|

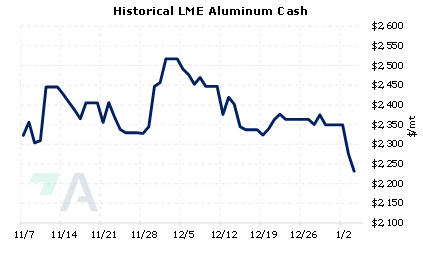

Some European metals traders have seen a recent uptick in spot aluminum purchases, and according to one unnamed source recently interviewed by S&P Global, the newly implemented cap on European natural gas prices “will grant more clarity to consumers, and with this, they can start hedging energy and start buying metal.” This cap on European natural gas prices is triggered when benchmark LNG prices reach a certain level and is an attempt to cool inflation and lower energy bills for residential and commercial consumers. These factors could push aluminum import premiums into Europe higher in 2023. These premiums fell precipitously in 2H 2022; as European duty-paid premiums (over LME) now hover near $250/mt. This is down nearly 60% from the record high seen in May 2022 when these premiums surged to $630/mt as end-users scrambled to buy up inventories. This initial run to buy aluminum was due to fears that escalating energy costs and logistical issues would lead to metal shortages. However, fears over Europe’s economic recovery have led to softening metals demand and premiums in 2H 2022. Due to falling demand, logistical issues, and self-sanctioning efforts by many European countries, nearly 1 million mt of Russian aluminum that normally goes to Europe was diverted to Asia last year. This is in addition to the nearly 1.4 million mt of European production due to soaring electricity prices. (Source: S&P Global, Reuters) |

|

|

|

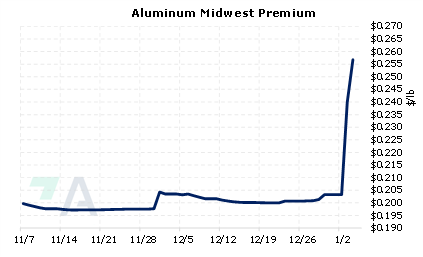

US aluminum consumers should closely watch European import premiums because rising premiums could foretell increasing global demand. As we noted above, European import premiums (over LME) have dropped recently, signaling that end-users and traders have turned away the supply of metal. However, rising premiums could lead to aluminum shipments being rerouted to Europe. As aluminum shipments are rerouted, the immediate result could be higher premiums in North America, represented most commonly by MWP. The MWP market can be hedged via CME MWP swaps. Please note that there is no options market for the CME MWP. The CME Midwest Premium swap market is thinly traded, so hedging in that market is tricky. Thus, we recommend using limit orders. Again, please contact AEGIS for specific strategies that fit your operations. (1/5/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

1/4/2023: Global Commodities Holdings to launch nickel trade platform in February 1/3/2023: European primary aluminum market faces uncertain start to 2023 1/3/2023: Analysis: Panama and First Quantum harden battle lines over key copper mine 1/2/2023: Panama president says final contract to miner First Quantum has been presented 12/30/2022: Panama says it rejects First Quantum's legal bid to avoid halting operations 12/30/2022: Growth constraints to shackle industrial metals for a few more months 12/30/2022: Coal, gas lead 2022 commodities rally; recession clouds new year |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||