|

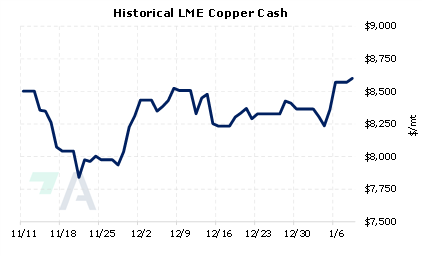

LME copper prices are up over 6% since last Wednesday’s close after China announced a series of economic stimulus measures. To boost slumping real estate demand, China lowered mortgage rates and down payment ratios for first-time home buyers, government officials announced last Thursday. The government is also considering easing borrowing restrictions on some property developers. According to government data, first-time home sales were down approximately 25% through the end of October 2022 compared to the same period in 2021. Also last Thursday, Chinese state media announced that 1,722 projects worth $945 billion are planned in the southern manufacturing hub of Guangzhou province. (Source: South China Morning Post, mining.com) |

|

|

|

AEGIS notes that the price action over the past three days finally pushed copper prices out of a nearly two-month-long sideways trend. Even with the positive action as of late, this could be a good opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps, especially if these stimulus measures create long-term copper demand. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/9/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

1/6/2023: India's April-December finished steel exports drop 54% y/y -data 1/5/2023: China establishes mortgage rate adjustment mechanism for some home buyers 1/5/2023: Copper price bounces on news about fresh investment in China 1/4/2023: Global Commodities Holdings to launch nickel trade platform in February 1/3/2023: European primary aluminum market faces uncertain start to 2023 1/3/2023: Analysis: Panama and First Quantum harden battle lines over key copper mine 1/2/2023: Panama president says final contract to miner First Quantum has been presented 12/30/2022: Panama says it rejects First Quantum's legal bid to avoid halting operations 12/30/2022: Growth constraints to shackle industrial metals for a few more months 12/30/2022: Coal, gas lead 2022 commodities rally; recession clouds new year |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||