|

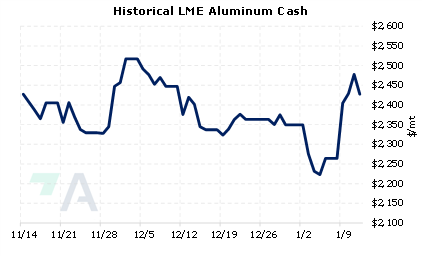

China shipped a record amount of aluminum last year; however, decreasing global demand could weigh on exports this year, according to CRU Group. Therefore, China might attempt to shift production to the region where demand needs it, rather than serving customers through its own in-country surplus production. In early 2022, falling aluminum production across Europe due to escalating energy costs forced metals traders to grab up Chinese inventories. However, Chinese exports peaked in May, as Western buyers pulled back from purchases due to fears of a looming global recession. Due to falling domestic demand and the potential for climate-based tariffs on Chinese aluminum production, both CRU and the China Nonferrous Metals Fabrication Industry Association believe Chinese smelters should move production to regions where demand is expected to remain robust, such as North America. (Source: Bloomberg) |

|

|

|

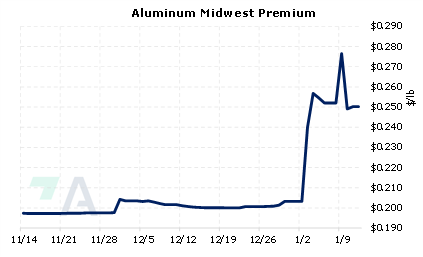

AEGIS notes that Chinese aluminum exports tend to peak as LME prices near a short-term top. Given that LME aluminum prices are down almost 40% from the peak in March 2022, this could be a good time for aluminum end users to hedge future needs by buying swaps. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/12/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/11/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? |

||

|

|

||

| Important Headlines | ||

|

1/11/2023: Chevron restarts production at Wheatstone gas plant 1/10/2023: Panama says Canada's First Quantum operating without contract 1/10/2023: Canada's First Quantum says in talks with Panama over mine dispute 1/10/2023: LME to decide nickel reforms by end of first quarter 1/9/2023: UPDATE 2-Alcoa's Australia unit flags 30% production cut at alumina refinery 1/9/2023: Nickel market faces new shock as ‘Big Shot’ boosts metal output |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||