|

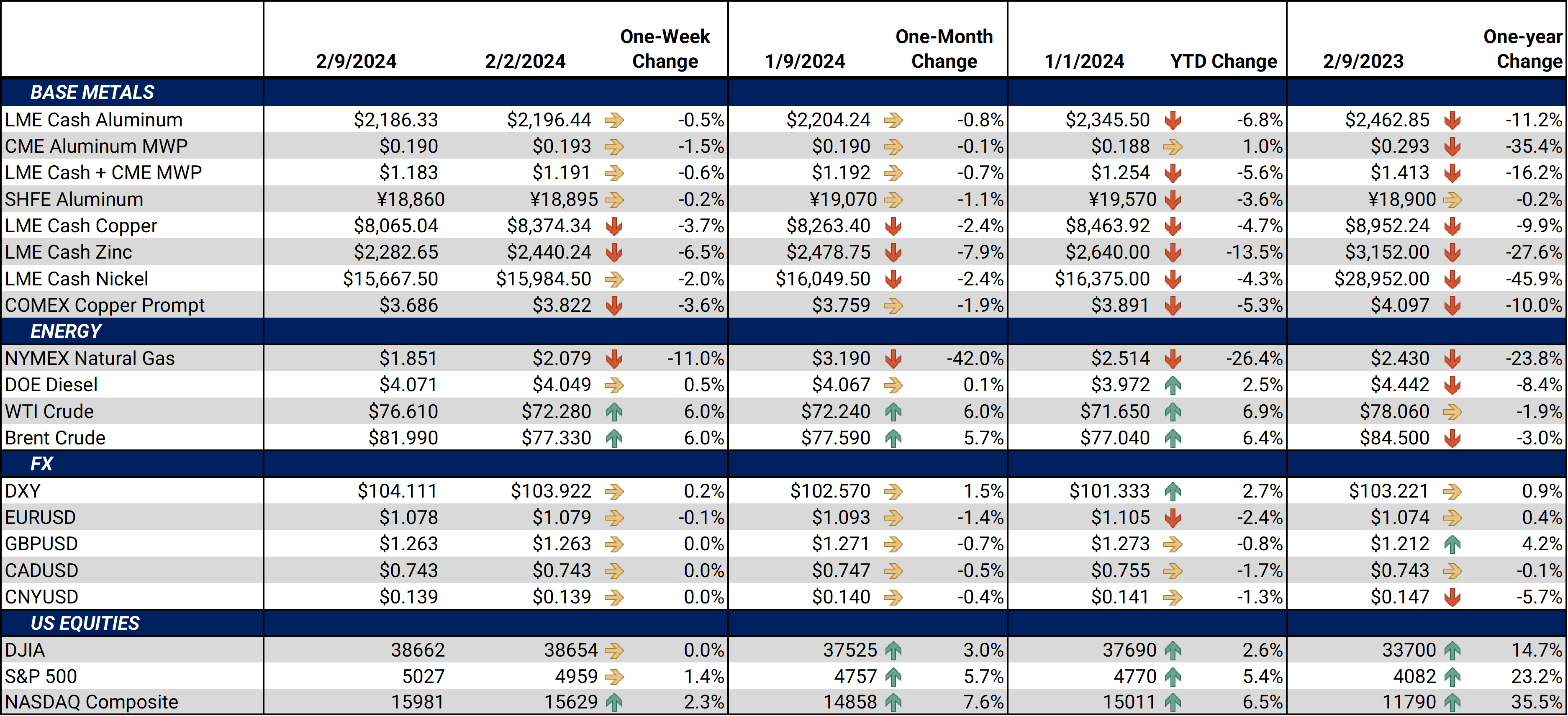

Aluminum LME aluminum prices stalled this week ahead of next week’s Chinese New Year. The demand picture for aluminum and other metals remains cloudy, and it's unclear if Chinese authorities will implement new stimulus measures. Similarly, it remains uncertain if recent efforts to lift the country’s slumping stock markets will boost investor confidence in the long term. (Source: Bloomberg) |

|

|

Investment funds continue to cover their short position in LME aluminum. As of last Friday, these funds, generally speculators in metals markets, are net short approximately 5,200 contracts, having purchased a net 11,000 contracts over the past two weeks. These investment funds can have an oversized influence on metals markets, which is likely why LME aluminum rallied about 3% during that two-week period. (Source: LME) The LME Aluminum Cash – 3M spread, a key gauge of spot demand, rallied in early February. Yesterday, this spread settled at a $29.55/mt discount cash to the 3M contract, down slightly from Wednesday’s settlement of $26/mt discount. Wednesday’s close was the narrowest traded spread since mid-November. Similarly, the largest one-day increase since late December was recorded on Wednesday, suggesting that spot demand has increased recently. (Source: LME) During its 4Q2023 earnings release late last week, Ball Corporation, a beverage can producer and a large aluminum end-user, reported better-than-expected results partially due to lower input costs. The company also stated that it was working on reducing other costs, such as warehousing and freight. As for 2024, its CFO said they expect higher volumes and earnings this year. (Source: Reuters) Qatar Aluminum, one of the Middle East’s largest aluminum producers, reported a 51% drop in profits last year, the company announced on Monday. During the earnings release, the company stated that this drop in profit was due to much lower realized sales prices compared to 2022. They also stated that sales volumes were slightly lower than in 2022 due to weaker demand. LME aluminum prices were volatile in 2023 but finished the year essentially unchanged. (Source: Bloomberg) |

|

Copper Due to expected supply constraints over the coming years, hedge funds have become quite bullish on copper. This has led to several of the world’s largest hedge funds making significant investments in miners and other copper-related equities in recent months. Demand is largely dependent on interest rates and China, they reiterated during recent interviews. (Source: Bloomberg) The race to become the world’s second-largest copper producer is heating up. Peru produced a record amount of copper last year, while the Democratic Republic of the Congo (DRC) also has record output. Meanwhile, Chile, which has long been the world’s top producer, has faced numerous production issues recently due to weather and political strife. (Source: Bloomberg) DRC’s copper production is expected to grow over the coming years. Ivanhoe Mines, which operates the Kamoa-Kakula as part of a joint venture, just secured a $200 million loan from the DRC’s Rawbank SA. These funds will be used to finance hydropower, which will, in turn, give the ability to increase output to 600,000 mt per year. Kamoa-Kakula produced nearly 400,000 mt in 2023. The DRC is the world’s third-largest copper producer and top cobalt producer. (Source: Bloomberg, Ivanhoe Mines) Meanwhile, Zambia, Africa’s second-largest copper producer, could see a sizable increase in production over the coming years. Kobold Metals, a San Francisco-based mining firm, claims that its Mingomba project is comparable in size and ore grade to that of the Kamoa-Kakula project in the neighboring country of the DRC. The Kamoa-Kakula mine produced nearly 400,000 mt in 2022 and has some of the highest ore grades in the world. Since the Mingomba project is reported to be as promising as Kamoa-Kakula, Kobold Metals says it will invest $2 billion into the Zambian operation. (Source: Bloomberg) Anglo American, one of the world’s largest copper miners, lowered its production guidance for fiscal year 2024. The company now expects to produce between 730,000 to 790,000 mt, unchanged from their December comments. This is likely due to an anticipated decline in ore grades in Peru. They also stated that Chilean production is dependent upon water availability. Last year, the company produced 826,000 mt, up 26% compared to 2022. (Source: Bloomberg) |

|

Steel ArcelorMittal, one of the world’s largest steelmakers, predicts world (ex-China) apparent steel consumption will grow by 3% to 4% this year, while US apparent steel consumption will grow by 1.5% to 3.5%. China will be a laggard this year, with apparent steel consumption growing by 0 to 2%. (Source: Bloomberg) US Steel reported better-than-expected 4Q2023 results late last week, with net sales topping $4 billion. Although the market welcomed these stellar results, at least two analysts quoted by Bloomberg are leery that the potential buyout by Nippon Steel will occur this year. Both companies remain optimistic, though, with US Steel expecting the sale to be completed by the 2nd or 3rd quarter of 2024. (Source: Bloomberg) Spanish stainless steelmaker Acerinox will buy Haynes International, an Indiana-based alloy producer, the companies announced on Monday. Acerinox will also invest an additional $200 million into the US, including $170 million into Haynes. The deal is expected to close in 3Q2024. (Source: Bloomberg) Prices for iron ore, a key raw material for most of China’s steel production, have fallen to a three-month low ahead of the country’s New Year’s holiday. Both steel production and demand have slumped in recent weeks due to the holiday. Also, China’s real estate sector has shown no signs of recovery and remains a burden for metals and raw material demand. (Source: Bloomberg) Bolivia will soon build the country's first zinc smelter after receiving a $350 million investment from China. According to Bolivian government estimates, operations will start in 2025 and produce 150,000 mt of zinc concentrate per year and 65,000 mt of metallic zinc. Bolivia is one of the world’s largest miners of zinc, a key raw material for hot-dipped galvanized steel production. (Source: Bloomberg) |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,216/mt, down $17.5/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $20/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.0¢/lb this week. The CME Midwest Premium market is now in a contango from the February ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,169/mt, down $313/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $300/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $15,921/mt, down $314/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $310/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $945/T, down $22/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $520/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

2/7/2024: Important US Economic Data (AEGIS Reference) 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/31/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge 1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users |

|||||

Notable News |

|||||

|

2/9/2024: Palladium price drops below platinum for the first time since 2018 2/8/2024: Anglo American posts 24% rise in annual copper output 2/8/2024: Finnish steelmaker Outokumpu sees European recovery continuing 2/6/2024: Credit card delinquencies surged in 2023, indicating ‘financial stress,’ New York Fed says 2/6/2024: Japan's EV sales fall on lower demand in January 2/6/2024: Aurubis Q1 profit misses forecast on lower metal prices 2/5/2024: Trump adds to Nippon-U.S. Steel deal woes in blow for Japan Inc 2/5/2024: Gold hits more than one-week low as dollar strengthens, yields rise 2/5/2024: Anglo American explores for copper, cobalt in Zambia 2/5/2024: Rare earths prices seen rebounding in second half of 2024 -analysts 2/5/2024: Analysts see weak demand dragging on base metals in 2024 |

|||||