|

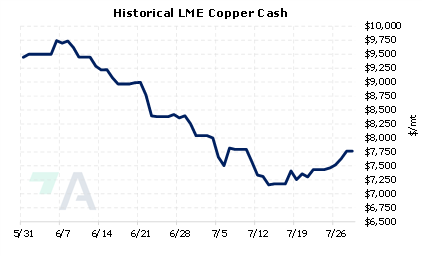

Southern Copper reports that its production cash cost jumped to $1.10/lb last quarter, up from $0.59/lb in 2Q 2021. Rising costs for fuel and other operating materials, and a mine stoppage led to a decline in income, according to Bloomberg’s interpretation of Southern Copper’s 2Q report. Southern Copper’s report also stated that production volumes for copper, silver, molybdenum, and zinc all had year-over-year declines. Miners such as Southern Copper are being burdened by rising inflationary pressures and falling metals prices. |

|

|

|

Copper prices at the LME are down nearly 28% from the March highs and are down nearly 5.3% in July alone. End-users such as home builders might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum copper price for a home builder, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (7/29/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/27/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/27/2022: American Automotive Production is on the Rebound 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

||

|

|

||

| Important Headlines | ||

|

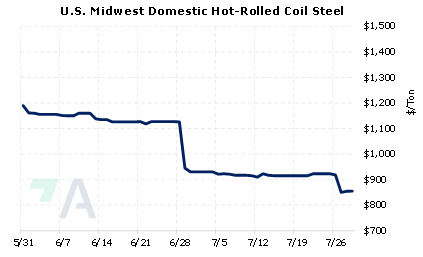

7/28/2022: US economy contracts for 2nd consecutive quarter 7/28/2022: ArcelorMittal H1 crude steel output falls 13% on year 7/27/2022: Analysis: Peru's mining execs 'lose faith' in gov't despite moderate shift 7/26/2022: US HRC: Prices fall, large buys reported 7/26/2022: Column: Where there's muck there's brass ... and critical minerals 7/26/2022: Why China’s economic measures may not be enough to drive up consumer demand 7/25/2022: LME won't ban Nornickel's metal as Russian firm isn't under UK sanctions -sources 7/24/2022: Column: Aluminium producers feel the margin pain as price slumps 7/22/2022: Cliffs expects automotive steel demand rebound by year-end: CEO

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||