|

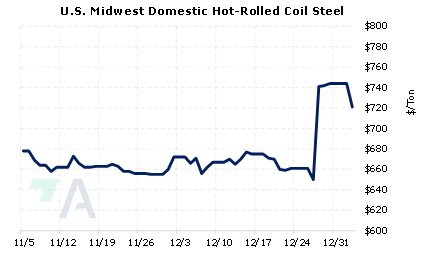

The EU’s proposed carbon tax on steel imports will make it more costly for Indian steelmakers to meet India’s lofty production goals, according to JSW Steel. The proposed tariff, which would be paid by the seller, is an attempt to combat carbon emissions from steel production in China, India, and other major producers. Approximately 45% of India’s steel is produced via high-polluting blast furnaces because JSW and other similar Indian producers have little access to adequate scrap supplies. Thus, to sell into Europe, the producer will either pay the carbon tax or adopt other, less-polluting production methods. Currently, India produces about 120 million mt of steel per year, with an annual capacity of 154 million mt. However, the Indian government wants domestic producers to double their production capacity to 300 million mt by 2030. In 2021, the EU imported a record 3.54 million mt of steel from India. This is approximately 11.6% of the EU’s total steel imports that year. |

|

|

|

If the EU’s imports of Indian steel drop significantly due to this change in policy, then steel buyers and sellers in the EU could be forced to change their policies with other trading partners. This could ultimately have an impact on American steel prices, specifically CME HRC prices. For example, the EU buys little steel from the US; however, the US was the second-largest importer of EU steel in 2021. That year, approximately 12.4%, or 2.226 million mt, of US steel imports came from the EU. If European producers significantly reduce exports, then American end-users could be forced to look elsewhere for steel, thus driving up HRC prices and import premiums here in the US. (Sources: Bloomberg, World Steel, Eurofer) This could be a good time for steel end-users to hedge future needs into 2023 by buying CME HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since CME HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/3/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

1/2/2023: Panama president says final contract to miner First Quantum has been presented 12/30/2022: Panama says it rejects First Quantum's legal bid to avoid halting operations 12/30/2022: Growth constraints to shackle industrial metals for a few more months 12/30/2022: Coal, gas lead 2022 commodities rally; recession clouds new year |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||