|

*Please note that our offices will be closed on Monday, February 19, due to the President’s Day holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * |

|

|

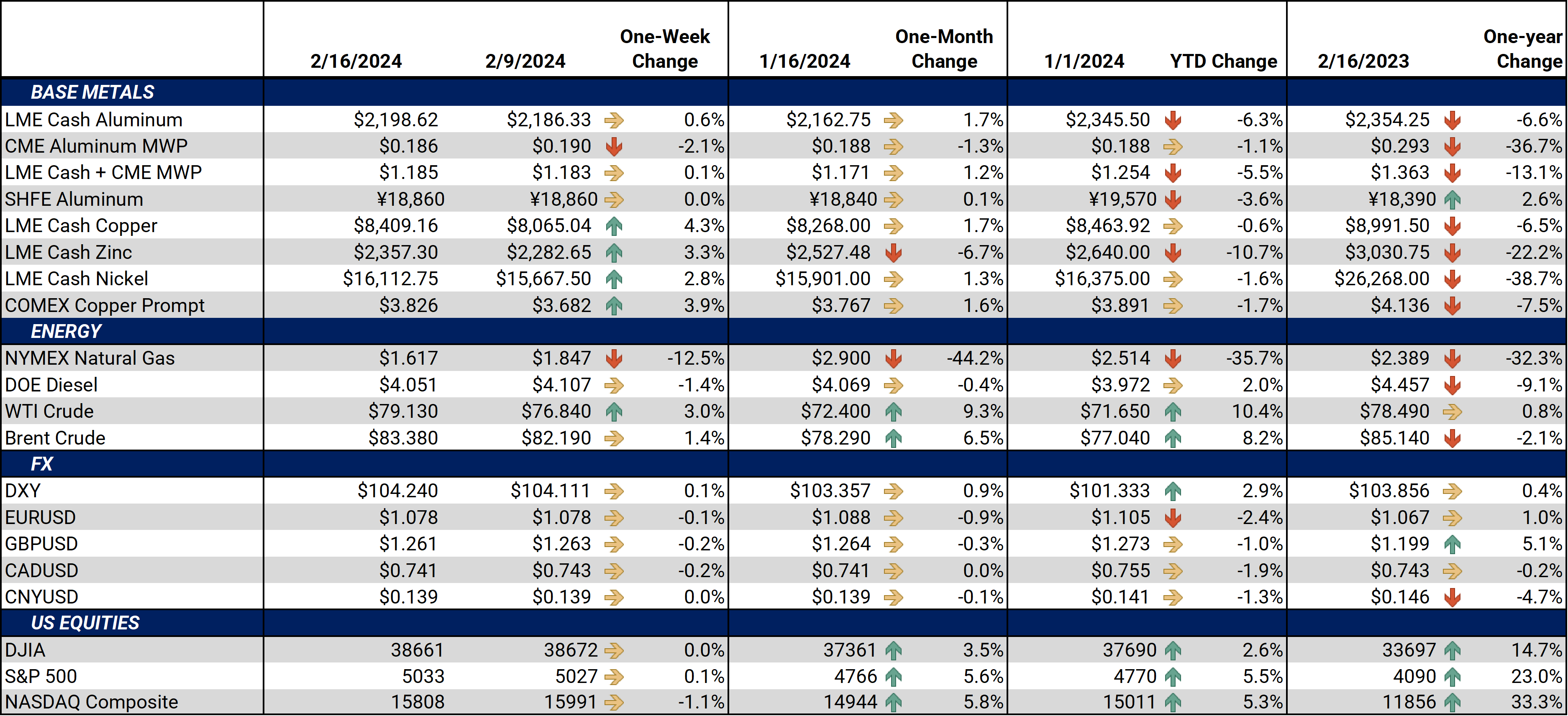

Aluminum Most metals prices fell earlier this week after the US inflation rate printed hotter than expected. To cool inflation, the US Federal Reserve could be forced to keep interest rates higher for longer. This, in turn, could be a continued burden on metals prices, especially aluminum and copper, which are highly sensitive to interest rates. Prices rallied in the latter half of the week, however, as the market now turns to post-Chinese New Year holiday demand. LME and SHFE aluminum prices are down on the year, but prices could rally if China implements more economic stimulus measures, according to Commerzbank. Although China’s economy continues to expand, its growth, as measured by GDP, is below historical norms. Also, the country’s inflation rate (as measured by consumer prices) continues to fall, with prices deflating at the fastest pace since the Great Recession. These factors will likely force Chinese authorities to implement more stimulus measures, which in turn could rally prices for aluminum and other metals. (Source: LME) Although LME volumes have ticked lower in January, Russian aluminum remains the dominant force in LME warehouses. As of January 31, 286,750 mt of Russian-origin aluminum is in LME warehouses, down from 338,375 at the end of 2023. Even with this slight drawdown, Russia still represents about 90% of the aluminum in the LME system. Russia’s oversized influence on the LME system has become a hot-button issue since the start of the Russia-Ukraine conflict nearly two years ago. (Source: LME) Vedanta Aluminum, India’s top producer, believes the country’s appetite for aluminum will grow at a blistering pace over the coming years. Over the past three years, India’s aluminum consumption has grown by 14% per year. According to Vedanta, annual consumption is approximately 5 million mt but could double in 5 years if it stays on the current trajectory. Most of India’s recent aluminum demand has come from renewables and infrastructure projects. (Source: Bloomberg) Hindalco Industries, a top global aluminum producer with expansion plans in the US, experienced a slump in profits last quarter due to higher-than-expected costs. The company’s aluminum rolling and recycling plant being built in Alabama will now cost $4.1 billion, roughly 64% higher than forecasted two years ago. Most of the cost overrun is due to “higher civil and construction expenses after the site of the plant had to be changed,” the company stated earlier this week. (Source: Bloomberg) |

|

Copper Russia’s metals exports fell by 15% to $60 billion last year, according to Russian customs data. Russia is largely known to be one of China’s top primary aluminum suppliers and sells significant quantities of refined copper into Chinese and European markets. Since 2022, Russia has stopped releasing monthly import/export data, so market participants rely on other sources, such as China Customs. (Source: Reuters) Chile’s state-owned copper miner, Codelco, estimates 2024 copper production will be 1.353 million mt, the company announced last week. This is up slightly from the 1.325 million mt produced last year. Last year’s production was the lowest in 25 years. Codelco, traditionally the world’s largest copper miner, has experienced many production issues in recent years, including declining ore grades, poor weather conditions, and political strife. (Source: Reuters) Freeport McMoran, a US-based copper miner, will likely seek growth via mergers and acquisitions, according to industry analysts quoted by Bloomberg earlier this week. Several of Freeport’s top competitors have been active in M&A in recent years, but Freeport has largely been on the sidelines. Freeport’s stock price has fallen in recent months amid falling copper prices, lower revenue, and higher costs. The company has already implemented severe cost-cutting measures, so revenue growth will likely come through M&A activity, according to analysts. (Source: Bloomberg) Finally, Adani Natural Resources, an India-based conglomerate, will begin refined copper production next month, the company announced earlier this month. The smelter will have an initial production of 500,000 mt/year but will expand to 1 million mt/year by 2029. This eventual doubling of capacity comes while India’s copper demand is also expected to double by the end of the decade. Adani also proclaims it will be a low-cost producer of the red metal, putting it at a competitive advantage over other producers. (Source: Bloomberg) |

|

Steel Outokumpu, a Finland-based stainless steel producer, says it expects European steel demand to rebound this year. Due to slumping European demand last year, the company expanded in the US HRC steel market via a procurement agreement with ArcelorMittal Nippon Steel. Outokumpu is the US’s second-largest stainless steel producer. (Source: Reuters) Thyssenkrupp, one of Europe’s top steelmakers, believes its business will slump this quarter due to a substantial drop in real estate-related demand. The company now expects to merely break even this year, as high interest rates will curtail end-user demand, thereby pressuring profits. New orders fell by 13% in the first fiscal quarter of 2024, they reported. (Source: Bloomberg) China and Indonesia will likely cut nickel production by over 100,000 mt in 2024 due to falling prices amid chronic oversupply, analysts told Reuters. Indonesia is the world’s largest nickel producer, with most of its production being exported to China in the form of stainless steel. Like nickel, prices for stainless steel have also slumped in 2023 and early 2024 due to excess supply amid falling demand. (Source: Reuters) The actions of investment funds, who are generally speculators in metals markets, have pressured zinc prices in recent weeks. As of last Friday, investment funds are now net short approximately 12,587 contracts of LME zinc, their largest short position since the early days of the COVID-19 pandemic. Prices for zinc, a key raw material for hot-dipped galvanized steel production, have fallen over 8% this month. (Source: LME) Reliance Steel and Aluminum, North America’s largest metals service center, will buy American Alloy Steel, the companies announced this week. American Alloy Steel is a top distributor of specialty carbon and alloy steel plate and round bar products, according to the press release. Last year, American Alloy Steel had $310 million in net sales and served both domestic and international markets. (Source: Bloomberg) |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,218/mt, up $2/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve was essentially unchanged. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.6¢/lb this week. The CME Midwest Premium market is now in a contango from the February ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,489/mt, up $320/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $320/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,356/mt, up $435/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher by about $430/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $929/T, down $16/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $520/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

2/14/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 2/13/2024: Important US Economic Data (AEGIS Reference) 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge 1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users |

|||||

Notable News |

|||||

|

2/15/2024: Cleveland-Cliffs to idle West Virginia tinplate plant, impacting 900 jobs 2/13/024: India's NALCO smashes third-quarter profit estimates on lower costs | Reuters 2/13/2024: Congo's Gecamines offers to buy some of Khazakh miner ERG's copper assets | Reuters 2/13/2024: Prices rose more than expected in January as inflation won’t go away 2/13/2024: India's NALCO smashes third-quarter profit estimates on lower costs 2/12/2024: China, Indonesia face deeper output cuts to tackle nickel price slide 2/12/2024: Glencore to halt New Caledonia nickel plant and sell stake 2/12/2024: Russia's dependence on exports to Asia rises as business with Europe falls | Reuters |

|||||