|

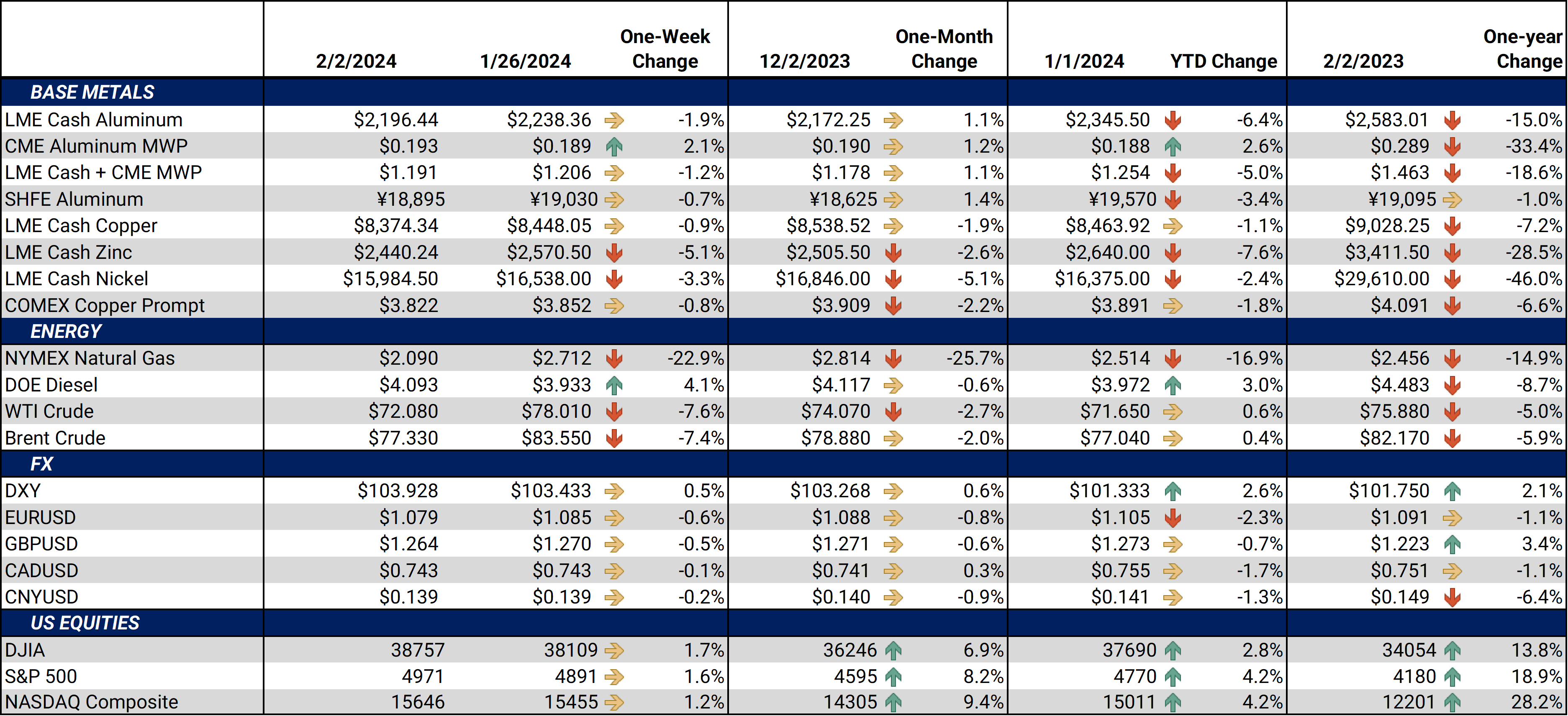

Aluminum Most metals prices fell Thursday and Friday after the US Federal Reserve left interest rates unchanged. Although this move was expected, Federal Reserve Chairman Jerome Powell suggested that interest rates may remain unchanged at the March meeting. Market participants were initially expecting the Federal Reserve to lower interest rates at the March meeting. Throughout 2023, the Federal Reserve raised interest rates to cool inflation. Even though inflation has fallen, it is still above the Federal Reserve’s target rate. In his press conference on Wednesday, Jerome Powell stated that the Federal Reserve hesitates to lower interest rates due to stubbornly high inflation. In general, higher interest rates result in higher borrowing costs for consumers. When borrowing costs increase, consumers usually spend less, which in turn cools inflation. |

|

|

If the EU bans Russian metals from entering the continent, this could ultimately lead to more shipments to China, Bloomberg suggested late last week. Even before the prospect of the EU sanctioning Russia's aluminum, imports to China were poised to increase due to improving import arbitrage amid low inventories. Last year, China imported a near-record amount of primary aluminum due in part to improving arbitrage. (Sources: Bloomberg, China Customs) Since last Thursday, China’s aluminum inventories surged over 8% to 472,200mt, according to Shanghai Metal Market's most recent inventory report, out yesterday. This recent inflow comes after inventories had dwindled to the lowest level since 2017. China’s aluminum inventories usually begin to increase before the country starts its New Year’s celebration in February and normally peak in early spring. This year, China’s eight-day-long New Year celebration starts on Saturday, February 10. (Source: Bloomberg, SMM) LME on-warrant aluminum inventories, meaning the metal is available to trade, have again started falling after surging in late December and early January. On Tuesday, the amount of aluminum earmarked for delivery jumped by over 8%, pushing on-warrant inventories to the lowest level in over a month. Most of yesterday’s delivery requests stem from Taiwanese warehouses. The aluminum being pulled from these Taiwanese warehouses is likely of Russian origin. Last month, warehouses in Taiwan and Malaysia saw a large influx of Russian-origin aluminum. (Source: LME) IXM, the trading arm of one of China’s top mining companies, CMOC Group, will shrink its aluminum business this year, the company announced this week. “This decision comes as part of our broader strategy to focus our resources on our core metals and metal concentrates marketing and trading business,” IXM stated. Without specifying any company, Bloomberg recently suggested that aluminum trading houses have been adversely affected by rising interest rates. (Source: Bloomberg) |

|

Copper Copper prices have made little headway this week while China’s weakening real estate sector weighs on demand. Earlier this week, China’s Evergrande Group, once the country’s largest property developer and its most indebted, was ordered to liquidate by Hong Kong authorities. As Bloomberg stated on Tuesday, “This is another blow to the confidence of investors and potential home buyers in the domestic market that leads to further deterioration in the housing sector.” Goldman Sachs echoed similar comments, proclaiming, “Most investors and Chinese commodity consumers are bearish on China aggregate and commodity demand, as they don’t see solutions to excess capacity in the property and manufacturing sectors, and to dismal consumer confidence.” (Source: Bloomberg) Continuing on Chinese demand, the prospects of China importing more copper remain dim. The Yangshan Copper Cathode Premium, a key gauge of Chinese copper import demand, has sunk to the lowest since last September. This premium soared alongside unwrought copper imports throughout the latter half of 2023. Since early December, though, this premium has fallen by over 50%, suggesting that import demand has slowed tremendously. (Source: Bloomberg, Shanghai Metal Market) Codelco, Chile’s state-owned copper miner and the world’s largest producer, issued two tranches of debt last week, albeit at higher interest rates than several other recent sales. As several analysts interviewed by Bloomberg recently stated, debt buyers are willing to finance Codelco’s new projects, but these creditors remain leery about Codelco's growing debt pile. S&P Global recently stated, “There’s no clear direction and the company is losing profitability and volume, and that makes it more vulnerable to price drops. This path of continuing to issue debt to finance deficits clearly deteriorates the credit profile.” (Source: Bloomberg) Glencore, one of the world's top copper producers, reported a 5% drop in copper output last year due to disposals at a key Australian mine, the company announced earlier this week. Total production in 2023 was 1.01 million mt. Due to last year’s drop in output, they anticipate 2024 production will be between 950,000 and 1.01 million mt. (Source: Glencore, Mining Weekly) |

|

Steel SSAB, one of Europe’s largest steel producers, has grown hesitant on demand due to the ongoing conflict in the Red Sea. “The geopolitical situation, which is nothing new maybe, still hampers the underlying demand a bit and the problems in the Suez Canal and so on,” CEO Martin Lindqvist stated on Tuesday. This apprehension about demand comes despite cooling inflation in most Western economies and the prospect of decreasing interest rates. (Source: Bloomberg) Prompt month prices for ferrous busheling scrap, a key raw material for most American steel production, has fallen dramatically in January. Yesterday, the prompt month (now February) CME Ferrous Busheling Scrap contract settled at $475/gross ton. On January 1, the prompt month (January) contract hovered near $535/gross ton. American steel production has fallen recently, reducing the demand for busheling scrap. (Source: CME) Nucor, which is one of America’s largest steelmakers, reported a drop in earnings due to lower prices and volumes during its earnings release on Monday. For 1Q2024, Nucor expects better sales in steel mill and raw materials divisions, but the steel products will remain a drag on overall performance. "We remain optimistic that Nucor's best days are ahead of us, with a resilient U.S. economy," CEO Leon Topalian reiterated. (Source: Reuters) Stelco Holdings Inc, one of Canada’s largest steel producers, has set aside $400 million to invest in coal and other metals production-related assets, its CEO proclaimed late last week. This will include buying assets in growth markets such as India, the Middle East, China, and Latin America, and will target assets related to aluminum, copper, and coal. These purchases will be made through the Miami-based holding company known as Bedrock Industries. Bedrock is the parent company of Stelco Holdings. (Source: Bloomberg) If re-elected, Donald Trump says he would block Nippon Steel's potential buyout of US Steel, he stated after a meeting with Teamsters earlier this week. These are Mr. Trump’s first comments about the deal since it was announced in December. Nippon Steel rebuffed Trump’s comments, stating, “The purchase would bring great benefits to US Steel, the US steel industry, its customers, workers and the regional community.” (Source: Bloomberg) |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,233.5/mt, down $41/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.3¢/lb this week. The CME Midwest Premium market is now in a contango from the February ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,482/mt, down $63.5/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $60/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,785/mt, down $550/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $550/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $968/T, up $25/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $540/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/31/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge 1/11/2024: Important US Economic Data (AEGIS Reference) 1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users |

|||||

Notable News |

|||||

|

2/1/2024: Glencore reports lower production, builds solar plant in South Africa 1/30/2024: Russia the driver behind China's aluminium import boom 1/29/2024: Nucor's fourth-quarter sales, profit decline on lower pricing, volumes 1/29/2024: ArcelorMittal South Africa in talks to avert factory closure 1/28/2024: Column: Another US primary aluminum smelter bites the dust 1/27/2024: Chinese companies to invest up to $7 billion in Congo mining infrastructure |

|||||