|

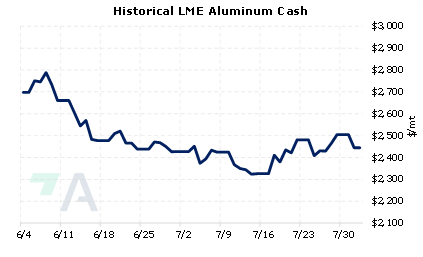

China’s exports of alumina to Russia surged again last month. Of the 190,000 mt China exported, 184,000 mt, or 96.8%, went to Russia, according to Reuters and Chinese customs data. This marks the highest monthly Chinese alumina sale to Russia so far this year. China normally exports little alumina to Russia, as they only shipped 1,747 mt to them in 2021. However, logistical issues and sanctions from the Russia-Ukraine conflict have forced Rusal to seek out Chinese alumina. These alumina imports have helped Russia’s aluminum producer, Rusal, to keep aluminum production flowing. |

|

|

|

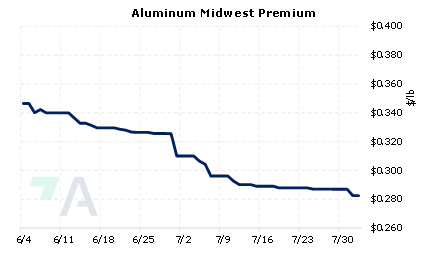

Rusal’s ability to maintain a steady aluminum output has likely contributed to falling global prices in 2022. Aluminum extruders that are concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options, both of which would establish a minimum price. Such positions are basic for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (8/2/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/27/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/27/2022: American Automotive Production is on the Rebound 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

||

|

|

||

| Important Headlines | ||

|

8/1/2022: Gas cuts unnerve ferro-alloy market as trade slows 7/31/2022: Column: China's exports smooth aluminium supply-chain disruption |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||