|

Natural gas shortages in Western Australia have forced aluminum producer Alcoa to curtail alumina production by 30% at its 2.2 million mt/yr Kwinana refinery, according to Bloomberg. The refinery has switched to diesel for its remaining operations. The current natural gas supply outage is due to an equipment failure at a Chevron natural gas plant. There is no word on when gas supply will be restored to Kwinana, nor when alumina production would resume full capacity. This natural gas shortage has also forced Alcoa’s Wesfarmers refinery to run on emergency natural gas supplies. Alcoa’s three alumina smelters produce approximately half the country’s production. At 21 million mt, Australia was the world’s second-largest alumina producer in 2021, bested only by China. (Sources: Bloomberg, Reuters, USGS) |

|

|

|

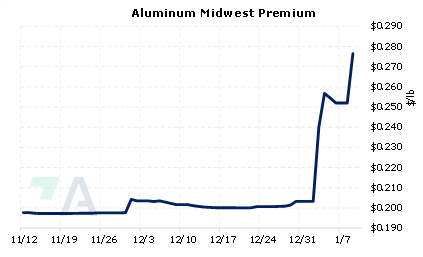

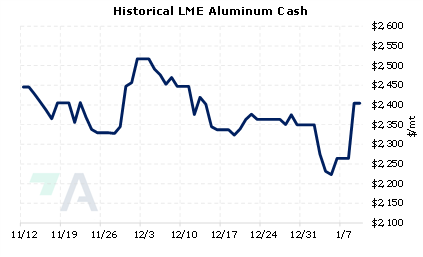

The news from Australia is the second positive catalyst the aluminum market has seen since January 1. China has just implemented a slew of economic stimulus measures that aim to boost its faltering real estate sector. These measures and alumina production issues in Australia could remain supportive of aluminum prices. Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/10/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? 12/01/2022: What's Been Driving Aluminum Prices Lately? |

||

|

|

||

| Important Headlines | ||

|

1/10/2023: Canada's First Quantum says in talks with Panama over mine dispute 1/10/2023: LME to decide nickel reforms by end of first quarter 1/9/2023: UPDATE 2-Alcoa's Australia unit flags 30% production cut at alumina refinery 1/9/2023: Nickel market faces new shock as ‘Big Shot’ boosts metal output |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||