|

Starting in January 2023, the LME will produce monthly reports detailing how much Russian metal is in LME warehouses. However, Rusal and Alcoa request that the LME reports detail metals of all origins, not just those from Russia. AEGIS notes that this is a rare amount of agreement for the two companies, as Alcoa previously demanded that the LME ban all Rusal and other Russian-produced metals from the exchange. However, earlier this month the LME dismissed such a ban. In September and October, Alcoa sent three letters to the LME requesting that Russian metal be banned from the exchange. At that time, Alcoa felt that allowing large volumes of Russian metal into the LME system could exert undue influence on LME aluminum prices and might upset the global aluminum supply and demand balance. These letters were in response to the discussion paper the LME launched in late September outlining possible actions against Russian metals producers, including an outright ban on their metals. (Source: Reuters) |

|

|

|

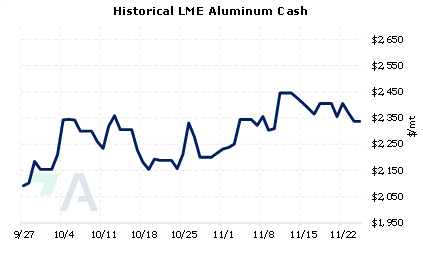

The LME Aluminum 3M Select contract is up nearly 14% from the late-September lows, with the last trade at $2,378/mt (7:00AM CST). However, allowing large volumes of Russian metal onto the LME could push prices lower. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (11/25/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

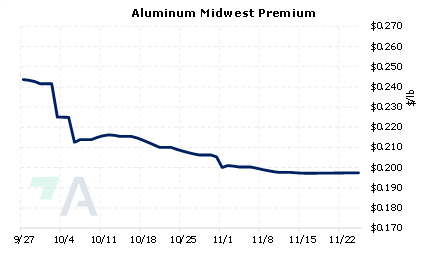

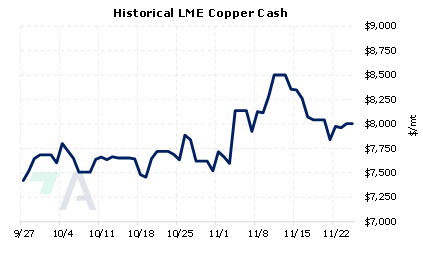

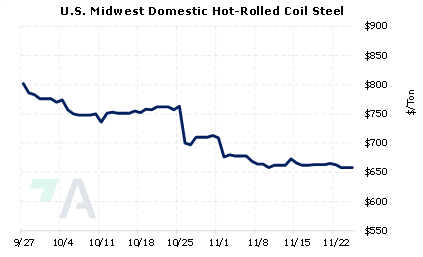

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

||

|

|

||

| Important Headlines | ||

|

11/21/2022: Alcoa backs Rusal's call for LME to reveal origin of all metal stocks 11/21/2022: Platinum deficit expected in 2023 after bumper surpluses, WPIC says 11/21/2022: North American auto losses deepen 11/21/2022: Large rail union SMART-TD votes to reject labor deal as national strike moves closer 11/18/2022: Rio to pursue Turquoise bid after ending talks with minority shareholders 11/18/2022: Indonesia faces difficult task to create OPEC-like group for nickel 11/17/2022: Canada 'very unlikely' to join OPEC-like group for nickel -gov't source |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||