|

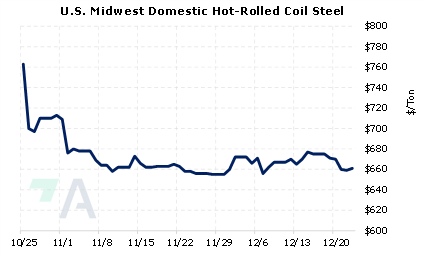

Customers of American steel service centers will likely do more spot purchases in 2023, thus shifting away from longer-term contracts, according to Argus. This is an unusual move, as most service centers try to limit price exposure to the spot market. AEGIS notes that this increased spot-market exposure adds risk. However, if the spot market is tied to a hedgeable index (such as CME HRC), this risk can be easily mitigated. As for market impact, HRC prices fell throughout most of 2022, some steel buyers backed out of orders, forcing service centers to sell excess inventories at a discount. Some service centers are therefore reducing contract sizes for those customers who did not meet their contractual obligations. (Source: Argus) |

|

|

|

AEGIS agrees with Argus’s assessment that this shift to greater spot volumes could lead to greater volatility in steel prices. However, HRC end-users can mitigate this potential volatility by hedging with CME HRC swaps. Also, given that CME HRC prices are down over 50% from the highs of early 2022, this could be a good time for steel end-users to hedge future needs into 2023 by buying CME HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. *Please note that our offices will be closed on Monday, December 26 due to the Christmas holiday. The LME and CME will be closed on Monday, December 26, and the LME will also be closed Tuesday, December 27. We will not produce the Metals First Look either morning. However, on Tuesday, December 27, our trading desk will provide CME coverage, and current clients can contact metals@aegis-hedging.com for indications. * (12/23/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/21/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

12/21/2022: Indonesia confirms bauxite export ban to proceed as scheduled 12/20/2022: Who’s in the driver’s seat: U.S. steel and scrap dynamics 12/20/2022: USW approves new contract with US Steel 12/20/2022: US HRC: Prices rise, demand slows 12/20/2022: Column: Zinc stocks at historic lows after a year of smelter woes 12/19/2022: Tesla hits 3,000 cars a week in Berlin, Austin later than planned 12/19/2022: Norway's Hydro plans wind farm to power industrial plants 12/18/2022: China November aluminium imports fall amid rising domestic supply 12/16/2022: First Quantum mulling all legal options after Panama halts flagship mine |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||