|

China’s aluminum output is expected to grow in the coming years as the industry switches more production from coal to hydropower, according to Bloomberg. This expected production growth comes despite a government-mandated capacity cap of 45 million mt/yr. According to Bloomberg estimates, production could hit 43 million mt by 2025, up from a record 40.21 million mt in 2022. The current 45 million mt/yr capacity cap was set in 2017 as part of a government effort to clamp down on emissions. |

|

|

|

AEGIS notes that China’s aluminum production expansion comes as its producers tap Indonesia for more alumina. Two Chinese metals producers, Tsingshan Group and Nanshan Group are building alumina smelters in Indonesia that will add approximately 750,000 mt to the country’s annual production capacity. Bloomberg expects Indonesia’s alumina output will hit 4 million mt this year, up 37% from 2022. (Source: Bloomberg) As we noted in yesterday’s First Look, China’s aluminum production expansion comes as their real estate-related demand is set to increase due to government stimulus measures. As Chinese aluminum demand increases so could global aluminum prices. Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (1/19/2023) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

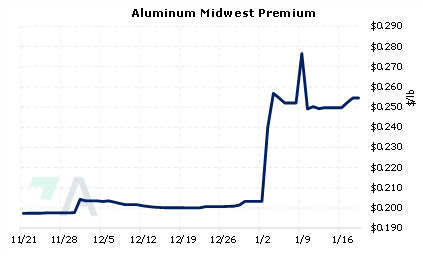

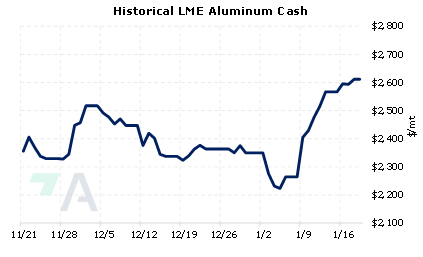

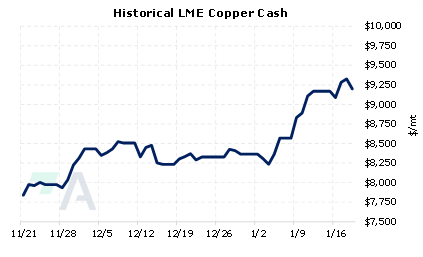

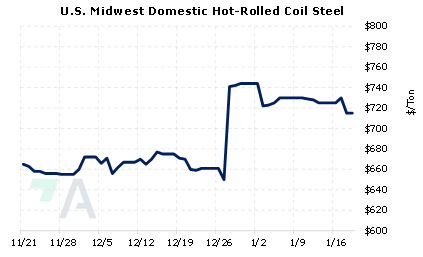

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/18/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 01/11/2023: Nickel Prices Could Remain Volatile Into 2023 12/21/2022: Nickel Prices Rally While 2023 Supply Picture Remains Unclear 12/14/2022: Could Peruvian Protests Affect Zinc Production or Prices? 12/07/2022: Does the Copper Rally Have Legs? |

||

|

|

||

| Important Headlines | ||

|

1/19/2023: Davos 2023: LME CEO says nickel reforms to be implemented 'relatively quickly' 1/16/2023: China's 2022 aluminium output hits record high of 40.21 mln tonnes 1/16/2023: Indonesia deploys security forces after nickel smelter protest turns deadly 1/15/2023: Column: Base metals start the new year with depleted inventory 1/13/2023: Thousands march in Peru capital demanding president step down |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||