|

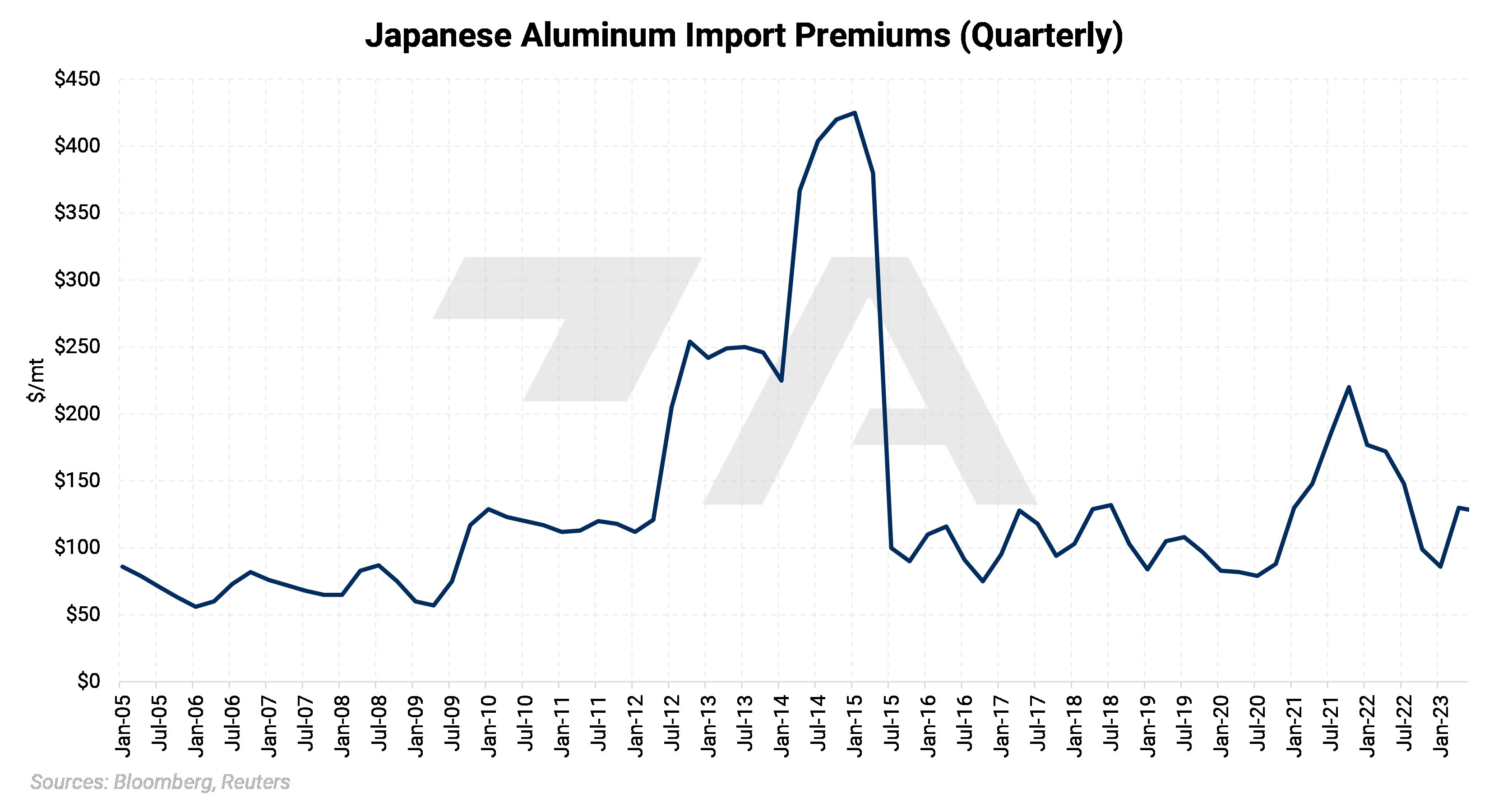

Aluminum Japanese aluminum buyers have agreed to set the country’s import premium at $127.50/mt in Q3, Reuters reported earlier this week. Approximately three weeks ago, one major aluminum importer agreed to a $127.50/mt premium over the LME, so this most recent announcement is in line with expectations. The premium set for Q3 is down slightly from the $130/premium paid the prior quarter. This slight dip in premiums is likely due to continually lackluster end-user demand. Japan is Asia’s largest aluminum importer; therefore, its import premium is considered a key gauge of Asian demand. (Source: Reuters) |

|

The battle over how the LME should handle Russian metals continues to heat up. In a joint statement released last Friday, five European aluminum associations adamantly declared that the LME should resist any bans or sanctions on Russian aluminum. The groups also believe that such calls are merely an attempt to eliminate competition from Rusal. They also believe that such a ban could hurt the European Green Deal. (Source: Bloomberg, FACE)

Some previously curtailed aluminum production in China’s Yunnan province is coming back online, and Shanghai Metal Market predicts that some large smelters could reach full capacity by the end of August. This could potentially lead to a record operating capacity. As for demand, the impact of recent economic stimulus measures is yet to be known, largely because most downstream end-users are in their “off-season.” (Source: Shanghai Metal Market)

|

|

|

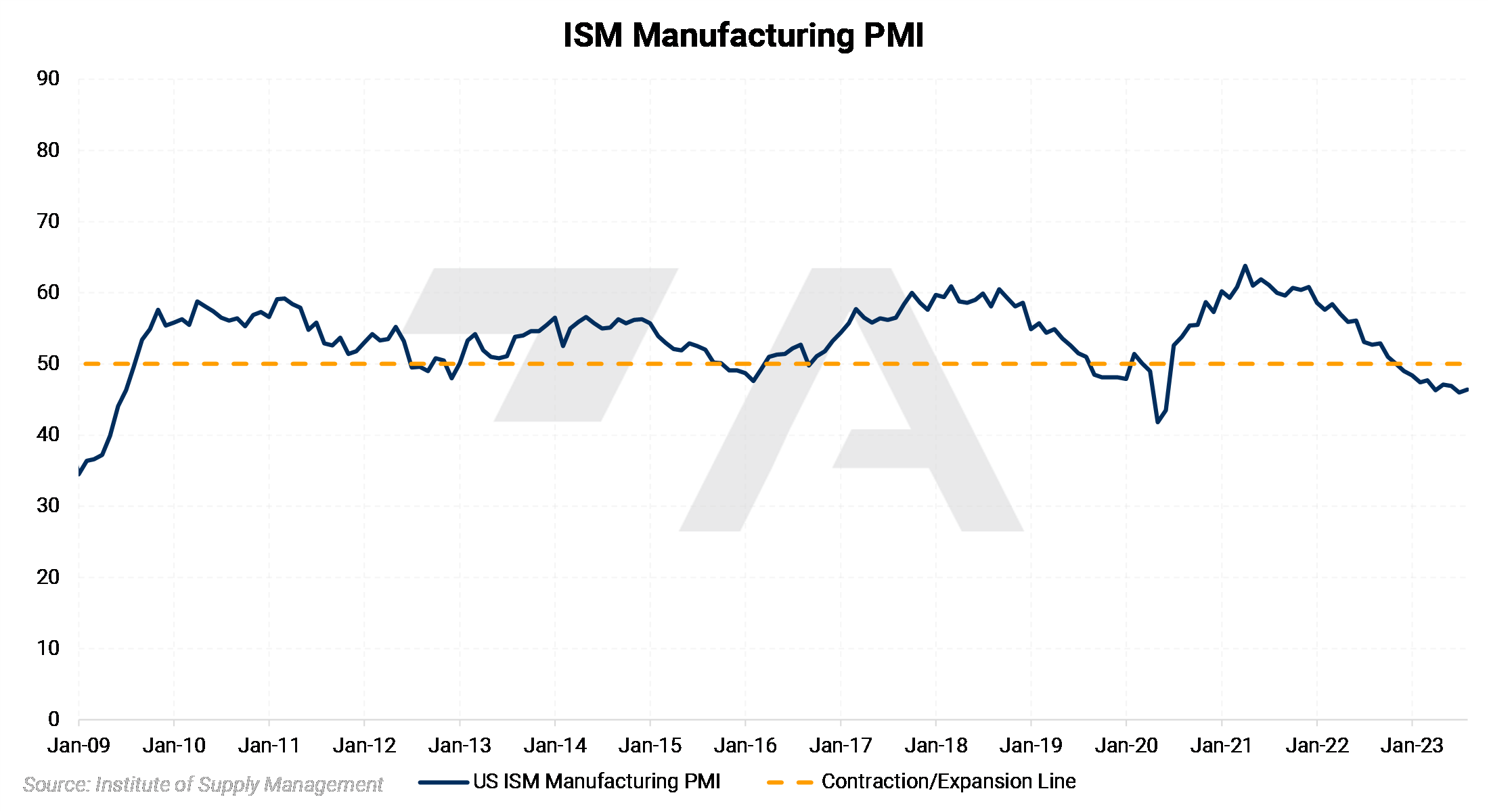

Copper Weak economic data continues to underpin metals prices. Released earlier this week, the Institute for Supply Management’s (ISM) gauge of US manufacturing activity showed the sector has contracted for nine consecutive months. High interest rates, along with tepid consumer demand, have been headwinds for the US manufacturing sector. (Source: Bloomberg) |

|

|

Copper prices have been susceptible to any news from China. Early this week, LME Copper prices jumped after the Chinese government provided more details on its much-anticipated economic stimulus package. Late Thursday, the country’s Housing and Urban-Rural Development minister stated that “homebuyers who had paid off previous mortgages to be considered as first-time purchasers”. Prior to this announcement, many buyers who have had a previous mortgage but don’t currently own property were subject to higher down payment rates on any new purchases. This move is meant to boost the country’s ailing real estate sector, which in turn should boost copper demand. (Source: Bloomberg) China’s Caixin manufacturing purchasing managers’ index (PMI), which is a key gauge of Chinese manufacturing activity, hit a six-month low of 49.2 in July. A reading below 50.0 suggests that the sector is contracting. This continued drop-in manufacturing activity also likely implies that recent economic stimulus measures have not had a meaningful impact yet. (Source: Bloomberg)

Recent import data suggests that Chinese imports of copper products show a tale of diverging markets. In 1H2023, the country imported 1.65 million mt of refined copper, down nearly 12% from 2022 and the lowest level of the pandemic era. Imports of copper concentrate (the precursor to refined copper) jumped a record 13.4 million mt in 1H2023, while scrap imports also increased. (Source: Reuters)

Codelco, which is Chile’s state-owned copper miner and the world's largest, continues to lower its production forecast for 2023. The company now predicts that it will produce between 1.31 million to 1.35 million mt, down from its prior forecast of 1.35 million mt to 1.45 million mt. Codelco's largest mine, El Teniente, recently experienced an explosion that will impact production for the remainder of 2023, the company stated. (Source: Reuters)

One of the largest and most promising Congolese copper-cobalt projects is in peril as its owner, Trafigura, seeks new investors. Trafigura has already invested $600 million into the project, but cost overruns and inflationary pressures amid low cobalt prices have forced the company to seek out another $200 to $300 million. After tremendous growth in recent years, the Democratic Republic of the Congo is now the world’s second-largest copper producer. (Source: Bloomberg, USGS)

Steel Like its competitors, Toyota has also experienced an uptick in global car sales in 2023. In the first half of 2023, the company sold 4.9 million vehicles, up from 4.7 million in 1H2022. Japan was the largest growth source, with sales jumping over 33% in the period. Sales in the US and China slipped, however. The global automotive sector is one of the largest markets for flat-rolled steel. According to the American Iron and Steel Institute, the average North American vehicle uses nearly 1,480 lbs of flat-rolled steel products. (Source: Reuters, Argus) |

|||||

|

|

|||||

|

While releasing its earnings late last week, US Steel proclaimed that Q3 earnings could be down nearly 40% compared to Q2. This is largely due to an expected drop in shipments from its tubular and European operations. Production and earnings could also be down in Q4 due to seasonal weakness. (Source: Bloomberg) Last Friday, Steel Dynamics’ successfully restarted its Sinton, TX-based mill that had an unplanned outage in early July, the company announced yesterday. In a prior announcement, the company predicted the outage will cost them between 50,000 to 70,000 st of shipments. The outage started on July 1 due to caster shear equipment issues. Section 232 tariffs on US imports of European steel and aluminum could resume this year unless the US and European Union come to an agreement by the end of October. One of the key issues is how to deal with chronic oversupply from China and other large producers and exporters. Initiated in 2018, these tariffs on EU steel and aluminum were set aside in 2020. These tariffs are at the discretion of the US executive branch and are meant to reduce the flow of metal imports, thereby preventing foreign exporters from dumping cheap aluminum onto the US market. (Source: Bloomberg) Nucor, which is one of America’s largest steel producers, has set its flat steel price at $1,570/st for September, the company announced earlier this week. The company has now left its flat steel price unchanged for three consecutive months. Nucor has been reluctant to lower prices, despite the hopes of buyers at service centers. (Source: Argus) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,232.5/mt, up $10.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $10/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 21.5¢/lb this week. The CME Midwest Premium market is now relatively flat for the August ‘23 through June ’24 contracts but then switches to a contango market after June ‘24. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,573/mt, down $89.5/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $90/mt and is now in a slight contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,310/mt, down $997/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $1,000/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $803/T, down $21/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

08/03/2023: Important US Economic Data (AEGIS Reference) 08/02/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 07/20/2023: Aluminum Prices Could Hinge on Chinese Stimulus 07/11/2023: Copper Prices Could Remain Subdued While African Production Grows 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied |

|||||

Notable News |

|||||

|

8/3/2023: Column: Rio Tinto counts the cost of producing green aluminium 8/2/2023: Factbox: The complexity of transforming rare earths from mine to magnet 8/2/2023: Trafigura seeks extra funds as Congo project costs overrun, Bloomberg reports 8/1/2023: UPDATE 1-Japan buyers agree to pay Q3 aluminium premium of $127.5/T -sources 8/1/2023: US HRC: Prices slip, market slows 8/1/2023: Nucor keeps plate pricing flat 8/1/2023: Column: China imports less refined copper but raw materials surge 7/31/2023: Summary of SMM Aluminium Morning Meeting on July 31, 2023 7/28/2023: Chile's Codelco sees lower copper output, more stoppages in 2023 7/28/2023: Toyota's global sales rise 5.1% to 4.9 million in first half of 2023 7/28/2023: Rusal considers restart of aluminium smelter in Nigeria |

|||||