|

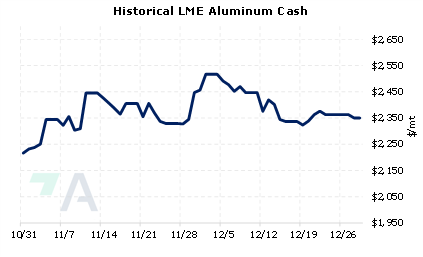

At least one major Japanese aluminum consumer has agreed to pay a $86/mt premium for 1Q 2023 deliveries, according to Bloomberg. AEGIS notes that this $86/mt premium is the lowest in two years and is down from initial offers of $95/mt from earlier this month. This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to pay for primary aluminum shipments. These premiums, which are set on a quarterly basis, are negotiated directly between Japanese end-users and global aluminum producers. This premium has dropped in recent quarters as demand, specifically from the automotive sector, has softened, according to Bloomberg. Japan imported approximately 2.793 million mt of aluminum in 2021, or about 4% of global production, according to the Japan Ministry of Finance and USGS data. (Sources: Bloomberg, Japan Ministry of Finance, USGS) |

|

|

|

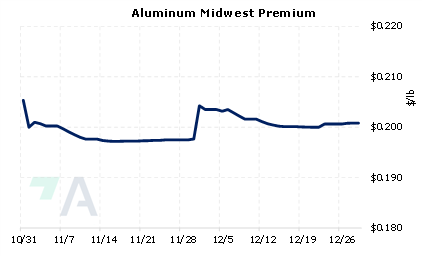

US aluminum consumers should closely watch Japanese import premiums because weakening premiums could foretell softening global demand. As we noted above, Japanese import premiums (over LME) are dropping, signaling that manufacturers are turning away the supply of metal. This shift in demand is likely to send the metal to other major aluminum importers. As aluminum shipments are rerouted, the immediate result could be lower premiums in North America, represented most commonly by MWP. More broadly, AEGIS wonders if these declining premiums are a sign that the market remains oversupplied. Consumers looking to hedge aluminum may wish to elect hedging structures tailored to participate in lower prices while protecting against higher prices. One popular way of hedging LME aluminum is with zero-cost (or "costless") collars, and we would love to talk you through those strategies. As for the Midwest Premium, this market can be hedged via CME MWP swaps. Like the Japanese import premium, the CME MWP has also fallen in recent months. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, so hedging in that market is tricky. Thus, we recommend using limit orders. Again, please contact AEGIS for specific strategies that fit your operations. (12/29/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

12/28/2022: Nyrstar's Port Pirie lead smelter ramps up production 12/28/2022: Canada's First Quantum says no disruption to Panama ops amid dispute 12/27/2022: Panama, Canada's First Quantum talks to continue on Wednesday - sources 12/26/2022: Canada's First Quantum CEO holds talks with Panama minister: source 12/24/2022: Canadian miner First Quantum starts arbitration against Panama, says government 12/23/2022: Panama aims for 'fair' deal with Canadian miner First Quantum |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||