|

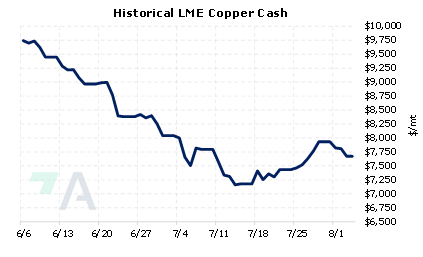

China’s slowing real estate sector has tempered copper demand for wiring and household appliances, according to Maike Metals International, a major China-based copper trader and importer. Maike, therefore, predicts copper prices will hover between $7,000/mt to $8,000/mt for the remainder of 2022, as the real estate sector remains subdued. The company also stated that further interest rate hikes by the US Federal Reserve to cool inflation could also keep a cap on copper prices. |

|

|

|

So far, 2022 has been an ugly year for copper prices. The LME 3M Select contract dropped by 15.5% in 1H 2022 and is down another 7% this quarter (7:00 AM CST). Due to this downward pressure, the forward curve for copper has shifted lower by nearly $200/mt since early May. This means that compared to three months ago, end users can lock in lower prices for the remainder of 2022 and into early 2023. Buying swaps or call options or both viable strategies to hedge future needs, as both would establish a maximum copper price. Such positions are basic for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (8/4/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

08/03/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 08/02/2022: Russia Finds New Alumina Supply 07/27/2022: American Automotive Production is on the Rebound 07/20/2022: Interest in Hedging Cobalt is Increasing |

||

|

|

||

| Important Headlines | ||

|

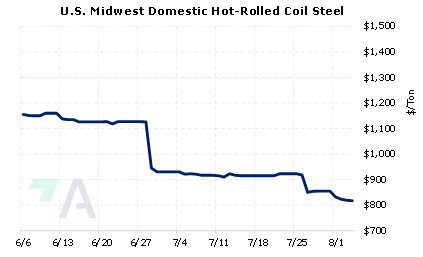

8/3/2022: Analysts slash platinum and palladium forecasts amid global slowdown 8/2/2022: US HRC: Prices decline, market looks for bottom 8/2/2022: Arconic cuts aluminum sales outlook on tighter margins, Tennessee plant disruption 8/2/2022: Copper price falls as Taiwan tensions spark risk-off selling 8/1/2022: Japan's manufacturing at 10-month low in July on auto parts shortage, rising costs 8/1/2022: Gas cuts unnerve ferro-alloy market as trade slows 7/31/2022: Column: China's exports smooth aluminium supply-chain disruption |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||