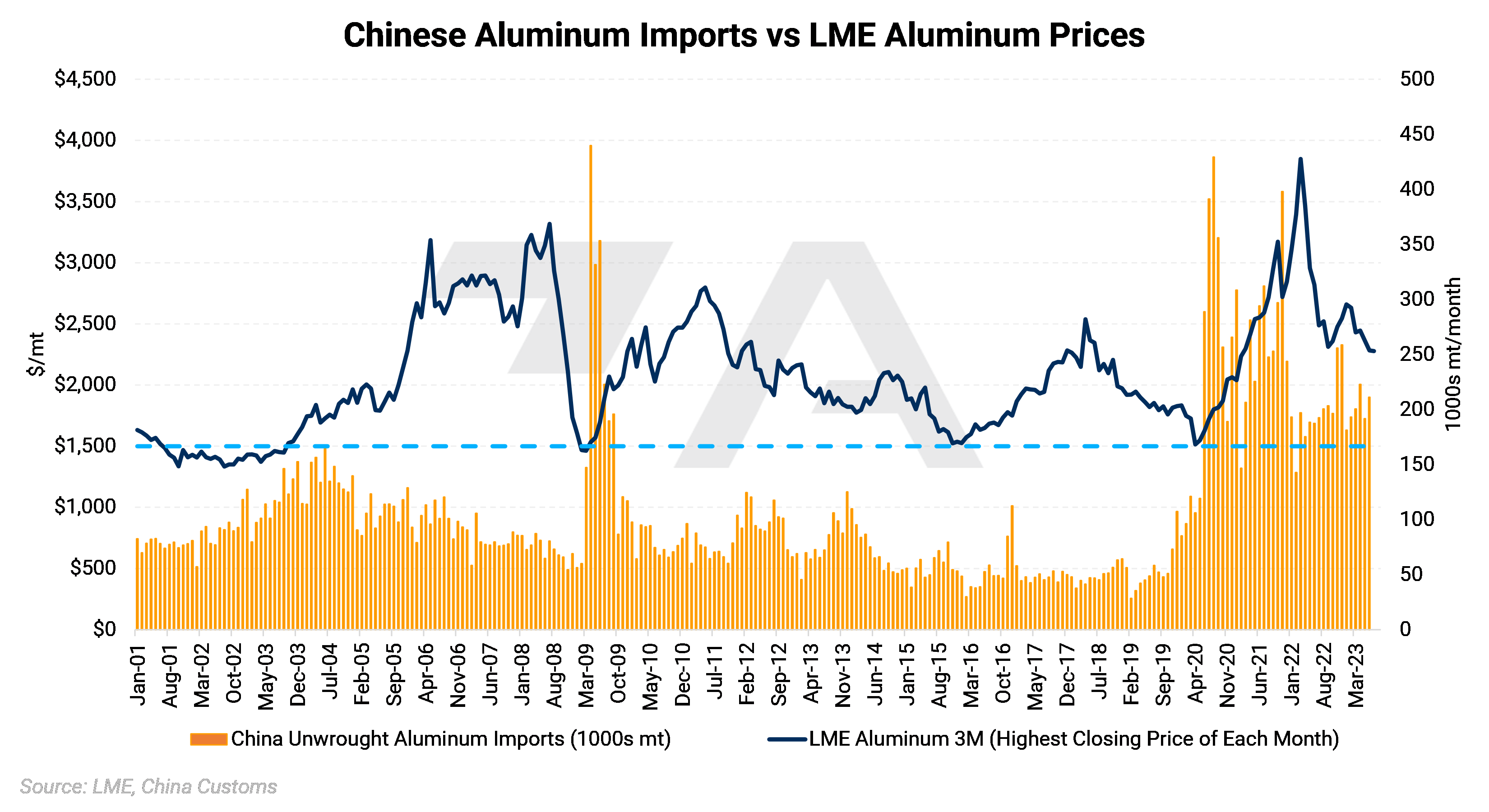

Aluminum Due to lower-than-expected production growth, China imported 1.2 million mt of aluminum in the first half of 2023, according to customs data released earlier this week. This is an increase of 10.7% compared to the first half of 2022. Chinese aluminum smelters have struggled with power-rationing issues this year, yet production still grew by 3.4% to 20.16 million mt in H1. According to Reuters’ suggestions, this production growth was still less than market expectations. (Source: Reuters) |

|

A trading arm of China’s largest aluminum producer, Chalco, has told several independent traders that it will not deliver contracted ingots for the remainder of 2023. According to Bloomberg, this stoppage “could potentially reduce liquidity in China’s aluminum market, although it’s not immediately clear what volumes are affected.” This stoppage is directly related to a government-directed inquiry into Chalco’s sales practices. Last April, the government warned Chalco “that it will investigate trades used to inflate sales or those serving as collateral to access banking facilities.” (Source: Bloomberg)

As for imports into Europe, according to a recent letter to its members, the European Aluminum trade association believes that Rusal’s aluminum should not be sanctioned. According to Reuters, the letter discussed the possibility of "actively calling for EU sanctions on Russian aluminum", but not specifically on Rusal’s production. "Due to its strategic importance on the global aluminum market, European Aluminum recommends avoiding that EU sanctions would target Rusal (the main Russian aluminum producer) as a company." (Source: Reuters)

The volume of aluminum in LME warehouses continues to drop. As of this morning, total warehouse stocks were 513,400 mt, the lowest level since early April. This is mainly due to cancellations at Malaysian and South Korean warehouses. The LME’s Malaysian warehouses are a known repository of Indian-origin aluminum, while the South Korean warehouses mostly house Russian-origin aluminum. (Sources: Bloomberg, Reuters, LME)

|

|

|

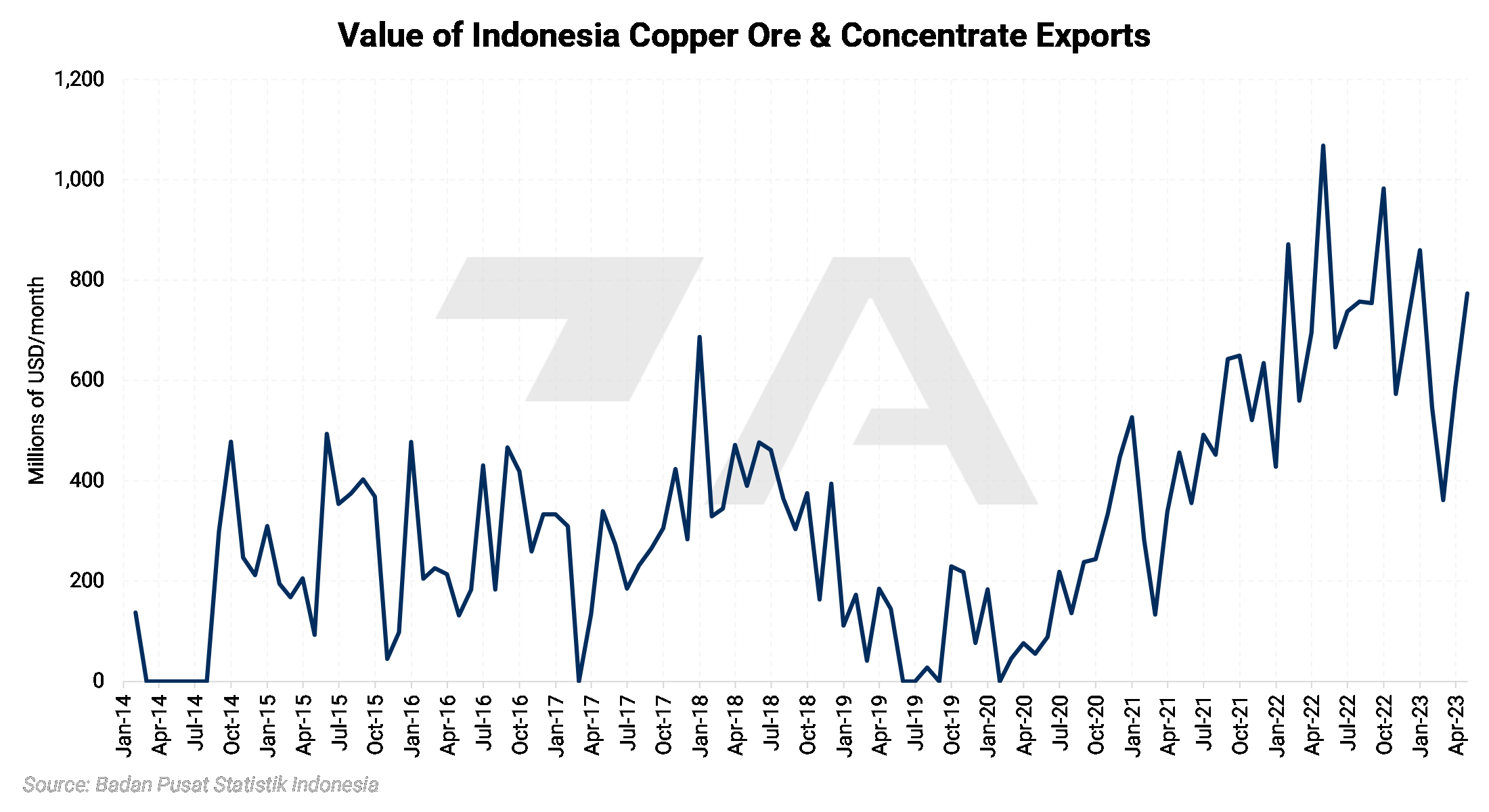

Finally, Alcoa expects to see “financial improvement” in the third quarter, largely due to reduced production and raw materials costs, the company stated in the 2Q earnings report. They still expect to ship between 2.5 to 2.6 million mt of aluminum in 2023, while alumina shipments will still be between 12.7 to 12.9 million mt. Despite the stable outlook for shipments, they also stated that “softer” billet demand could weigh on sales. (Source: Bloomberg) Copper Copper prices jumped Thursday, after the Chinese government and the Communist Party issued a joint statement proclaiming they will work to improve conditions for private businesses, according to Bloomberg. This was later followed by the Ministry of Industry and Information Technology declaration that “it was drafting plans to boost development in 10 key industries, including steel and autos.” Many sectors of China’s economy, especially real estate, have stumbled in recent months, pressuring global copper prices. (Source: Bloomberg) Not all the recent news from China has been rosy, though. On Monday, LME Copper coughed up nearly all last week’s gains after data showed that China’s economy data has slowed more than expected. The country's GDP grew by 6.3% year-over-year, which was less than expected, while retail sales also slumped. New home prices, which is a key gauge for metals demand, also slipped. (Source: Bloomberg) Indonesia, which is one of the world's largest copper producers and exporters, has raised its export tax on copper concentrate to a range of 5% to 10%, up from a flat tax of 5% previously. The new tax is part of a government effort to increase the number of domestic copper smelters. By adding more smelters, the country would get more value out of its mineral resources, as opposed to merely exporting raw materials. In June, Indonesia banned exports of raw copper and other minerals. (Source: Reuters) |

|

|

According to Bloomberg, China will see an influx of Congolese copper later this month, all while domestic demand remains tepid. Shipments from the Congo to China have slowed in recent months due to a royalty dispute between the Congolese government and domestic producers. These new, large-volume shipments amid subpar demand could lead to lower import premiums, researcher Mysteel said in a note. (Source: Bloomberg) |

|||||

|

Steel CME HRC steel prices fell this week even as the spot market stalled. At $870/st, Argus’s weekly domestic HRC assessment was unchanged compared to last week. This is likely due to “limited” end-user buying at service centers, according to Argus. Echoing similar comments to last week, Argus also stated the repercussions of Steel Dynamics’ unplanned shutdown of Sinton, TX mill is yet to be known. (Source: Argus) Germany’s construction industry remains in dire straits. According to its top construction association, residential construction orders fell by 29.8% month-over-month, its 13th consecutive month of decline. One large German steel product maker stated that Germany’s construction economy is suffering even worse than in France, Spain, Italy, or Poland. (Source: Bloomberg) Due in part to discounts of $30 to $50/mt, India’s imports of Chinese steel products are now at the highest level since the pandemic. According to Fitch Ratings, "The Chinese are offering discounts because other markets are not doing well and we are seeing good growth in Indian automobile and construction sectors." India’s industrial activity should increase after the monsoon season, analysts also stated. (Source: Reuters) |

|||||

|

|

|||||

|

The markets for steel and iron ore could be under pressure for some time, according to recent industry comments. The global iron ore market “is vulnerable to abundant supply,” according to comments from Bloomberg. Similarly, steel demand is facing “persistent headwinds,” while shipments from Brazil and Australia are “at or close to all-time highs” Rio Tinto stated earlier this week. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

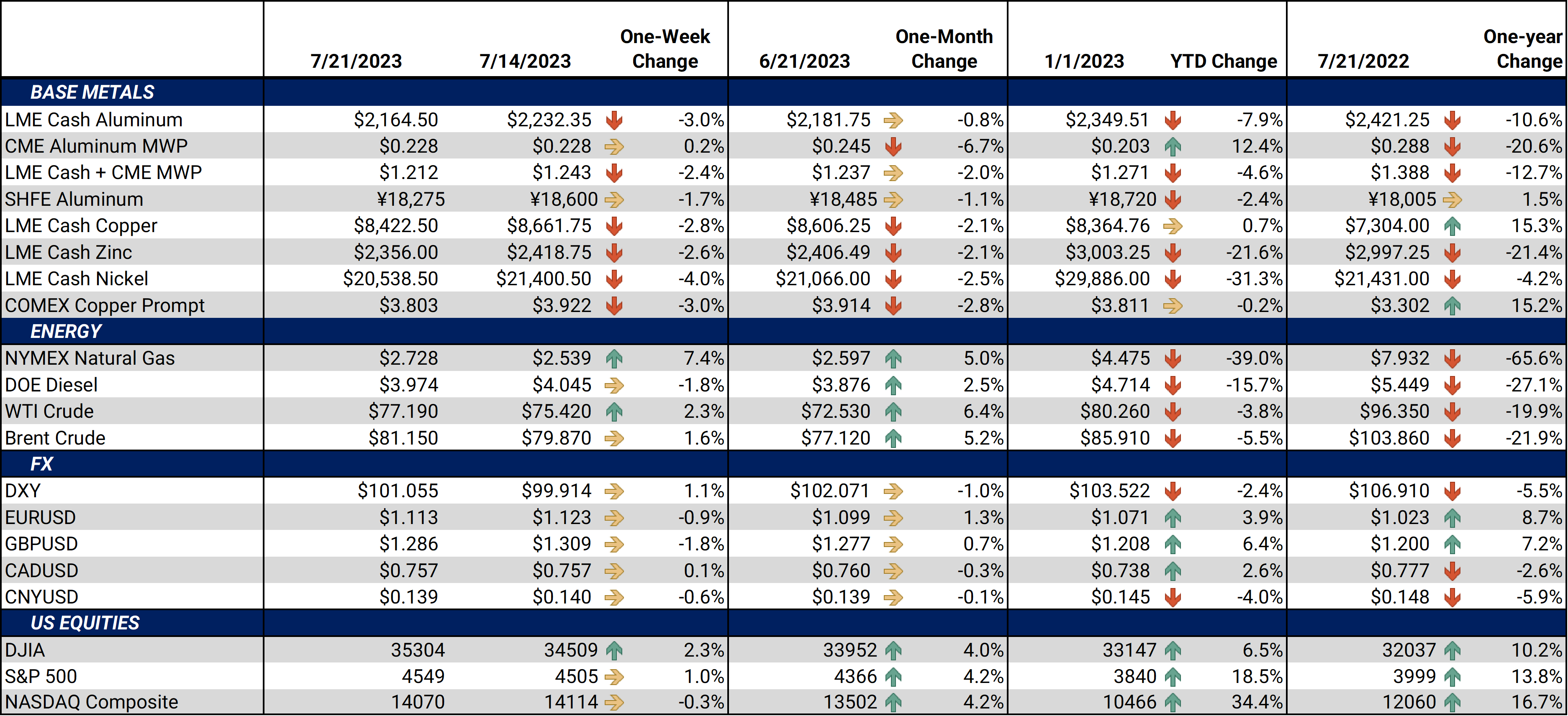

LME Aluminum 3M settled at $2,204.5/mt, down $72/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $70/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 22.8¢/lb this week. The CME Midwest Premium market is now flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,452/mt, down $221.5/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $220/mt and is now in a slight contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $20,769/mt, down $861/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $860/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $858/T, down $39/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/20/2023: Aluminum Prices Could Hinge on Chinese Stimulus 07/19/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 07/11/2023: Copper Prices Could Remain Subdued While African Production Grows 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied |

|||||

Notable News |

|||||

|

7/20/2023: SDI's Texas mill expected to restart soon 7/19/2023: US HRC: Prices flat, market pauses 7/18/2023: Indonesia hikes export taxes for copper, zinc and iron - finmin 7/17/2023: China's frail Q2 GDP growth raises urgency for more policy support 7/17/2023: CORRECTED-China's aluminium imports rise 10.7% y/y in H1 7/17/2023: Indian traders scoop up cheaper Chinese steel - industry execs say 7/16/2023: China's June crude steel production rises on better margins |

|||||