|

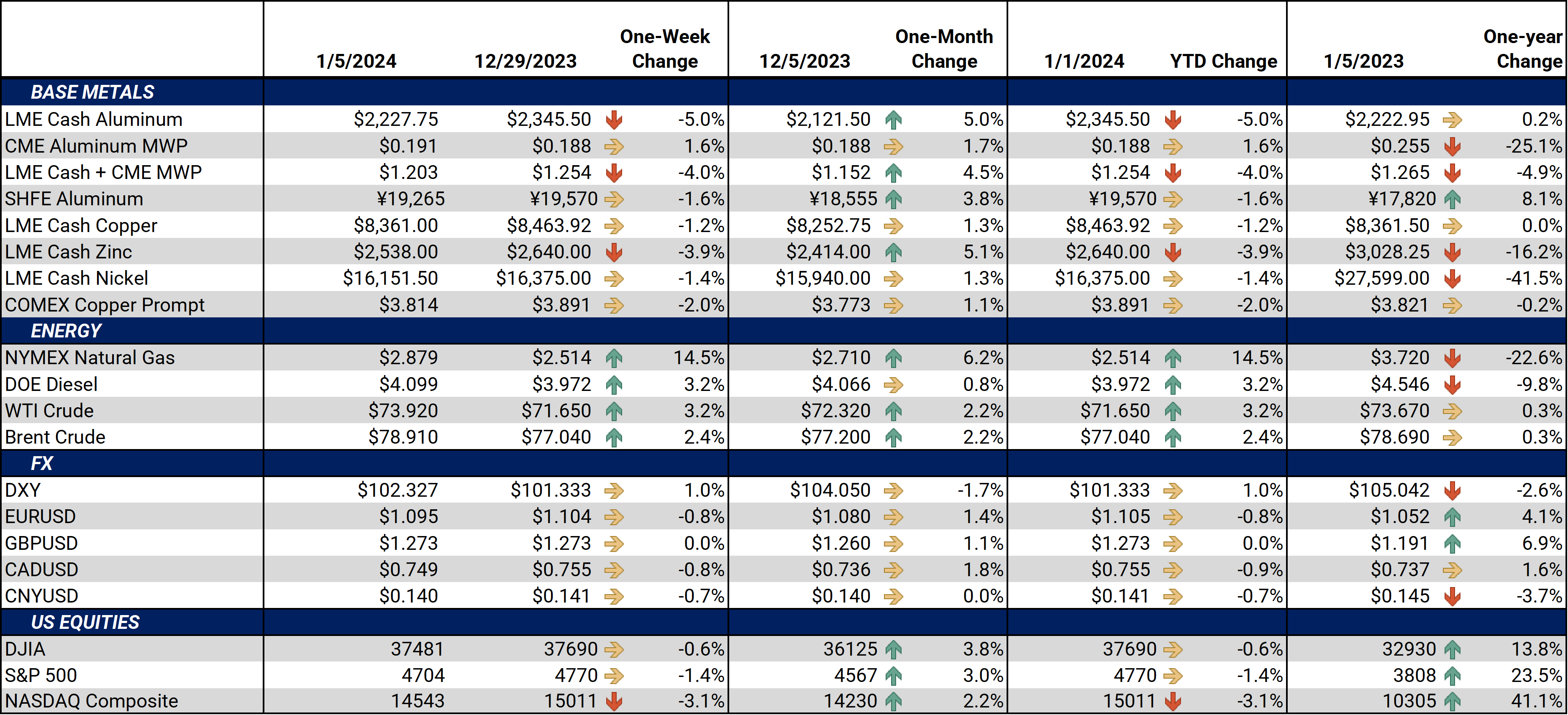

Aluminum Even though China is going through widespread bauxite and alumina-related supply issues, these problems alone won’t be enough to sustain an extensive, long-term aluminum rally, according to Morgan Stanley. “Unless we see a prolonged disruption to Guinea’s bauxite production, the current moves higher in alumina and aluminium may turn out to be overdone,” analysts at the bank proclaimed on Wednesday. Due to a port fire late last month, bauxite transport and production in China’s top supplier, Guinea, has suffered. Meanwhile, several of China’s top alumina production regions have cut output due to safety and environmental concerns. LME aluminum prices surged in late December due to these issues but cooled in early January. (Source: Bloomberg) |

|

|

As of last Friday, investment funds, which are purely speculators in metals markets, are net long approximately 9,800 contracts of LME aluminum, having purchased about 46,000 contracts since the December 8 close. The repositioning that occurred in the last three weeks of December covered their largest short position since the early days of the pandemic. LME aluminum prices are highly sensitive to the actions of these investment funds, so this is likely why prices rallied nearly 9% in December. (Source: LME) |

|

|

|

Copper Analysts are mixed over short-term price and demand for copper. In a note from Wednesday morning, Saxo Bank stated that China’s continually poor manufacturing sector will be a burden for demand and prices. Nanhua Futures, a Chinese commodity brokerage, echoed similar comments, as copper refiners will pull back on production due to slumping demand. Nanhua also said that inventory restocking, usually in mid-to-late January, could be a supportive factor. (Source: Bloomberg) That said, some analysts are extremely bullish on copper demand and prices over the next few years. In a report from last month, Citigroup proclaimed that if global renewable energy capacity triples by 2030, as outlined at the recent COP28 conference, copper demand would jump by 4.2 million mt by the end of the decade. This predicted surge in demand would cause copper to rally to $15,000/mt, or nearly 75%, by the end of 2025. These analysts did caveat that by stating, “This assumes a very soft landing in the U.S. and Europe, an earlier global growth recovery, significant China easing" (Source: Bloomberg) Chilean copper production continues to fall, according to government data released late last week. The country produced 444,905 mt in November, down from 461,776 mt in October. This is also down from last November when they produced 459,229 mt. Chile’s copper miners struggled with numerous political and weather-related setbacks in 2023. (Source: Bloomberg) Copper supplies from Africa’s top producer, the Democratic Republic of the Congo (DRC), will soon reach the market at a faster pace, according to Ivanhoe Mines. Earlier this week, Ivanhoe Mines completed its initial test of shipping via rail to ports in Angola, a process that only took eight days. Currently, 90% of the DRC’s copper is trucked to ports in South Africa, a journey that takes 40 to 50 days and nearly twice the travel distance compared to railing to Angola. (Source: Bloomberg) |

|

Steel The US manufacturing sector has contracted for 14 straight months, according to a recent survey. The Institute of Supply Management’s (ISM) latest survey reads, “US manufacturing sector continued to contract, but at a slightly slower rate in December as compared to November. Companies are still managing outputs appropriately as order softness continues." The ISM’s purchasing managers’ index (PMI), a key gauge of manufacturing activity, rose to 47.4 last month, up from 46.7 in November. A reading below 50.0 signals that the sector is contracting, while above 50.0 signals expansion. Given that the US manufacturing sector is one of the top sources of domestic steel demand, a continually contracting sector will continue to weigh on steel prices and demand. (Source: Argus) |

|

|

|

On Wednesday, Cleveland Cliffs, which is one of the largest steel producers in the US, raised its minimum HRC steel price to $1,150/st, up from $1,100/st previously. This is the first such announcement by a major steel producer in 2024. Throughout 2023, Cleveland Cliffs and other steel producers gradually raised spot prices to maintain profitability. Those moves, in turn, supported the CME HRC steel market in 2023. (Source: Cleveland Cliffs) Demand for prime scrap will jump this year as more electric-arc furnaces come online in the US. According to Argus estimates, 16.1 million st/yr of new EAF capacity between 4Q2023 through 2025, the bulk of that occurring in 2024. Approximately 70% of American steel production is via EAFs, with the remaining portion coming from blast-oxygen furnaces (BOF). Although BOFs traditionally use iron ore as a primary raw material, some BOFs are looking to scrap to boost efficiency and reduce carbon. These moves by BOFs will also boost scrap demand. (Source: Argus) Nickel, a key raw material for stainless steel production, was the worst-performing LME metal in 2023, having fallen 45%. Regarding nickel supply and demand, late last week, Chinese brokerage firm Huatai Futures stated, “Nickel supply continues to grow, but consumption is showing no sign of improvement.” Given that supply remains ample amid poor demand, investment funds continue to have a sizable short position in LME nickel, with little reason to do any significant short covering. (Sources: LME, Bloomberg)

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,273.5/mt, down $110.5/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $100/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.1¢/lb this week. The CME Midwest Premium market is now in a contango from the January ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,463/mt, down $96/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $95/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,372/mt, down $231/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $230/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,052/T, down $52/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023, and are starting 2024 on a good note as well. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $630/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 1/3/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users 12/06/2023: Important US Economic Data (AEGIS Reference) 11/17/2023: Aluminum and Copper End-Users Should Hedge As Inflation Eases |

|||||

Notable News |

|||||

|

1/5/2024: Nippon Steel confident of completing US Steel acquisition 1/5/2024: Exclusive: First Quantum in talks with Jiangxi Copper on sale of stake in Zambian mines-source 1/3/2024: Cleveland-Cliffs Announces Price Increase for Hot Rolled, Cold Rolled and Coated Steel Products 1/2/2024: US construction spending up in November, metals mixed 12/29/2023: Viewpoint: US EAF growth fuels prime scrap demand |

|||||