|

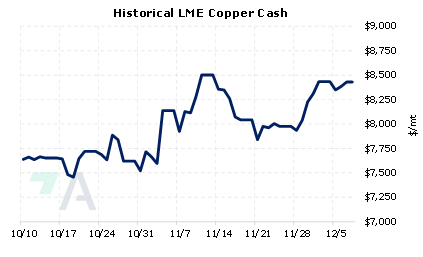

For more info on copper, please check out our latest article, Does the Copper Rally Have Legs? Largely due to China easing its COVID restrictions, Goldman Sachs has lifted its 2023 average price forecast to $9,750/mt, from $8,325/mt. They also upped their 3/6/12 months price targets to $9,500/$10,000/$11,000/mt, compared to $6,700/$7,600/$9,000/mt previously. According to their note, “China’s stockpiles of the metal almost entirely depleted” as we enter 2023, thus the bank anticipates improved buyer demand as stockpiles increase. (Source: Bloomberg) |

|

|

|

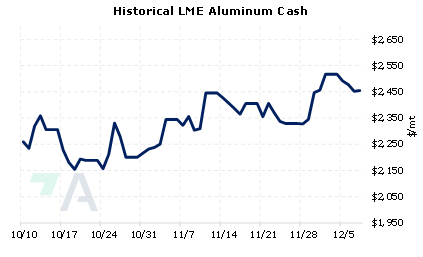

The bullish views also go beyond 2023. Due to increasing demand from the energy transition, miner Glencore now predicts a cumulative copper shortfall of nearly 50 million mt by 2030. Despite the expected deficit, Glencore does not currently plan to increase production. Earlier this week, Glencore stated “we want to see that deficit,” later declaring that they will only increase production when buyers are “screaming” for copper. According to the company, current production hovers near 1 million mt but could be increased by 60% even with the current assets. (Sources: Bloomberg, Glencore) LME copper prices have already rallied nearly 9% off the November 28 lows as China begins to ease COVID restrictions. The last trade on the LME 3M Select contract was $8,547/mt (7:00 AM CST). Even with the recent price gains, this still could be a good opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/8/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/07/2022: Does the Copper Rally Have Legs? 12/07/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History |

||

|

|

||

| Important Headlines | ||

|

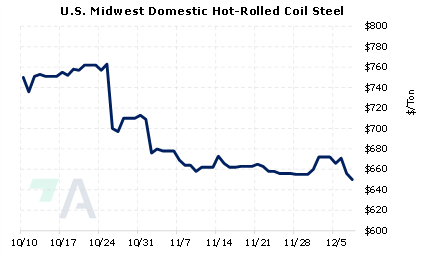

12/7/2022: U.S. floats new steel, aluminum tariffs based on carbon emissions 12/7/2022: Nyrstar's Auby zinc plant on care and maintenance until further notice 12/6/2022: US HRC: Prices jump on mill price hikes 12/6/2022: Glencore 2023 production outlook disappoints, shares fall 12/5/2022: US, EU weigh climate-based tariffs on Chinese steel, aluminium -Bloomberg News 12/5/2022: Volkswagen resumes production at China plants 12/2/2022: HSBC resigns as LME member after exiting industrial metals |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||