|

The current Section 232 tariffs on steel and aluminum imports will remain in place, despite opposition from the World Trade Organization (WTO). Last Friday, the Biden administration stated they are “committed to preserving U.S. national security by ensuring the long-term viability of our steel and aluminum industries, and we do not intend to remove the Section 232 duties.” AEGIS notes the Biden administration likely felt obligated to reiterate their stance on these tariffs after the WTO stated the tariffs violated international law earlier in the week. Despite the WTO’s comments, they have little recourse over the Biden administration’s decision. According to an international trade lawyer interviewed by Bloomberg, “the WTO cannot declare that a US law is invalid. All they can do is impose sanctions for not changing it.” (Source: Bloomberg) |

|

|

|

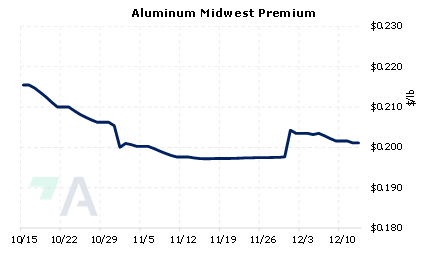

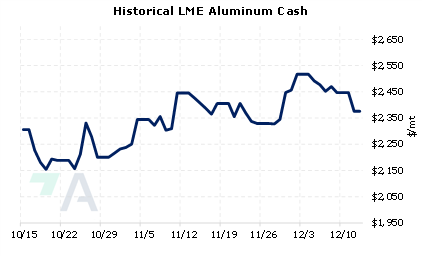

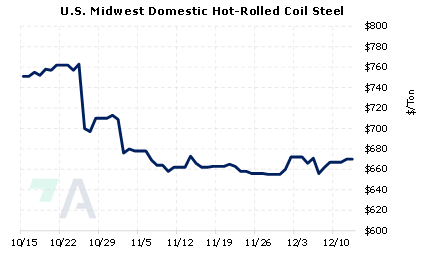

Section 232 tariffs are at the discretion of the US executive branch and are allowed for reasons of national security. Current tariffs are 10% on aluminum imports and 25% on steel imports. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap aluminum onto the US market. AEGIS notes the cost of the tariffs has supported the MWP. Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the US, as these tariffs are based on aluminum prices, and are built into the MWP. The current Section 232 tariffs have been in place since 2017, thus AEGIS believes that keeping the “status quo” in place will likely have no impact on MWP. The CME Midwest Premium is a premium that midwestern US buyers pay on top of the LME price and can be hedged via swaps. However, the CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using limit orders. As for HRC steel, this market can also be hedged via CME swaps. Since CME HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (12/13/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

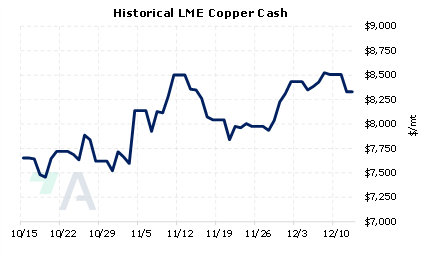

12/07/2022: Does the Copper Rally Have Legs? 12/07/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History |

||

|

|

||

| Important Headlines | ||

|

12/12/2022: Analysis: Turbulence still haunts LME nickel, months on from trade debacle 12/9/2022: Exclusive: Canada aims to speed up new projects with critical minerals strategy 12/9/2022: WTO rules US steel, Al tariffs unwarranted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||