|

Due to “challenging market conditions,” Nyrstar’s Auby, France zinc smelter will remain closed “indefinitely” after completing scheduled maintenance, the company announced late last week. The smelter, which has a 172,000 mt annual capacity and is one of Europe’s largest, was closed in October to perform the scheduled maintenance. Previously, the smelter was shut down in January and February this year because of high electricity costs. However, production resumed in late March at a reduced level. Nyrstar is one of the world’s largest zinc producers, with 720,000 mt of annual zinc production in Europe, according to Reuters. Most of Nyrstar’s production is based in Europe, with smaller operations in Australia and the US. (Source: Reuters, Bloomberg) |

|

|

|

This has been a tough year for European zinc smelters, as many have curtailed production fully or partially. Despite the shutdowns, zinc prices at the LME are down over 9% this year, with the last trade at $3,238/mt (7:00 AM CST). Also, zinc’s forward curve is currently backwardated. This allows a zinc end-user such as a galvanizer to hedge future purchases at prices lower than the current spot market. Buying swaps or call options are viable strategies, as either would establish a maximum zinc price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please note that zinc options have lower liquidity than swaps. Please contact AEGIS for specific strategies that fit your operations. (12/12/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

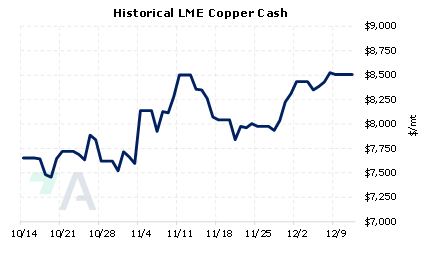

12/07/2022: Does the Copper Rally Have Legs? 12/07/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History |

||

|

|

||

| Important Headlines | ||

|

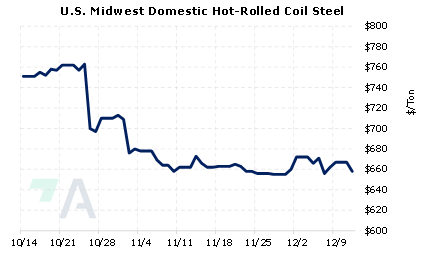

12/9/2022: U.S. bid for battery metals has Africa blind spot 12/8/2022: WTO rules against U.S. steel, aluminium tariffs, Norway says 12/8/2022: US steel imports may fall to February '21 levels 12/8/2022: Anglo American cuts 2023 copper output target on poor Chilean ore grades 12/8/2022: Column: Copper mine supply wave arrives but will it be the last? 12/7/2022: U.S. floats new steel, aluminum tariffs based on carbon emissions 12/7/2022: Nyrstar's Auby zinc plant on care and maintenance until further notice 12/6/2022: US HRC: Prices jump on mill price hikes 12/6/2022: Glencore 2023 production outlook disappoints, shares fall 12/5/2022: US, EU weigh climate-based tariffs on Chinese steel, aluminium -Bloomberg News 12/5/2022: Volkswagen resumes production at China plants 12/2/2022: HSBC resigns as LME member after exiting industrial metals |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||