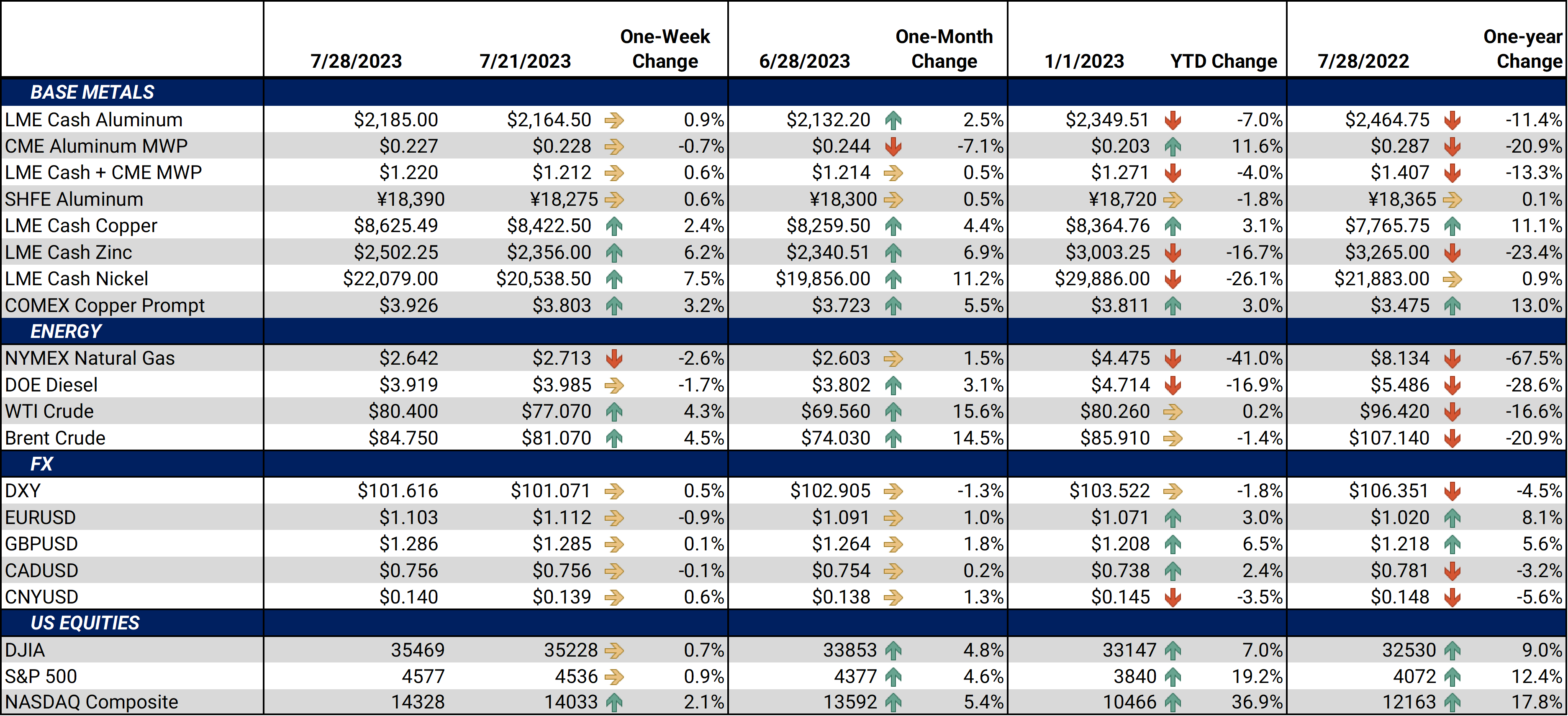

|

Aluminum Despite pleas from Norsk Hydro and other large aluminum producers, the LME continues to resist calls to ban Russian aluminum and other metals from the exchange. Earlier this week, Norsk Hydro sent the LME another letter requesting that the exchange reconsider its position, but the LME responded by saying “We note that all metals of Russian origin continue to be consumed by a broad section of the market, and we will remain vigilant in respect of this matter. They also stated, “it would continue to reflect all relevant government sanctions and tariffs, and monitor for any market orderliness concerns in respect of Russian metal,” according to Reuters. |

Unsurprisingly, Rusal, which is Russia’s top aluminum producer, sided with the LME, proclaiming that it would be “highly disruptive” to remove its metals from the supply chain. "Rusal considers these comments to be aimed at destabilizing the market and driving anti-competitive behavior... hence to the benefit of the competitor,” the company also lamented. (Source: Reuters)

Another major concern is Russia's oversized impact on the global market. Russian aluminum producers (namely Rusal) continue to sell aluminum at discounted prices, leading to the currently oversupplied market, according to Norsk Hydro. Some large Western buyers' self-sanctioning efforts haven’t worked, as Russia has found other willing buyers, Norsk Hydro stated.

Norsk Hydro is also concerned about the volume of Russian aluminum that is in LME warehouses. According to Norsk Hydro’s CFO, the company recently sent a letter to the LME asking them to reevaluate its stance on not banning Russian metal from LME warehouses. Approximately 80% of the aluminum in LME warehouses is of Russian origin. (Sources: LME, CNBC)

|

|

|

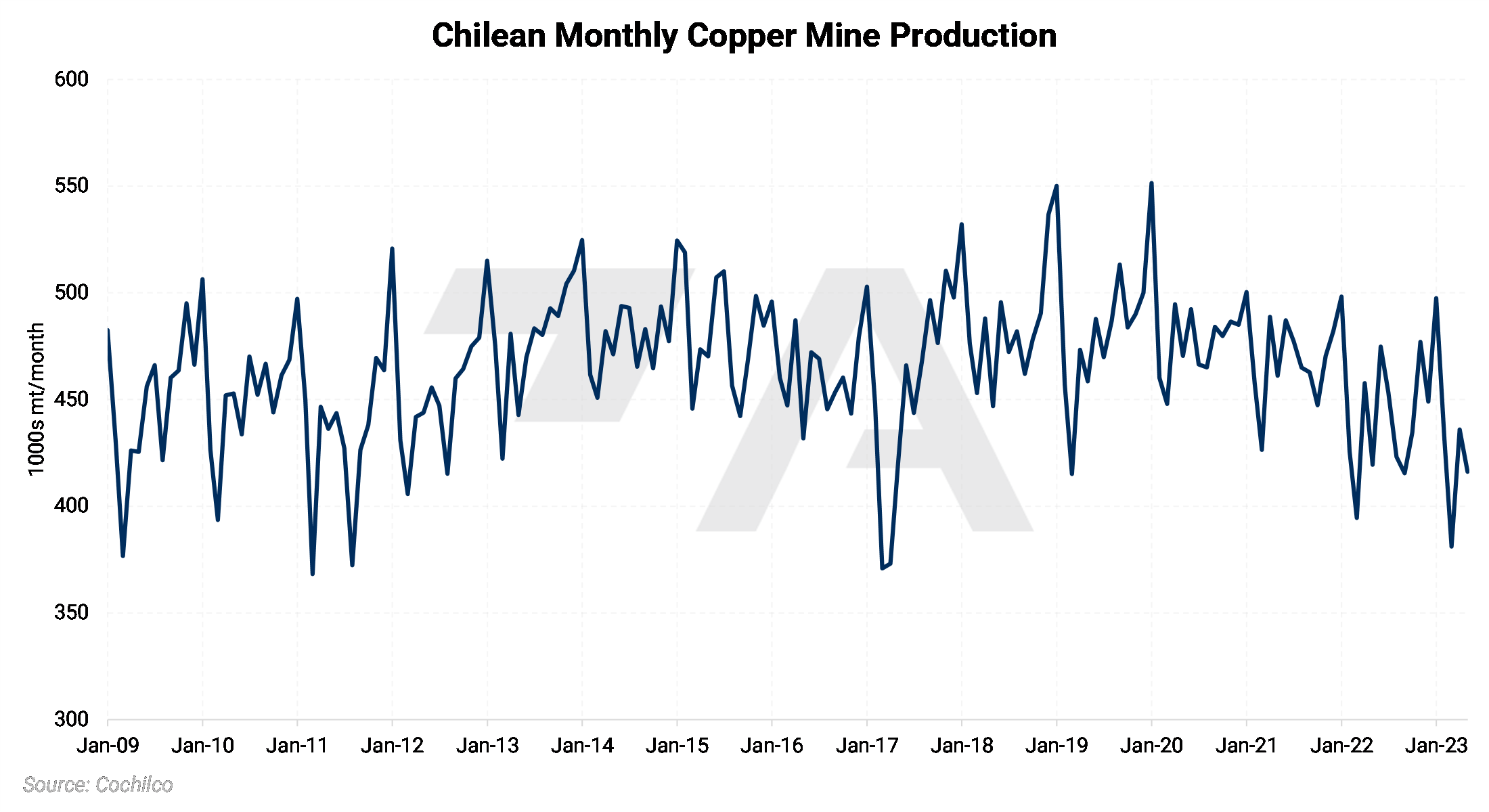

Due to poor market conditions, Norsk Hydro won’t restart the 130,000 mt of annual capacity it idled during the 2022 European energy crisis, CFO Pal Kildemo stated in a Bloomberg TV interview late last week. “We could restart it — it would make sense from a financial perspective — but there’s no market for that metal at the moment,” Kildemo also added. While reporting its second-quarter earnings, the company stated, “demand for primary aluminum is declining in the short-term, while Chinese supply is returning, leading to the global primary balance weakening in recent months.” (Source: Bloomberg) Both Norsk Hydro and Alcoa remain bearish on aluminum demand for the remainder of 2023. In a phone interview with Bloomberg earlier this week, Norsk Hydro stated that demand will slump due to a slowing global real estate sector. The company stated that automotive demand remains stellar, particularly in the EV market. During its earnings call last week, Alcoa echoed similar comments, stating that the aluminum is sending “mixed signals.” (Source: Bloomberg) Copper Early this week, LME Copper rallied on news that China will soon “adjust policies for the property sector at a key economic planning meeting,” according to Bloomberg. The meeting will address ways to grow domestic demand and real estate-related debt risks. Bloomberg cautioned that the meeting might not lead to any “big bang stimulus,” however. (Source: Bloomberg) Glencore produced 488,000 mt of copper in the first half of 2023, down approximately 4.4% from the 510,200 mt output in 1H2022, according to the company’s 2Q2023 earnings report. Despite the drop in production, the company stated they anticipated lower output and were therefore pleased with the result. The company still expects to produce about 1.04 million mt of copper this year. (Source: Bloomberg) Due in part to slumping copper prices and production, Rio Tinto’s 1H2023 earnings fell by 43% compared to last year. The company cites poor demand from China as the key issue behind the drop in earnings and commodity prices. They still remain bullish on the long-term prospects of China, stating “We are deeply ingrained in the Chinese economy, it’s our biggest market…the Chinese have quite an impressive ability to manage the economy. For sure they have some challenges, but in the past, they have had that and managed it well.” (Source: Bloomberg) Chilean copper production keeps ratcheting lower. While reporting its Q2 earnings yesterday, Teck Resources stated that 2023 production at its Quebrada Blanca project in Chile will be between 90,000 to 110,000 mt, down from its prior guidance of 150,000 to 180,000 mt. Teck cites delays in construction and commissioning for the expected drop in production. (Source: Teck Resources, Bloomberg) |

|

|

Steel The US automotive industry continues to be a bright spot for steel demand. While releasing its second-quarter earnings, steelmaker Cleveland Cliffs stated that “automotive shipments hit a record in the second quarter and led to higher-than-expected prices.” The company proclaimed “while the performance of our automotive clients continues to improve, the sector has not returned to pre-COVID levels yet.” (Source: Cleveland Cliffs) The automotive market's strong steel demand is likely tied to a strong consumer market. In Q12023, Stellantis (formerly Daimler Chrysler) saw shipments across all major regions, including North America. GM also announced similar results, with sales up in the US and China, but essentially unchanged in South America. (Source: GM, Stellantis, Argus) |

|||||

|

|

|||||

|

India-based Tata Steel, which is one of the largest global steel producers, saw its profits shrink by nearly 92% last quarter due to lower European production and sales. Contrarily, Tata’s Indian sales, and production grew higher domestic demand. During its earnings release, the company stated that the “global economic recovery continued to face headwinds affecting commodity prices including steel… In India, domestic steel demand continued to grow and was up around 10% on a year-on-year basis but steel spot prices moderated in line with global cues.” (Source: Bloomberg) Late last week, Steel Dynamics (SDI) stated that its temporarily shuttered Sinton TX steel mill will reopen "in the next few days," but will only ramp up to 80% capacity by year’s end. The outage will cost SDI between 50,000 to 70,000 st of shipments. The outage started on July 1 due to issues with its caster shear equipment. (Source: Argus) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,222/mt, up $17.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $15/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 22.7¢/lb this week. The CME Midwest Premium market is now flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,662.5/mt, up $210.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $210/mt and is now in a slight contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,307/mt, up $1,538/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $1,540/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $823/T, down $26/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/26/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 07/20/2023: Aluminum Prices Could Hinge on Chinese Stimulus 07/11/2023: Copper Prices Could Remain Subdued While African Production Grows 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied |

|||||

Notable News |

|||||

|

7/28/2023: Collective reply to LME 7/28/2023: Industry groups urge LME to resist calls to ban Russian aluminium 7/27/2023: Column: LME's Russian aluminium dilemma set to become more acute 7/26/2023: GM ups 2Q auto volumes on US, China sales 7/24/2023: Smaller miners’ hunger for cash grows as copper prices fall, sparking M&A bets 7/24/2023: Cliffs ups steel shipments on auto volumes 7/24/2023: Worker trapped after accident at Codelco project in Chile unharmed 7/24/2023: China to step up policy adjustments amid tortuous recovery 7/24/2023: Focus: Smaller miners' hunger for cash grows as copper prices fall, sparking M&A bets 7/21/2023: Russian materials finding their way into the market place at discounted prices, Norsk Hydro says 7/21/2023: US' Tesla to invest, expand EV facilities in Malaysia 7/21/2023: Hydro says Russian metal threatens LME benchmark, Rusal hits back |

|||||