|

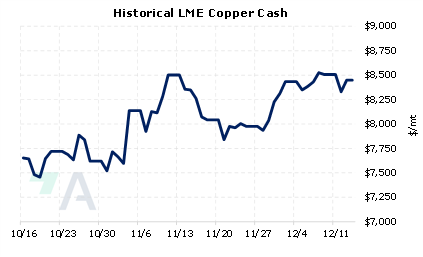

Despite nearby political protests, zinc and copper mines owned by Freeport McMoran, Southern Copper, BHP, Glencore, and Hochschild Mining are operating normally, according to Peru’s energy society SNMPE. Since then-President Pedro Castillo was impeached and arrested on corruption charges on December 7, deadly protests have blocked highways in Peru’s key agricultural areas, and “battles” have erupted in key urban centers including Lima, Apurimac, Arequipa, Ica, and Trujillo. These protests have fueled concerns that deliveries of semi-processed metal to ports could also be disrupted, according to Bloomberg. The Cerro Verde mine, which is owned by Freeport McMoran, is experiencing some logistical issues with people and supplies, but mining operations continue uninterrupted. Currently, the only known instance of mining disruptions is at the Las Bambas mine. However, the protests at Las Bambas predate the ones that just erupted. Moreover, operations continue at Las Bambas, but semi-processed copper cannot be shipped to the port due to a blockage at the main entrance. Peru is the world’s second-largest miner of both copper and zinc, according to USGS data. (Sources: Bloomberg, USGS) |

|

|

|

As stated above, the new and ongoing protests have not impeded Peru’s zinc or copper production. However, given that zinc and copper prices are down for the year, this could be a good time for end-users of either metal to hedge future needs. This would allow such an end-user to be “ahead of the game,” should protests interrupt the production or transport of zinc or copper. Buying swaps or call options are viable strategies, as either would establish a maximum zinc or copper price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please note that zinc options have lower liquidity than swaps. Please contact AEGIS for specific strategies that fit your operations. (12/14/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

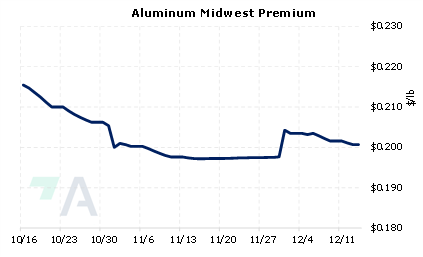

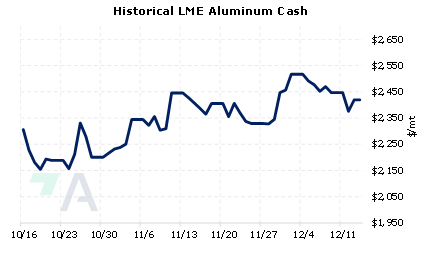

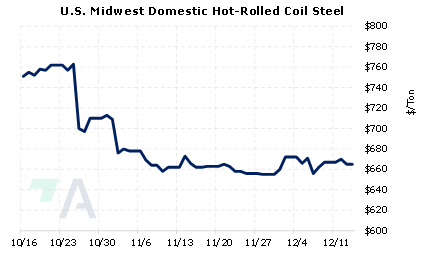

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/07/2022: Does the Copper Rally Have Legs? 12/07/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/01/2022: What's Been Driving Aluminum Prices Lately? 11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/07/2022: AEGIS Primer on LME Aluminum Price History |

||

|

|

||

| Important Headlines | ||

|

12/13/2022: US HRC: Prices flat, new increase announced 12/13/2022: Peru copper mines face transport delays as protests spread 12/13/2022: Copper price rises as US inflation rate slows 12/12/2022: Analysis: Turbulence still haunts LME nickel, months on from trade debacle 12/9/2022: Exclusive: Canada aims to speed up new projects with critical minerals strategy 12/9/2022: WTO rules US steel, Al tariffs unwarranted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||