|

The Australia-based Port Pirie lead smelter, which is one of the largest in the world, has started ramping up production after completing a project that improves efficiency and performance, owner-operator Nyrstar stated earlier this week. The smelter has been closed since October to complete the project. Nyrstar did not say how much these improvements will increase production. The plant produced 160,000 mt of lead in 2018, according to Reuters. (Source: Reuters) |

|

|

|

This re-opening is likely welcome news to end-users. A recent scramble to buy LME warehouse lead stocks has pushed inventories to the equivalent of a few hours of global consumption, according to Reuters. As of this morning, lead stocks listed as "on warrant," which denotes they are available to trade, totaled 12,650 mt. This is barely off the October 25 low of 10,075 mt. AEGIS notes the recent rush on LME warehouses was likely initiated by end-users that are worried about global supplies. Soaring electricity prices in Europe have forced several large smelters to curtail production or contemplate shutdowns due to unprofitability. One Germany-based smelter has been closed for over a year due to flood damage and related regulatory issues. China, which is the world’s largest lead miner and refiner, is also grappling with low scrap supplies and power issues. The recent scramble for LME inventories has pushed lead prices up over 21% since October 1. However, prices are nearly unchanged on the year, even with the recent rally, as the last trade was $2,277/mt (7:00 AM CST). End-users such as battery producers might consider applying simple hedges such as buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. *Please note that our offices will be closed on Monday, January 2 due to the New Year’s Day holiday. The LME and CME are also closed that day. We will not produce a Metals First Look that morning. * (12/30/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

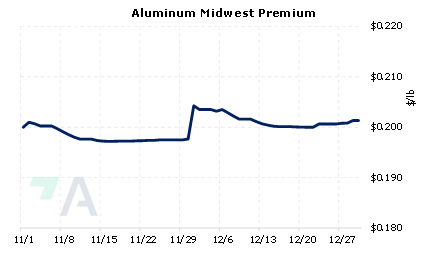

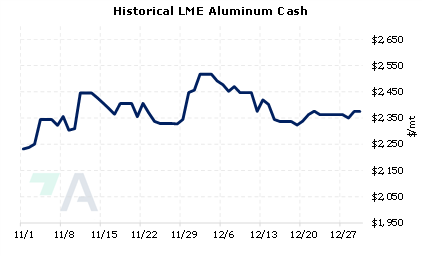

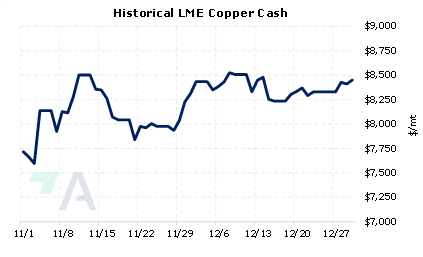

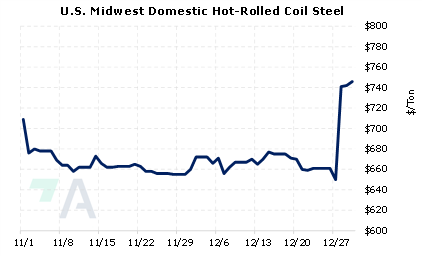

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

12/29/2022: Viewpoint: High nickel premiums the new normal 12/29/2022: Viewpoint: LME nickel grapples with identity crisis 12/28/2022: Nyrstar's Port Pirie lead smelter ramps up production 12/28/2022: Canada's First Quantum says no disruption to Panama ops amid dispute 12/27/2022: Panama, Canada's First Quantum talks to continue on Wednesday - sources 12/26/2022: Canada's First Quantum CEO holds talks with Panama minister: source 12/24/2022: Canadian miner First Quantum starts arbitration against Panama, says government 12/23/2022: Panama aims for 'fair' deal with Canadian miner First Quantum |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||