|

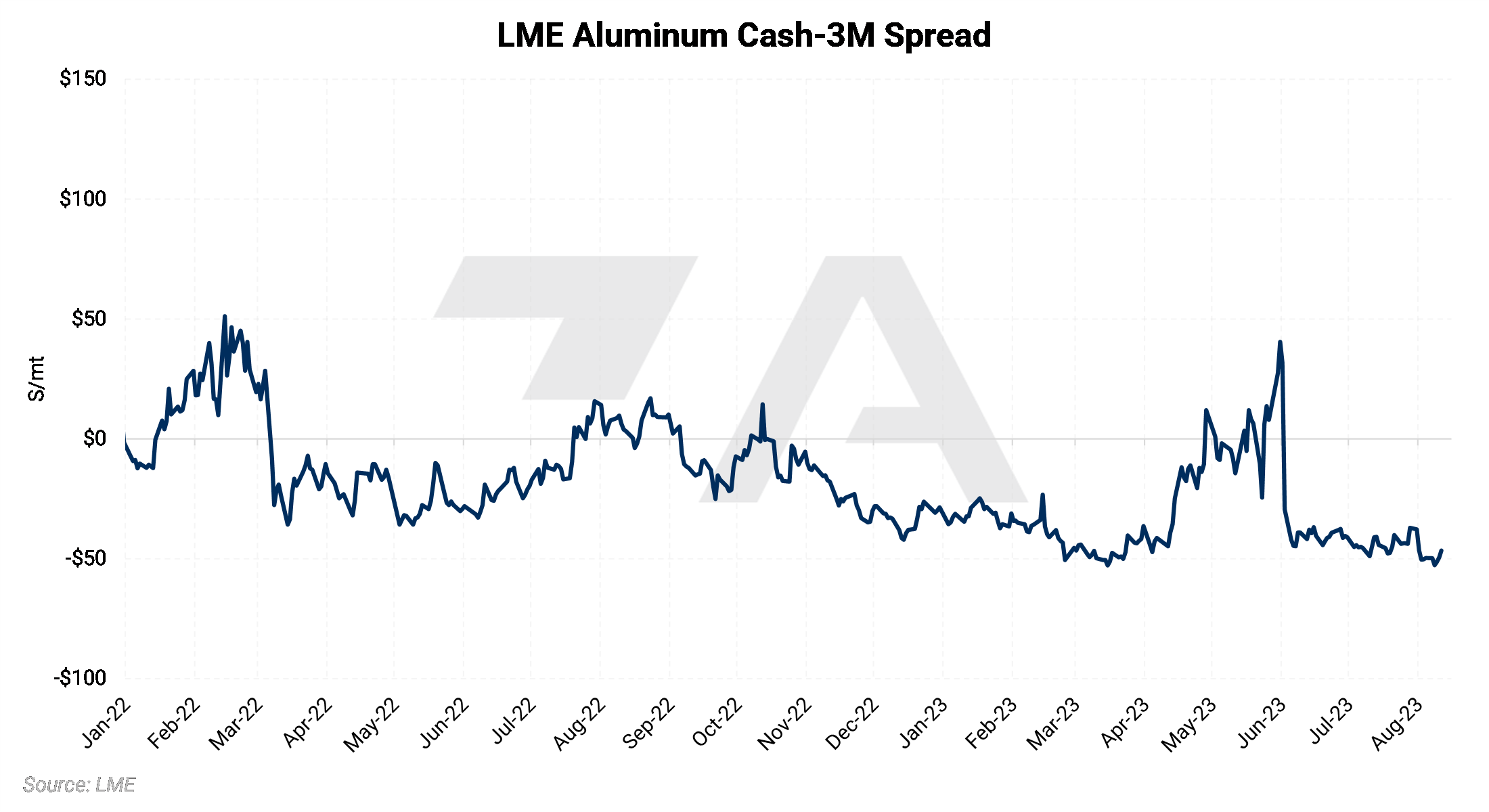

Aluminum The spread between LME cash to benchmark three-month (3M) contract has sunk to the deepest discount since 2008 due to weak spot demand and a continued glut of Russian metal weighing on the market. As of this writing, the spread sits at approximately a $47/mt discount (cash-3M), narrowing slightly from the nearly $54/mt discount seen on Thursday. Except for a brief spike in May, this spread has been trading at a discount for most of 2023, largely due to subpar Chinese demand. This spread is generally considered to be a key indicator of spot aluminum demand. (Source: Bloomberg) |

|

China’s imports and exports of primary aluminum soared in June. The country imported 89,388 mt, up nearly 213% compared to June 2022. Primary aluminum exports 32,989 mt, a jump of nearly 400% compared to last June.

|

|

|

|

Meanwhile, unwrought aluminum exports totaled 489,740 mt, down from 607,440 mt exported in June 2022. Shanghai Metal Market speculated that the slump in exports could be due to the recent drop in global aluminum prices. Chinese unwrought aluminum exports tend to rise as LME prices increase. (Source: China Customs, Shanghai Metal Market)

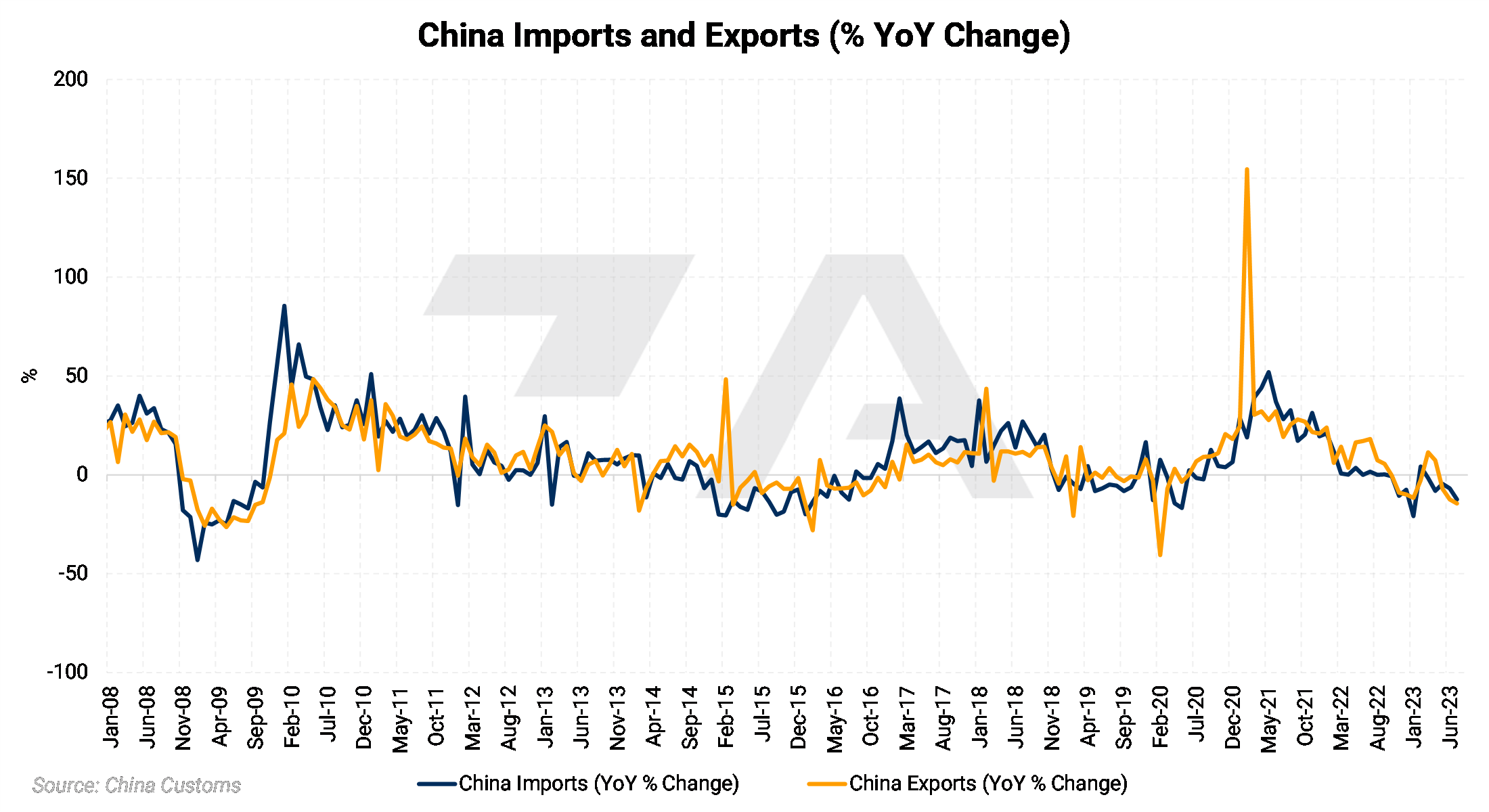

Rusal, Russia’s top aluminum producer, likely had steady aluminum output in 1H2023 compared to last year, according to Bloomberg calculations. Even though it was shut off from its alumina smelter in Ukraine due to the Russia-Ukraine conflict, and blocked from Australian imports, Rusal was able to secure the critical raw material from other sources. Profit margins shrunk as alumina costs jumped while aluminum prices dropped. (Source: Bloomberg) Novelis, which is one of the top producers of aluminum flat-rolled products, reported a 20% drop in net sales in 1Q2024, largely due to lower sales and average prices. Shipments totaled 879,000 mt, down 9% compared to the prior year, while net sales totaled $4.1 billion. Beverage can shipments were down, and poor economic conditions weighed on building & construction demand. The automotive sector proved to be a bright spot, with automotive shipments hitting a record in the quarter. (Source: Novelis) India-based Hindalco, which is one of Asia’s largest primary aluminum producers, remains bullish on domestic demand due to electrification projects. They also stated that rising imports from China are a concern. The company is stockpiling low-priced coal and now has higher-than-usual coal inventories. Due in part to this lower-priced coal, production costs fell by 4% last quarter, and are expected to fall another 3% this quarter. (Source: Bloomberg) Copper Weak Chinese economic data continues to be a burden for copper and other commodities. Last month, exports in dollar terms fell by 14.5% compared to July 2022, making it the worst drop since February 2020, while imports fell by 12.4%. This slump confirms that it will likely take several months for the recent stimulus measures to have a meaningful impact on demand for not only metals and raw materials but finished consumer products as well. (Source: Bloomberg) |

|

|

|

Chinese refined copper stocks are now reaching “critical” levels. According to Goldman Sachs’ estimates, the country’s stockpiles are the roughly equivalent of four days of usage, a record low, and down from an average of eight days of usage in 2022. Guotai Junan Futures Co echoed similar concerns, stating that inventories could “deplete further once China steps up stimulus and profit margins at fabricators improve”. Guotai Junan Futures also proclaimed that Chinese refined copper demand could be up 5% this year. (Source: Bloomberg) Last month, Chile’s copper export revenue fell to the lowest level since January, despite a slight uptick in global prices. Revenues totaled $3.359 billion, down about 13% from June. This is likely due to continued production problems at some of Chile’s largest copper mines. According to Bloomberg, this could also explain why China’s copper inventories are at “critical levels.” (Source: Bloomberg)

Codelco, which is Chile’s state-owned copper miner and the world's largest, is seeking ways to bolster its recently subpar production. This includes working with Anglo American, another larger copper producer, at their adjoining operations to boost production volumes and efficiencies. Current discussions revolve around jointly mining “rich ore grades” that sit between the two operations, as well as using Anglo’s facilities to process some of Codelco’s current operations. No ownership changes would take place, as this is purely an operational collaboration. (Source: Bloomberg) BMO Capital recently warned that copper usage might grow at a slower than initially expected pace if end-users seek out alternatives. Initially, the researcher estimated that copper consumption could grow by 3%/year through 2030. Price spikes and supply fears could cut growth to only 1.3%/yr, if manufacturers switch to fiber optics, aluminum, and other materials, they also stated. (Source: Bloomberg) Steel Argus’s weekly HRC assessment stalled at $805/st this week, citing limited buying action. They also repeated warnings that a potential United Auto Workers strike could negatively impact the HRC market. This assessment has now fallen about 32% from the April peak. (Source: Argus) The American steel market continues to slow. Shunning longer-term contracts, most steel service centers are comfortable with current inventory levels but will dip into the spot market if necessary. Interest in imports has also slowed due to longer-than-normal lead times. (Source: Argus) Even the US automotive sector, which has been a bright spot in recent months, is showing signs of weakness. AutoForecast Solutions, a US automotive market researcher, continues to lower its 2023 US auto production forecast. According to their most recent estimates, the US auto producer will produce 342,000 fewer vehicles this year, while 300,000 are at risk. The researcher cites continued supply chain issues, along with a potential UAW strike for the current and potential production woes. The North American automotive sector is one of the largest markets for flat-rolled steel, as the average North American vehicle uses nearly 1,480 lbs of flat-rolled steel products. (Source: Argus, American Iron and Steel Institute) |

|||||

|

|

|||||

|

Steelmaker Nucor has just started building its 3 million st/year mill in Gallipolis Ferry, WV, the company announced late last week. Construction is expected to take two years and will cost $3.1 billion. The mill will produce high-end automotive and construction-grade sheets. (Source: Argus) Thyssenkrupp, which is one of Europe’s largest steel producers, expects its fortunes to turn around this year as its restructuring efforts begin to take hold. The company has experienced poor profitability amid weak metals prices and other structural challenges in recent years. Details of restructuring plans will be revealed soon, the company stated during its most recent earnings release. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,175.5/mt, down $57/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $60/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 21.6¢/lb this week. The CME Midwest Premium market is now relatively flat for the August ‘23 through June ’24 contracts but then switches to a contango market after June ‘24. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,294.5/mt, down $278.5/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $280/mt and is now in a steep contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $20,241/mt, down $1,069/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $1,000/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $806/T, up $3/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

08/09/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 08/03/2023: Important US Economic Data (AEGIS Reference) 07/20/2023: Aluminum Prices Could Hinge on Chinese Stimulus 07/11/2023: Copper Prices Could Remain Subdued While African Production Grows 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied |

|||||

Notable News |

|||||

|

8/11/2023: India's Jindal Steel posts drop in Q1 profit on higher expenses, fall in prices 8/11/2023: Australia's South32 to halt some Appin mine operations amid workers strike 8/11/2023: Steelmaker SSAB to furlough workers in Finland 8/9/2023: US HRC: Prices flat, market stagnates 8/7/2023: NorthAm auto cuts estimate rise by 40,000 8/7/2023: Aurubis upbeat for full-year profit as quarterly earnings surge 20% 8/4/2023: Nucor gets final permit for W Virginia mill 8/4/2023: US discussed 'creative ways' to help landlocked Mongolia export rare earths, officials say 8/3/2023: Novelis Reports First Quarter Fiscal Year 2024 Results |

|||||