|

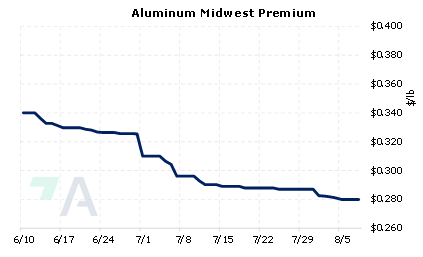

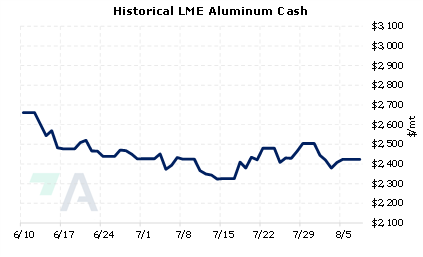

European aluminum supply outlook is under threat from a continuing energy crunch, according to analysts quoted by Bloomberg last Friday. Several European smelters have closed in 2021 and 2022 due to high electricity costs, and more curtailments could occur if energy prices stay high or strengthen further. Alcoa’s CEO echoed similar comments late last month, as they estimate that between 10 to 20% of global aluminum smelter capacity was unprofitable in June. Analysts also feel that the recent drop in LME warehouse stocks could be supportive of aluminum prices. LME aluminum stocks were 287,425 mt this morning and are nearing 22-year lows. |

|

|

|

Despite the supply issues, LME aluminum prices have dropped nearly $578/mt, or 19.2%, since May 1, as the last trade was $2,435/mt (7:00 AM CST). In that time, the forward curve has switched from backwardation to contango. This means that spot prices are currently lower than futures prices. Even though the forward curve is now in contango, it could still be a good time for aluminum end-users to apply simple hedges that provide upside price protection, such as buying swaps or call options, both of which would establish a maximum price. Such positions are basic for end-user hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (8/8/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

08/03/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 08/02/2022: Russia Finds New Alumina Supply 07/27/2022: American Automotive Production is on the Rebound 07/20/2022: Interest in Hedging Cobalt is Increasing |

||

|

|

||

| Important Headlines | ||

|

8/7/2022: US Senate passes landmark bill to tackle climate 8/5/2022: US imports of unalloyed aluminum continue to rise loosening supply further 8/5/2022: FUTURES WRAP: LME scrap contract reaches all-time daily trading volume high |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||